According to a recent post by Milk Road, Aave, a leading decentralized finance (DeFi) protocol, has reported an impressive revenue surge of $500 million since the start of 2024.

This achievement positions Aave as one of the top protocols in terms of revenue generated within the DeFi space.

However, despite this success, the price of AAVE has been on a downward trajectory since mid-September.

AAVE price has dropped 14% in two weeks

According to CoinGecko data, AAVE price has dropped by over 14% over the past two weeks and by around 4% over the past month.

Aave has posted a strong bullish trend since the beginning of the year despite a slight pullback in April.

The token went ahead to register a two-year high of $177.42 on September 23, 2024, before turning bearish almost immediately after.

Understanding the factors contributing to this price decline is essential for investors and market observers especially seeing the high revenue that the Aave decentralized lending platform has made so far this year.

Aave network activity decline

One of the primary reasons for the price drop is the decline in network activity.

Although Aave’s revenue has skyrocketed, metrics related to user engagement have shown a concerning trend.

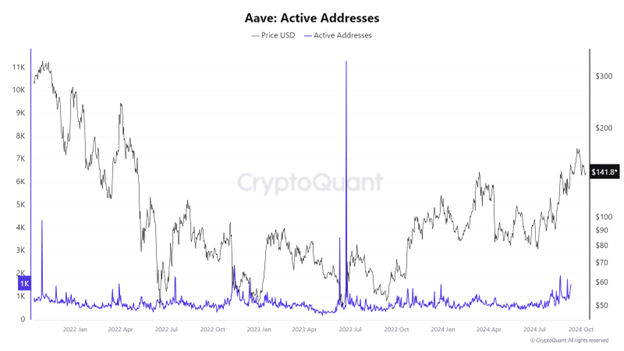

Daily active addresses, a critical indicator of user participation, experienced a spike in September but began to decline afterward.

Source: CryptoQuant

The decrease in transactions is closely related to this drop in active users, signaling a potential loss of interest or engagement with the platform.

A reduction in network activity often leads to bearish sentiment, as it suggests that fewer users are utilizing the protocol’s services.

Moreover, the birth-to-death ratio of addresses within the Aave ecosystem has also seen a decline.

This ratio measures the number of new addresses created against those that have remained inactive for over a year.

Source: IntoTheBlock

A declining birth-to-death ratio indicates that fewer new users are entering the ecosystem while existing users may be losing interest.

This can contribute to the perception of Aave as a less attractive investment, further influencing the token’s price negatively.

Increasing selling pressure

Another significant factor impacting Aave’s price is the increasing selling pressure observed in recent weeks.

Data from Santiment highlights a sharp increase in AAVE’s supply on exchanges, coupled with a drop in supply held outside exchanges.

This trend suggests that investors are actively selling their holdings, likely in response to market conditions and sentiment shifts.

Increased selling pressure typically leads to price corrections, as it overwhelms buying interest.

Market sentiment around Aave has turned notably bearish as well. As investor enthusiasm wanes, the overall sentiment can shift, resulting in lower demand for the token.

Sentiment metrics indicate that negative feelings towards Aave have risen, further compounding the price challenges the protocol is facing.

The fear of potential losses often leads investors to liquidate their positions, exacerbating the downward price movement.

Can Aave price bounce back?

While Aave’s impressive revenue performance of $500 million is commendable, several factors including declining network activity, increased selling pressure, and shifting market sentiment, are contributing to the ongoing drop in AAVE’s price.

Nevertheless, despite these challenges, there is a glimmer of hope for Aave investors.

The token recently tested a crucial support level at around $135, which, if sustained, could signal a potential bullish reversal.

If buying pressure increases and investors regain confidence, there may be opportunities for recovery and growth in the token’s price.

The post Aave price dropping since mid-September despite $500M revenue: here’s why appeared first on Invezz