- Losing the historical support level puts BTC in pole position for another fall.

- MVRV Long/Short difference revealed that the coin’s price might recover later in the cycle

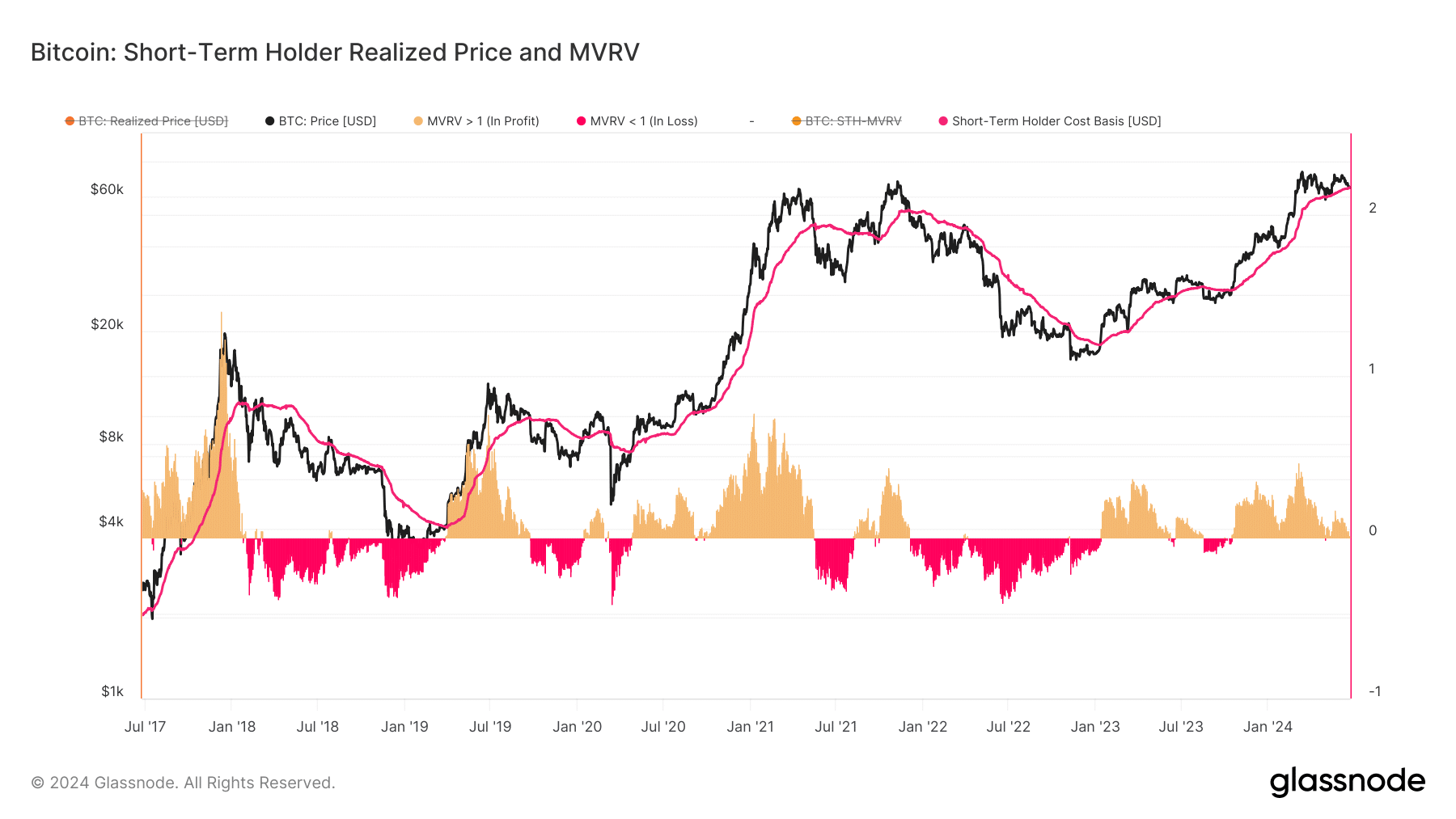

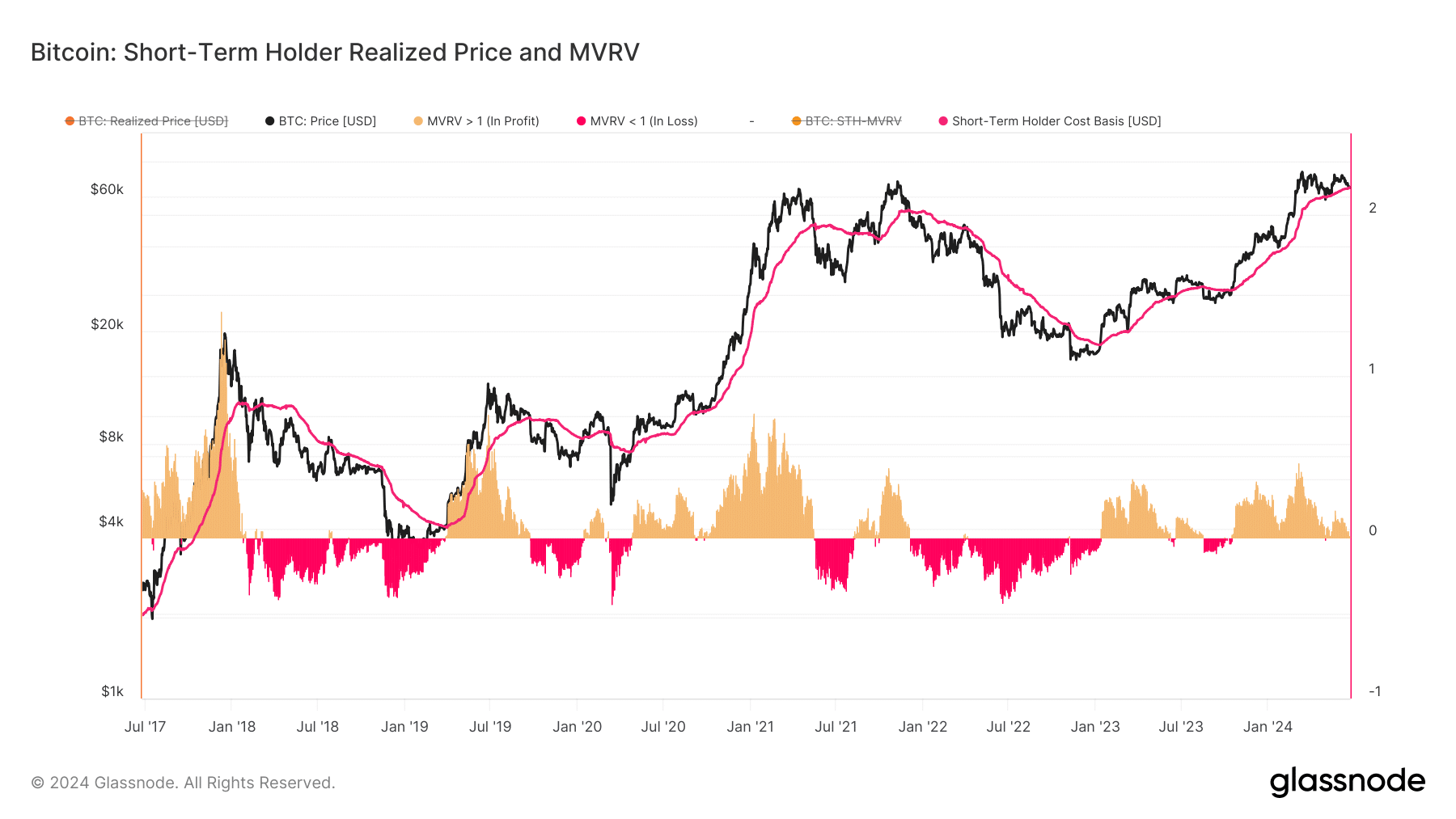

Bitcoin [BTC] has fallen below the Short Term Holder (STH) Realized Price, indicating that the price might drop to $61,000 or below $60,000 in the coming days.

According to Glassnode, at press time, Bitcoin’s STH Realized Price was $64, 372 while BTC’s value was $64,066. Also, known as the on-chain cost basis, the metric is the average value of the STH Bitcoin supply.

Here, it’s worth pointing out that the STH Realized Price is valued at the day each coin was last transacted on-chain. Typically, STH are those who bought BTC not later than the last 155 days.

Bitcoin looks set to slide

When Bitcoin rises above the Realized Price, it increases the chance of a price rise. This, because the metric acts as support for the crypto’s price. However, a fall below the threshold sparks the possibility of a correction. This was also evident in previous market cycles too.

For example, back in 2018, the cryptocurrency fell below the Realized Price of $11,012. A few months later, the price of the coin dropped to $8,455. In the last days of 2021 when Bitcoin’s price was $48,962, and the metric was over $53,000, it did not take long for the value to drop to $42,306.

Source: Glassnode

If we go by this historical data, the value of BTC is at risk of another correction despite its 7.82% fall in the last 30 days.

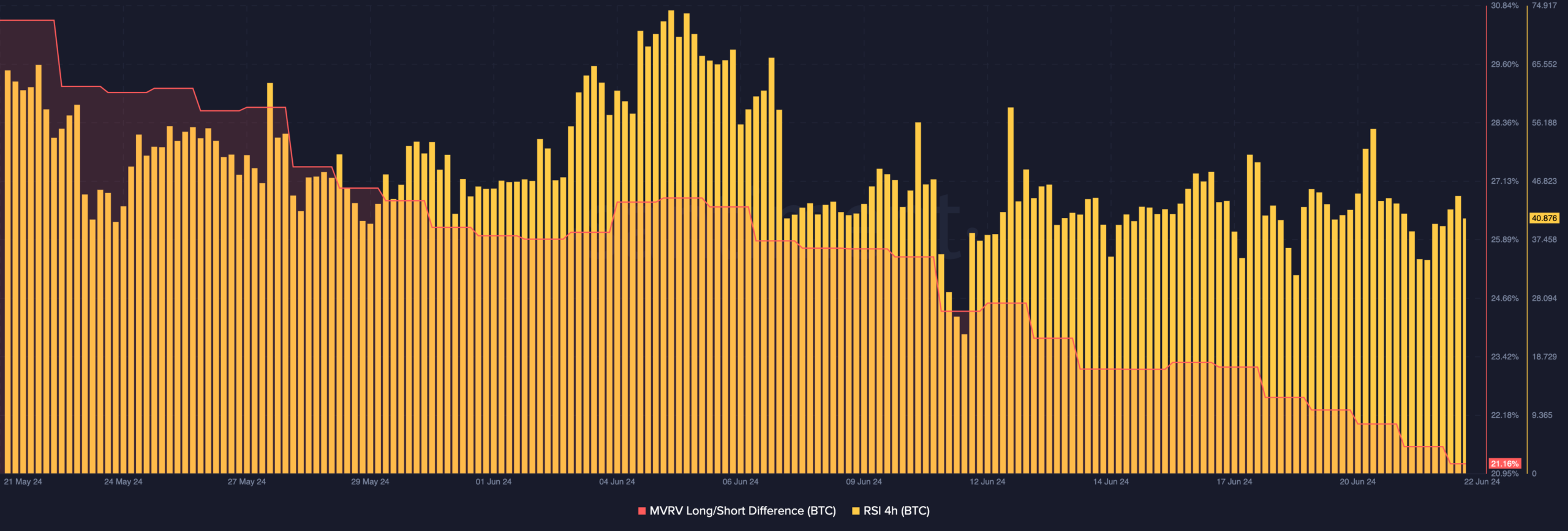

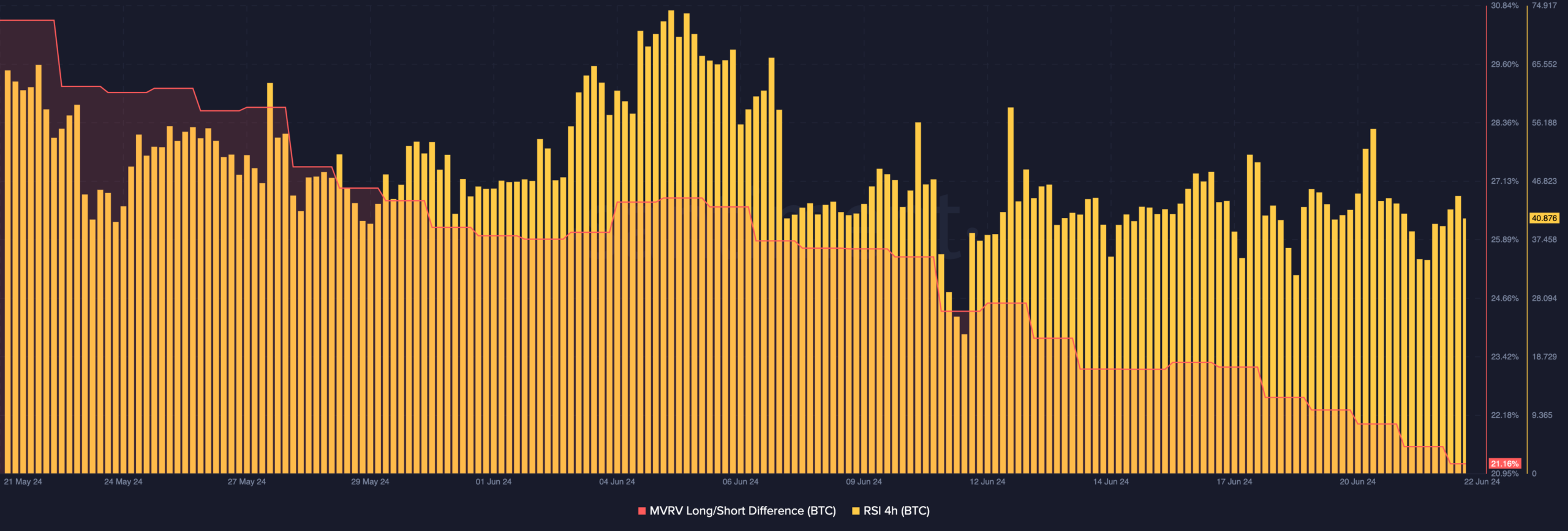

In addition to this, AMBCrypto analyzed the Market Value to Realized Value (MVRV) Long/Short Difference. This metric uses the ratio of long-term holders and new money coming into Bitcoin to determine potential market deviations.

It’s still a bull market!

If the MVRV Long/Short rises, it means that new money is entering the coin’s market. However, a decline implies otherwise. At press time, the metric was down to 21.16%.

This is a sign that BTC has lacked a high level of capital in recent times. Hence, the price of the coin could drop in the short term.

However, the metric also reveals if a cryptocurrency is in a bear or bull phase. Since the reading was positive, it means Bitcoin is still in a bull market. As such, if the price drops to $61,000, the value could be much higher later in the cycle.

Additionally, the Relative Strength Index (RSI) on the 4-hour chart was 40.87. Here, the RSI measures momentum, showing if it is bullish or bearish. The reading for the same was below 50 – A sign of bearish momentum.

Source: Santiment

Realistic or not, here’s BTC’s market cap in ETH terms

Hence, BTC’s bearish prediction could be validated. That being said, an analyst on X – Crypto Caesar – predicted that the decline could be an opportunity to buy before another rally begin. He wrote,

“Bitcoin‘s short-term holder realized price generally acts as support in upward trending markets (see chart). Currently sitting at $63,900. Historically this has been a good BTFD opportunity before more banana mode.”