Ethereum’s market has experienced impressive growth since November 5, rising by over 40.86%. As of now, the Ethereum price stands at $3,373.69. Recently, Scott Melker, host of The Wolf of All Streets Podcast, shared his prediction that ETH could hit $6,000 by the first quarter of 2025.

Why is he so optimistic about Ethereum’s future? Let’s break down the factors that could drive Ethereum’s price to new heights.

Ethereum Enters ‘Scarcity Mode’

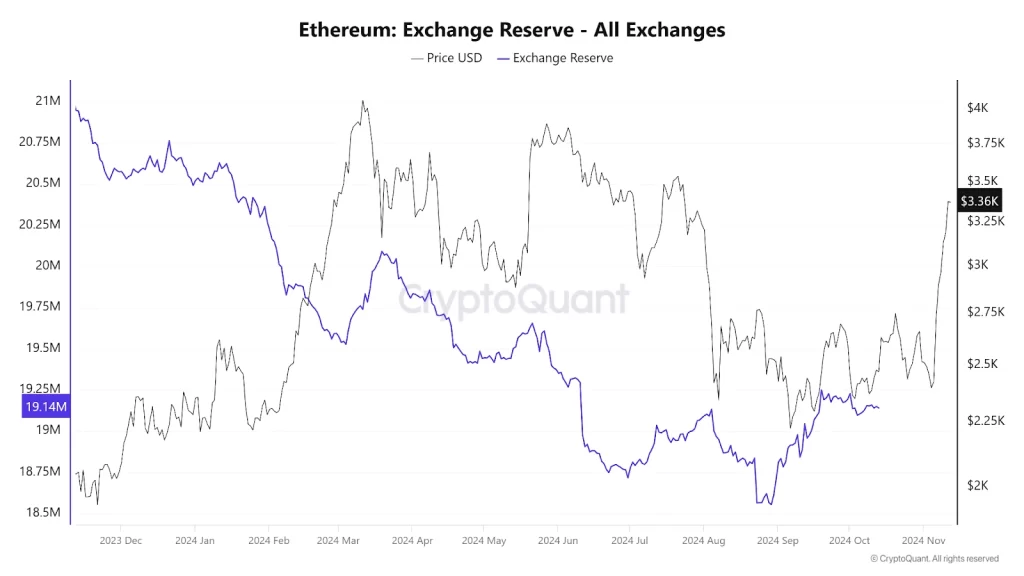

At the start of this year, the Exchange Reserve of Ethereum was around 20,521,862.99. Since then, it has dropped steadily. When the ETH price reached its market peak of $4,065.092, the reserve was around 19,738,964.89. On August 28, it touched the lowest point of 18,566,012.24. Right now, it remains around the range of 19,149,691.51.

This sharp drop in Ethereum’s Exchange Reserve, combined with increasing demand, signals that the market has entered a “Scarcity Mode.”

According to basic economic principles, when an asset becomes scarce, its price tends to rise, which bodes well for Ethereum’s future price growth.

Ethereum Price Momentum: Breaking the 200-Day MA

At the start of 2023, Ethereum’s price was hovering around $1,198.54, well below the 200-day Moving Average (SMA) of $1,386.69. On January 23, ETH broke above this line, but the price didn’t stay above for long. The market tested the SMA multiple times, with price drops on March 10 and June 15. By August 17, ETH fell below the 200-day SMA again, but in early November, the price surged above the line.

Currently, Ethereum stands at $3,405.25, significantly higher than the 200-day SMA of $2,958.42. This solid upward momentum has led experts like Melker to predict further price gains in the coming months.

- Also Read :

- Will Crypto Keep Going Up? What’s Next For Bitcoin and Altcoins?

- ,

Institutional Interest Drives Growth

Another critical factor contributing to Ethereum’s upward trajectory is the recent $132 million inflow into the Ethereum ETF market. Melker points out that institutional interest in Ethereum has risen significantly, signaling growing confidence in the asset.

This surge in institutional investment suggests that Ethereum is gaining traction among large-scale investors, which could provide further support for its price growth.

With Ethereum’s supply constrained and institutional interest on the rise, the factors are aligning for significant price growth in the coming year. Analysts are optimistic, with the potential for Ethereum to reach $6,000 by Q1 2025.

As scarcity and institutional demand drive the market, Ethereum’s price could continue to rise, making it a key asset to watch in 2024 and beyond.