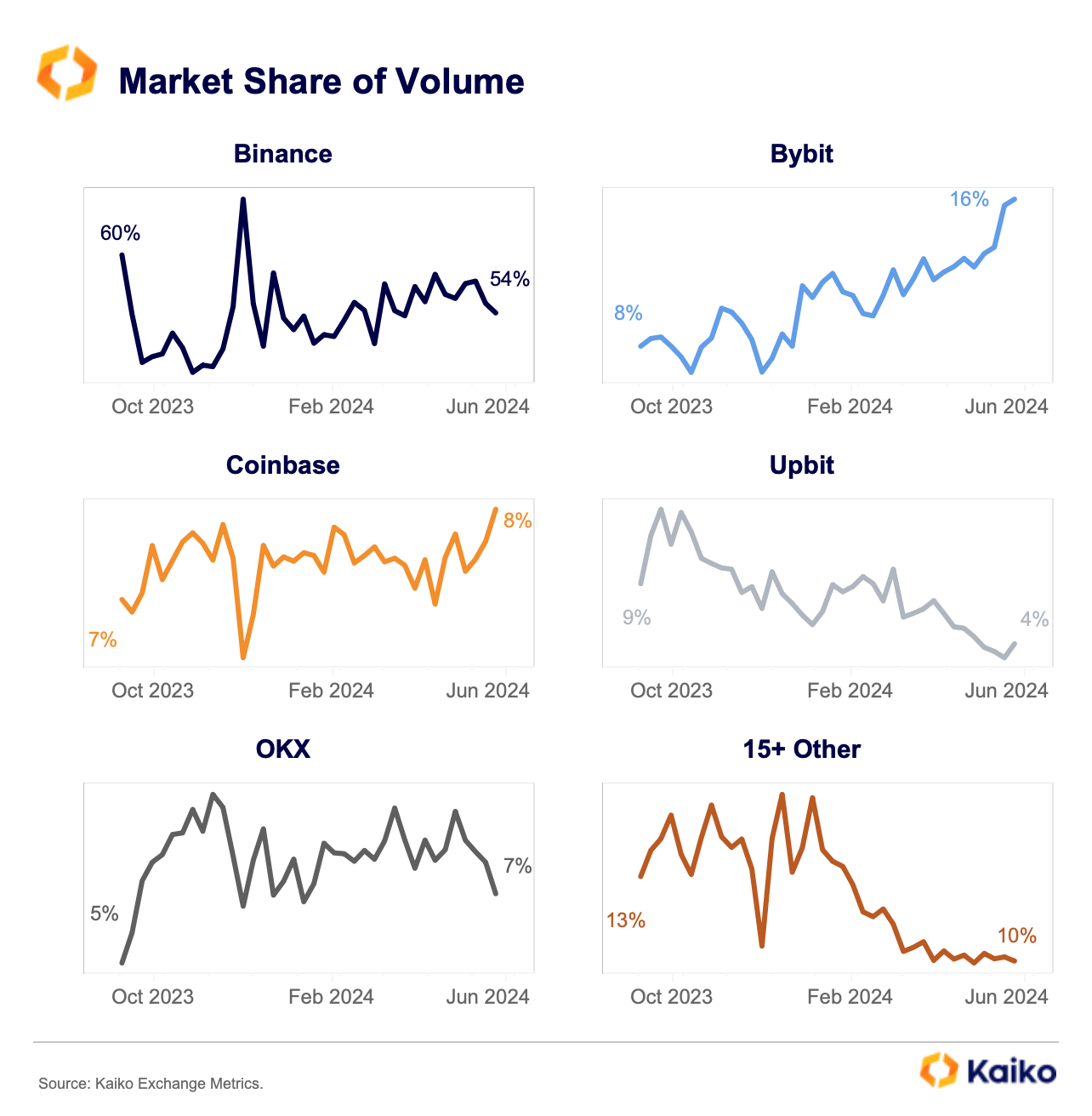

Crypto exchange Coinbase has been surpassed in volume by Bybit since October, according to analytics firm Kaiko.

In a new report, Kaiko says that the launch of Bitcoin (BTC) exchange-traded funds (ETFs) in the US has helped Bybit more than others in its push for market dominance.

“The launch of spot Bitcoin ETFs in the US has significantly boosted global crypto trading volumes. However, not all exchanges have benefited equally from the rally that started in October.

One exchange has by far made the most gains: Bybit. Since October, the exchange’s market share has surged from 8% to 16%, surpassing Coinbase in March to become the second-largest exchange after Binance.

Despite reporting improved revenue and profits, Coinbase’s global market share has seen only a minor increase of 1% over the same time period.”

According to Kaiko, Bybit’s low fees could be a key factor behind the exchange’s growth.

“However, other offshore exchanges like Binance and OKX also offer low fees, and many exchanges have ongoing zero-fee promotions and reward campaigns. Bybit launched zero fees for USDC trading in February 2023, while Binance has promoted TUSD and FDUSD over the past year. This suggests that while low fees contribute to Bybit’s competitive edge, they are not the only reason for its rise.”

According to Kaiko, Bitcoin and Ethereum (ETH) trading have aided Bybit’s growth as the exchange’s market share of the two leading digital assets has grown from 17% to 53% over the last 12 months.

“Bybit’s growing spot market share has also been supported by its rapidly growing derivatives offering. In 2023, Bybit cemented its place as the second-largest derivative market after Binance.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney