- The altcoin season index also hinted at a delayed altcoin rally.

- All the top altcoins fell victim to price corrections in the recent past.

The crypto market did witness some volatility over the last week, but towards the negative side. While several expected an altcoin season to hit, latest data revealed that investors might have to wait longer for that to happen.

In fact, investors might not see an altcoin summer until 2025.

Bitcoin continues to dominate

Alphractal, a popular data analytics platform, recently posted a tweet revealing a major update. As per the tweet, only a small number of altcoins have outperformed Bitcoin [BTC] in the last 30 days.

Generally, when BTC rises and stabilizes, some altcoins tend to stand out.

However, over a 90-day period, there’s still no sign of an altcoin season in this cycle. In the meantime, Bitcoin dominance continued to rise. This hike was justified considering the underwhelming performances of most altcoins.

Although Bitcoin has somewhat decreased in the near term, altcoins have declined even farther, supporting the prediction that Bitcoin will continue to gain market share.

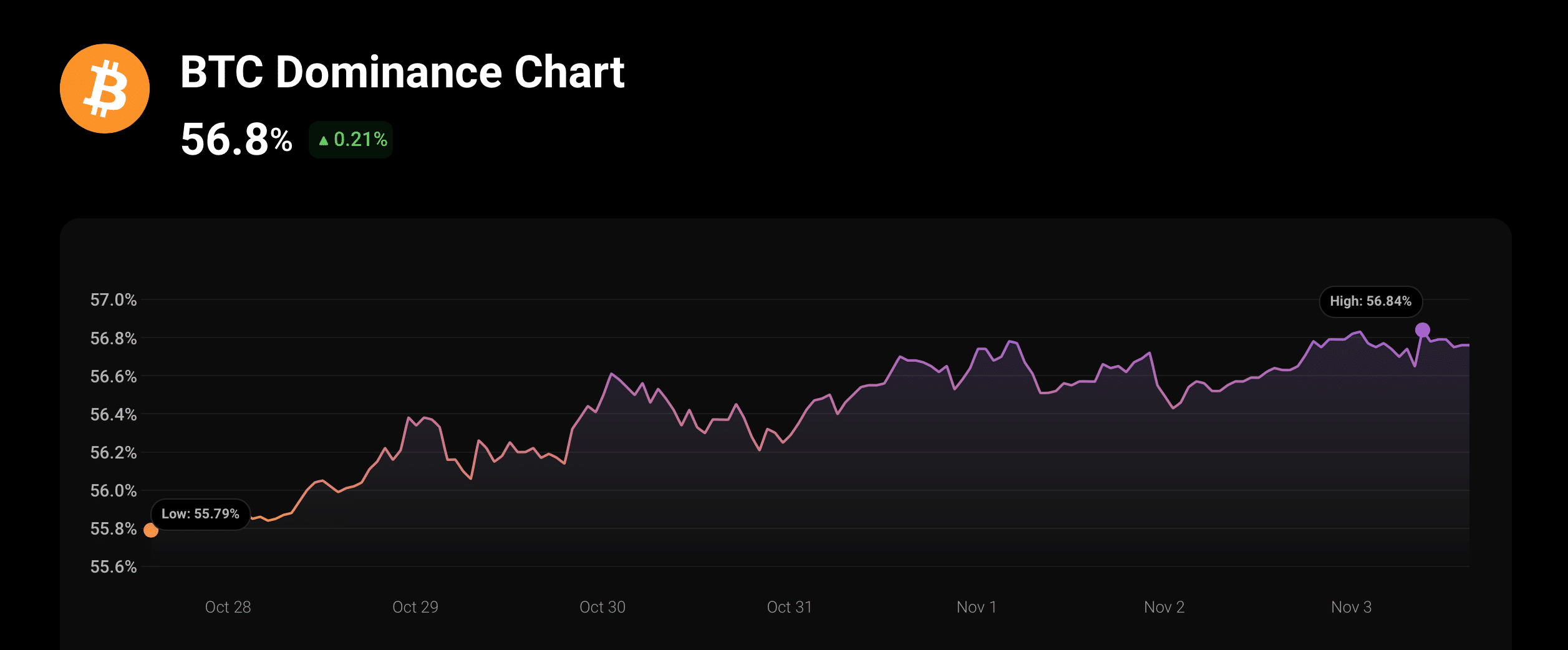

In just one week, BTC dominance surged by 1%, and at press time, the metric had a value of over 56%.

Source: CoinStats

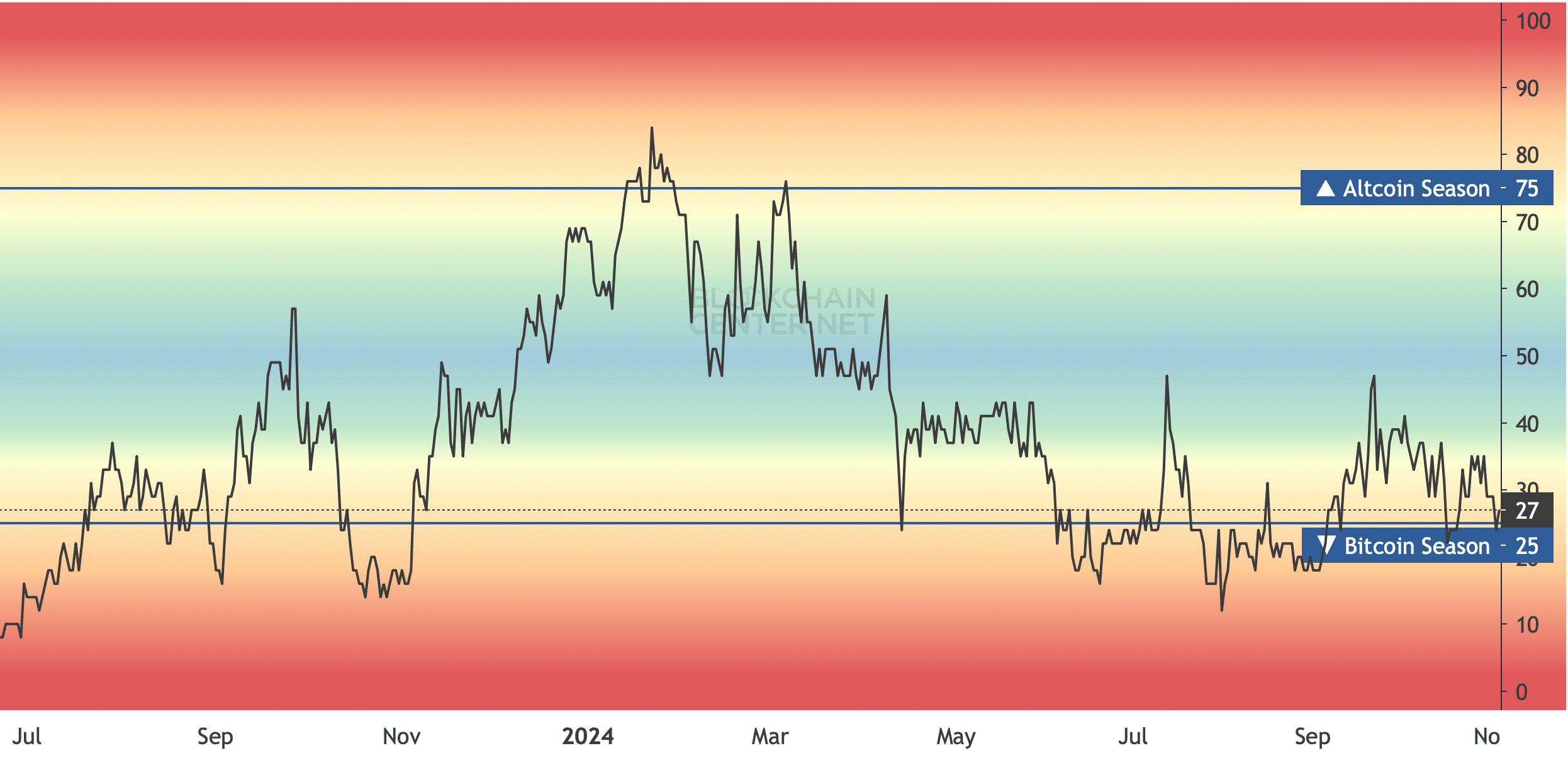

Apart from this, AMBCrypto analysis revealed that the altcoin season index had a value of 27. For starters, it is considered to be a Bitcoin season if the metric has a reading near or below 25.

To the contrary, an alts season is when the metric reaches 75. All of these aforementioned datasets clearly suggested that it would take longer for an altcoin season to arrive.

Source: Blockchaincenter

How are the top altcoins doing?

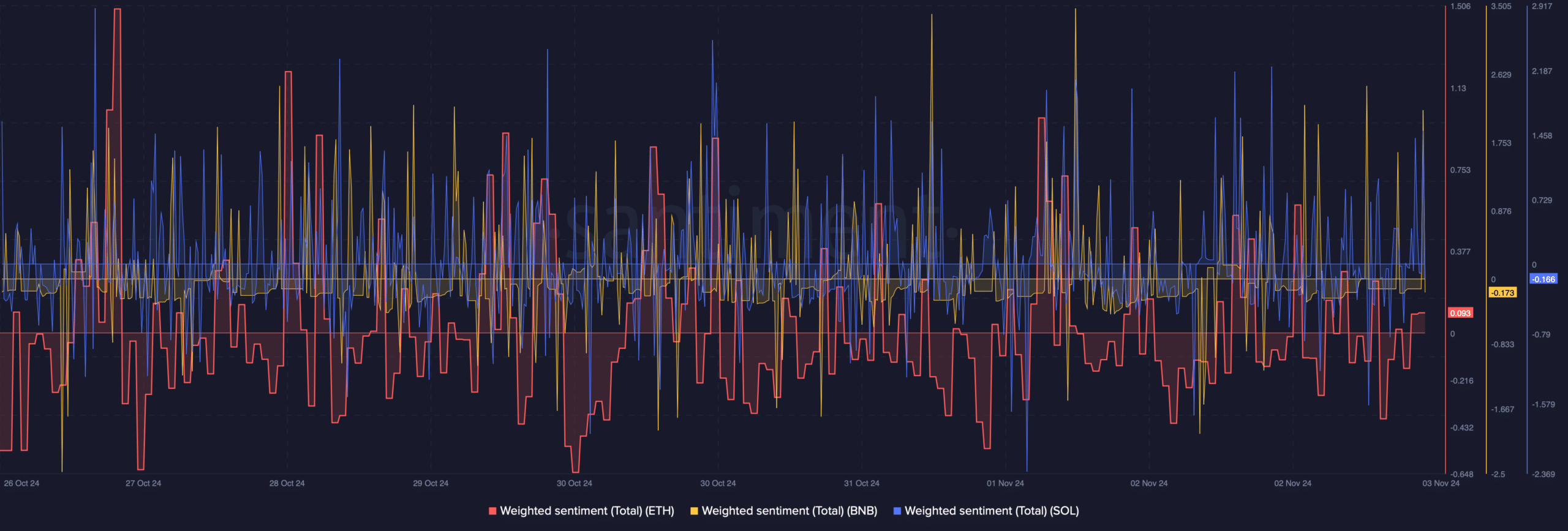

To double check whether alts could begin a rally, AMBCrypto assessed the states of Ethereum [ETH], BNB, and Solana [SOL].

As per an analysis of Santiment’s data, ETH’s weighted sentiment dropped last week, indicating a rise in bearish sentiment.

Surprisingly, despite the price decline, BNB’s weighted sentiment remained high. A similar increasing trend was also observed on Solana’s chart. This suggested that investors were confident in BNB and SOL, expecting a price hike soon.

Source: Santiment

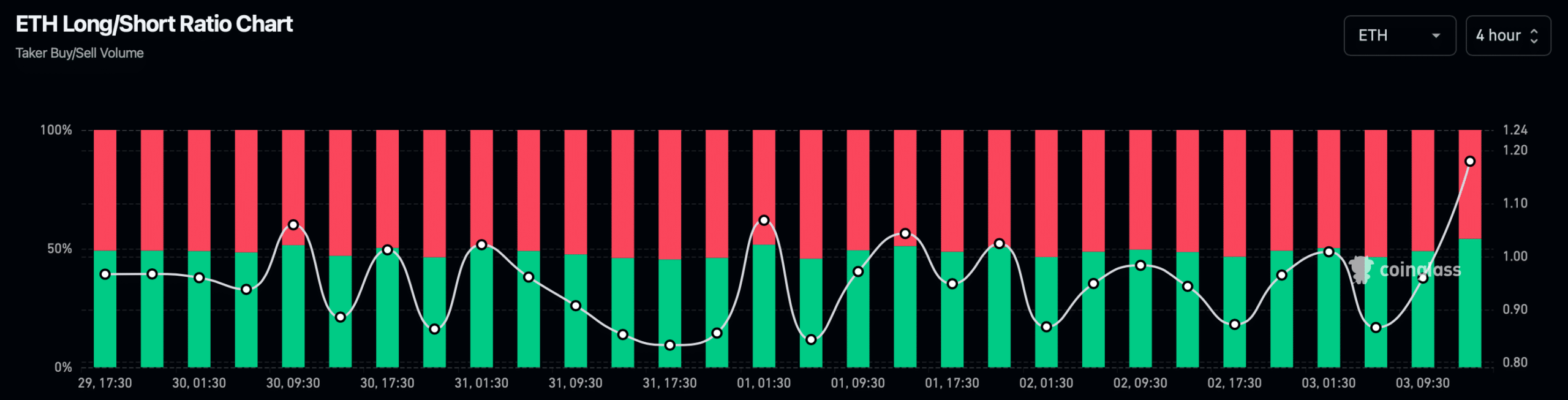

We then checked each of these altcoin’s derivatives metrics. Interestingly, while BNB and SOL’s weighted sentiment increased. Their long/short ratios dipped, as per Coinglass’ data.

Read Ethereum [ETH] Price Prediction 2024-25

A decline in the metric means that there are more short positions in the market than short positions, which is bearish. To the contrary, ETH’s long/short ratio registered a sharp uptick, hinting at a possible price rise.

Source: Coinglass