Elliott Investment Management has acquired a roughly $1 billion stake in Anglo American Plc, the UK-listed mining company that has received an unsolicited takeover bid from Australia’s BHP Group Ltd.

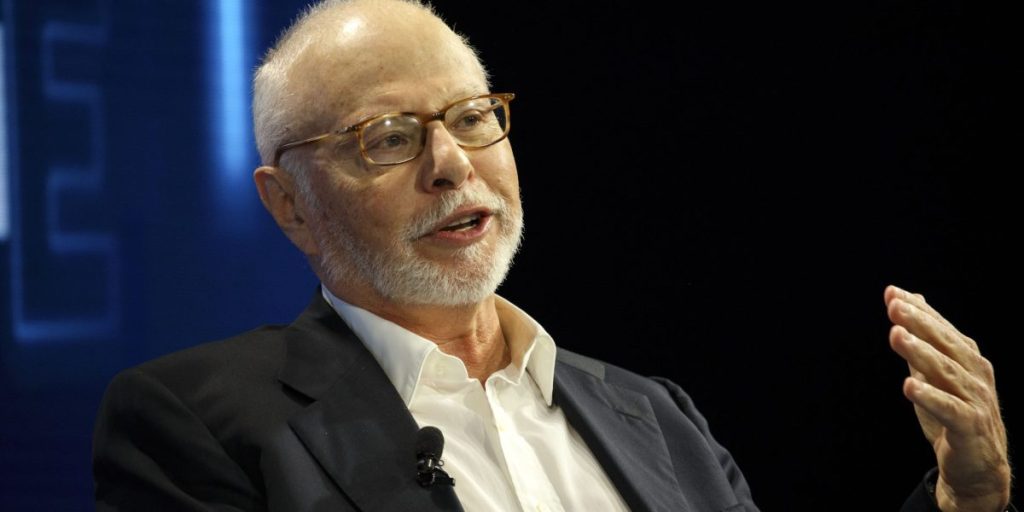

The activist hedge fund led by Paul Singer has access to nearly 33.6 million Anglo American shares through derivatives, according to a UK regulatory filing on Friday that confirmed report according to Bloomberg News. The company has amassed a 2.5% stake in recent months, according to people familiar with the matter who asked not to be identified discussing private information.

The investment puts Elliott among Anglo American’s 10 largest shareholders, according to Bloomberg. Anglo American shares jumped 6.3% in London after Bloomberg News reported on the action.

Elliott also has a 0.07% short position in BHP, as shown in a separate filing. Representatives for Elliott and Anglo American declined to comment.

Elliott’s presence in Anglo American shares comes as the miner is the subject of a takeover by BHP. Australian miner proposed an acquisition that values its smaller rival at £31.1 billion ($38.9 billion) and would create the world’s leading copper producer. Bloomberg News reported BHP’s approach on Wednesday. Anglo American announced the offer significantly underestimates company.

Singer’s firm is known for intervening in crashed stocks and then pushing companies to take actions ranging from stock buybacks to outright sales of businesses.

“We like to see value investors on the roster,” said Giuseppe Bivona, chief investment officer of fellow activist Bluebell Capital Partners, which took a stake in Anglo American in February. The company is “certainly worth much more than BHP is offering.”

Anglo American has long been seen as a potential target among major miners, particularly because it owns attractive copper properties in South America at a time when much of the industry is looking to boost reserves and production.

But bidders are put off by its complex structure and mix of other commodities, as well as its deep dependence on South Africa. In February, Anglo American reported a sharp drop in profits and a cut in dividends amid falling demand for diamonds and platinum group metals, commodities that are unique to its portfolio.

BHP has proposed an all-share deal that would see Anglo first transfer majority stakes in South African platinum and iron ore miners to its shareholders.

Anglo American shares closed 3.2% higher in London trading on Friday at 2,643.00 pence, giving the company a market value of around £32.4 billion. Shares rose 16% on Thursday following BHP’s announcement. Even after this week’s rally, shares are still down more than a third from their peak two years ago.

Elliott took a significant position in BHP in 2017 and pushed him to spin off certain oil assets. In 2021 the miner struck deals which extended its divestment from fossil fuels, including sale oil and gas production operations Woodside Petroleum Ltd.

Singer’s company also collaborated with other metallurgical companies. In 2022, Elliott negotiated with Kinross Gold Corp., which resulted in the mining company announcing $300 million share buyback. And it is the majority shareholder of Triple Flag Precious Metals Corp., which provides financing to mining companies. The company is also establishing a new venture, Hyperion, to invest in mining assets.