- Solana and Ethereum have both held significant milestones while fostering a competitive rivalry

- However, a recent event may exacerbate tensions between the two

In its monthly report, Swiss crypto bank Sygnum highlighted Solana [SOL] as Ethereum’s [ETH] most significant challenger in the finance sector and a viable alternative for numerous rollouts and development breakthroughs.

Often referred to as an “Ethereum killer,” Solana has steadily gained traction by leveraging Ethereum’s weaknesses to establish a competitive edge.

However, a significant market cap gap exists – around $218 billion – as Ether continues to outpace Solana. And yet, Solana’s price ratio to Ether has surged 300% year-on-year. What contributed to the surge?

Solana’s strong foothold in the finance sector

Two years ago, a similar rivalry between SOL and ETH emerged when Solana partnered with Visa. At the time, SOL was integrated for USD Coin settlements, touting its high throughput and low costs.

Recently, the upside was further bolstered by asset manager Franklin Templeton’s announcement to launch a mutual fund on Solana.

Solana’s growing resourcefulness in the financial sector has led the Swiss bank to recognize the blockchain as a “serious challenger” to Ethereum in the long run.

While there’s no clear timeline for when this shift might occur, Solana is undeniably closing the gap with Ethereum across various metrics.

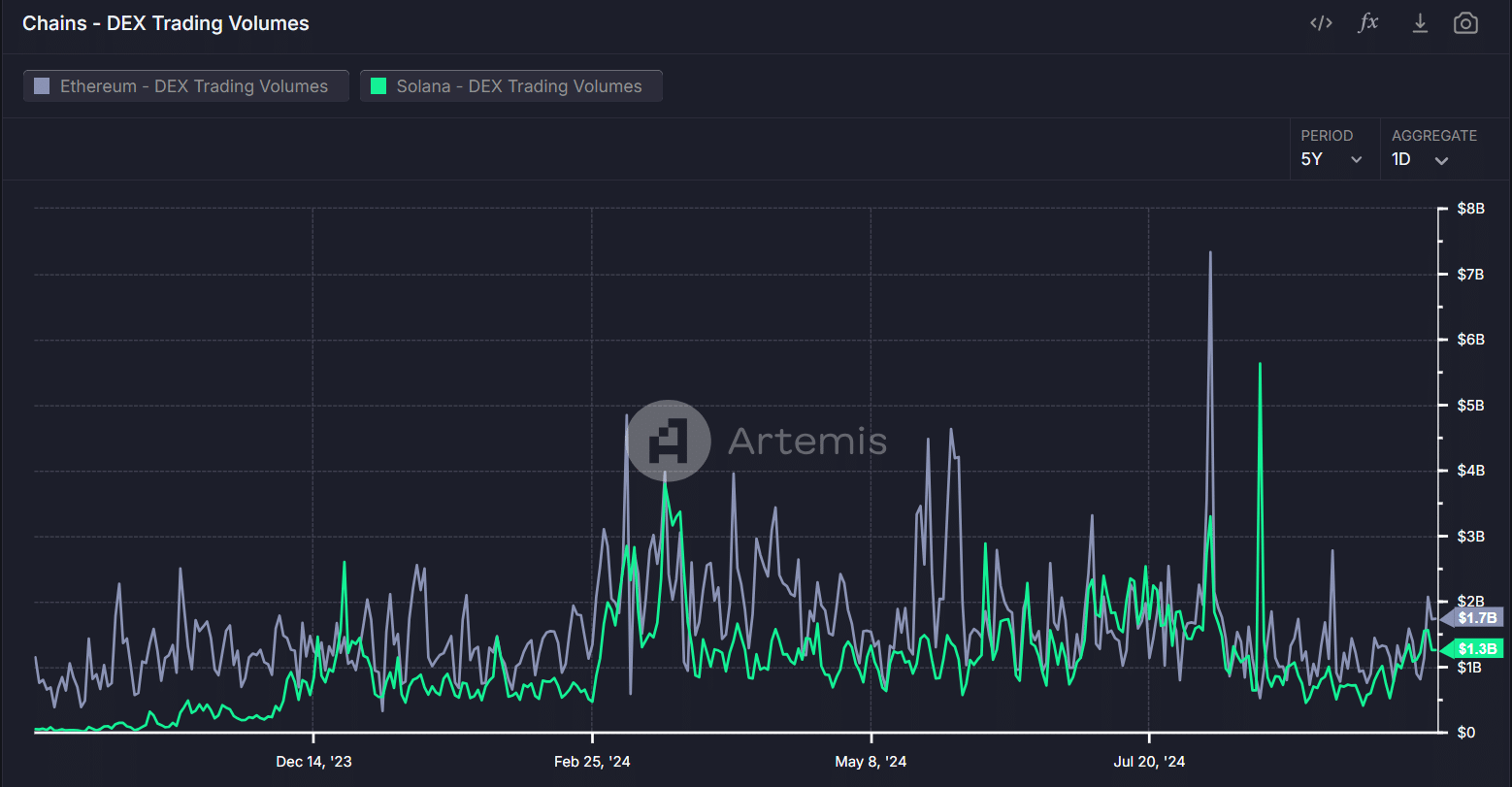

For starters, Ethereum’s DEX volume had dropped from $2 billion in August to $1.7 billion at press time. On the contrary, Solana’s DEX volume has remained stable, even improving over the same period.

Source : Artemis Terminal

In short, partnerships with major financial institutions, such as Visa, have enhanced Solana’s visibility, potentially drawing in new investors and challenging Ethereum’s dominance.

Beyond these collaborations, the ongoing comparisons between Solana and Ethereum are supported by a well-crafted strategy. One that is aimed at overtaking the five-year-older Ethereum blockchain.

Solana capitalizes on Ethereum’s shortcomings

Solana’s architecture supports high throughput and low transaction fees, making it attractive for users and developers alike.

In contrast, Ethereum faces challenges with high gas costs, which can deter users from engaging with its network.

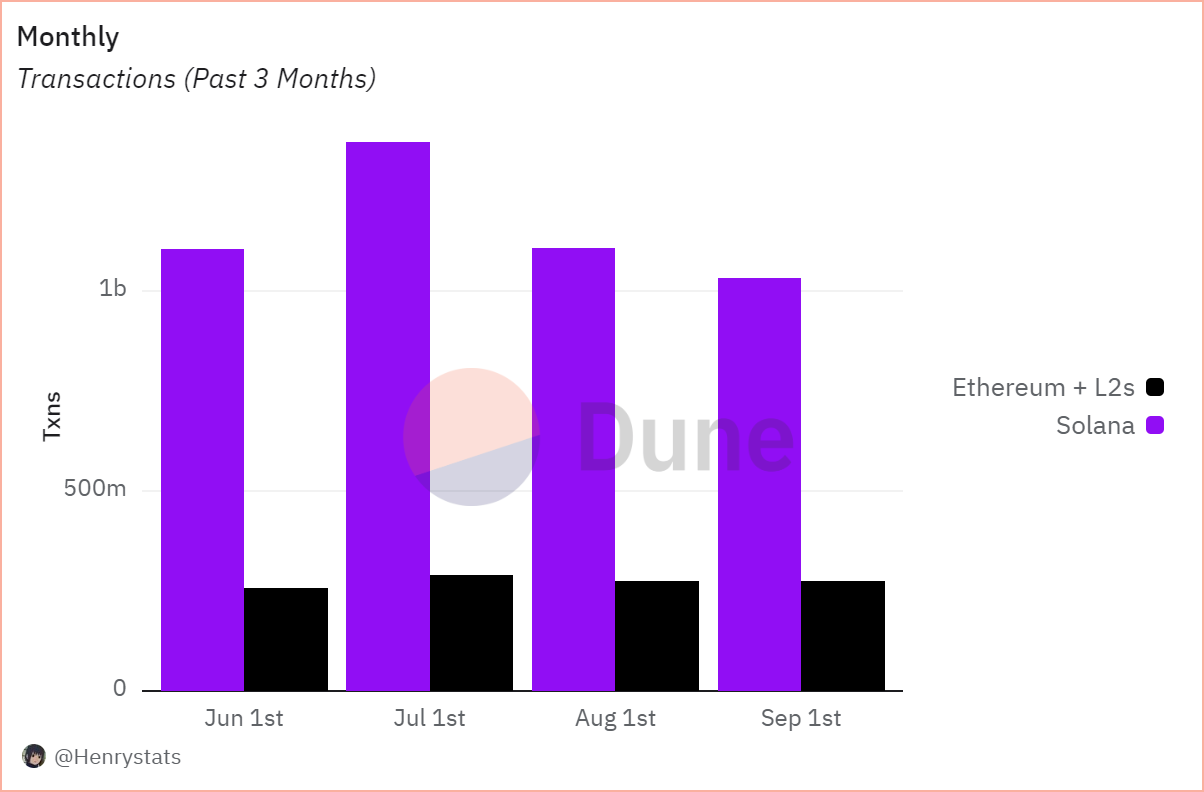

Source : Dune

The impact of this disparity is evident in the chart above. Monthly transactions on Solana have surpassed 1 billion, while Ethereum is experiencing low network activity with only 200 million in transactional volume.

Clearly, high gas fees on Ethereum have driven users to Solana for faster transactions at lower costs.

Read Solana’s [SOL] Price Prediction 2024–2025

In essence, Solana has achieved significant traction in just four years since its launch. However, while there are areas where SOL excels, Ethereum remains dominant in others.

Overall, for Solana to truly rival Ethereum, it must develop innovative decentralized applications that promote widespread adoption – An area where Ethereum currently rules.