- DOT’s Open Interest and volatility dropped, suggesting a lack of demand for the token.

- The liquidation heatmap showed that DOT’s price might drop to $5.90.

Since the 14th of June, Polkadot [DOT] has been trading between $6.10 and $6.25. By the look of things, the sideways movement might not continue.

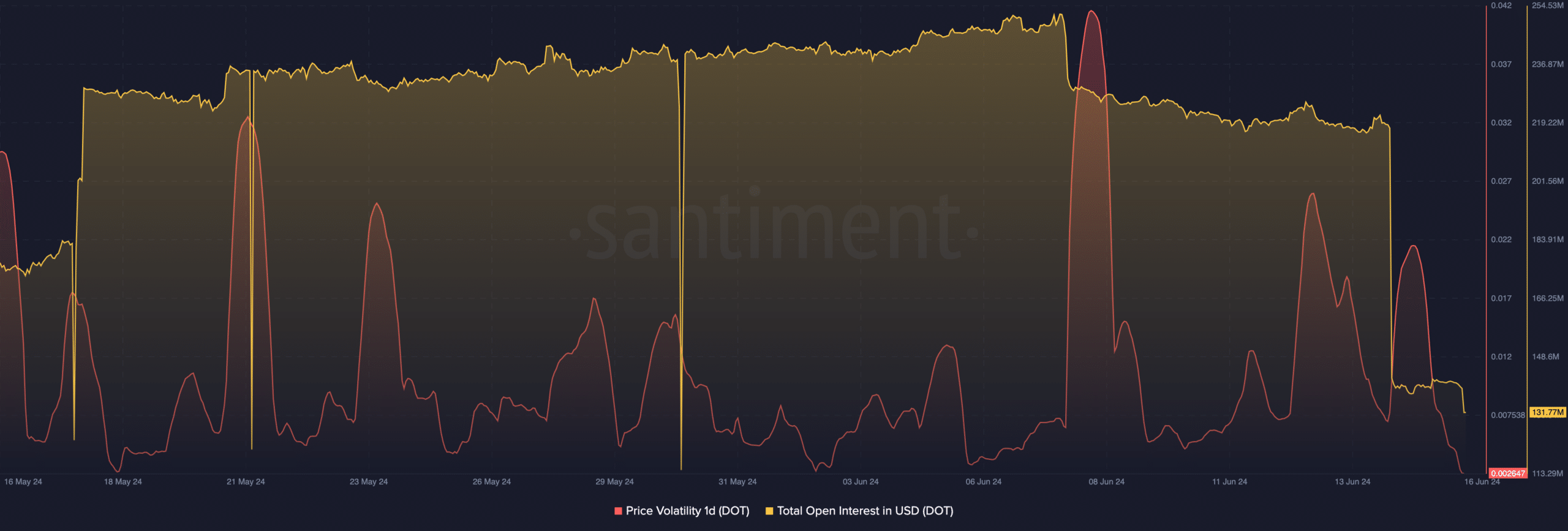

AMBCrypto observed this after examining DOT’s volatility. In crypto, volatility refers to the frequency of price fluctuations in the market.

A high volatility means the price of a token can swing to an extreme height or low within a short period.

On the flip side, low volatility suggests that the price might keep trading within a tight region. For Polkadot, based on data from Santiment, the one-day volatility had dropped to its lowest since the 18th of May.

DOT set to keep swinging around the same region

Specifically, the reading was 0.0026. If the metric remains at a low spot going forward, it could be challenging for DOT to move past the $6 zone.

Apart from the token’s volatile condition, Open Interest (OI) was another indicator that reinforced the prediction. OI is the value of open contracts in the market.

When it increases, it implies that liquidity is flowing into contracts related to a cryptocurrency. However, a decrease in the OI means net positioning is decreasing and money is flowing out of the market.

Source: Santiment

At press time, Polkadot’s Open Interest was down to $131.77 million. About a week ago, the value was over $250 million.

Therefore, the decline serves a sign that DOT might not have the strength to break through $7 in the short term.

Next move may be down to $5.90

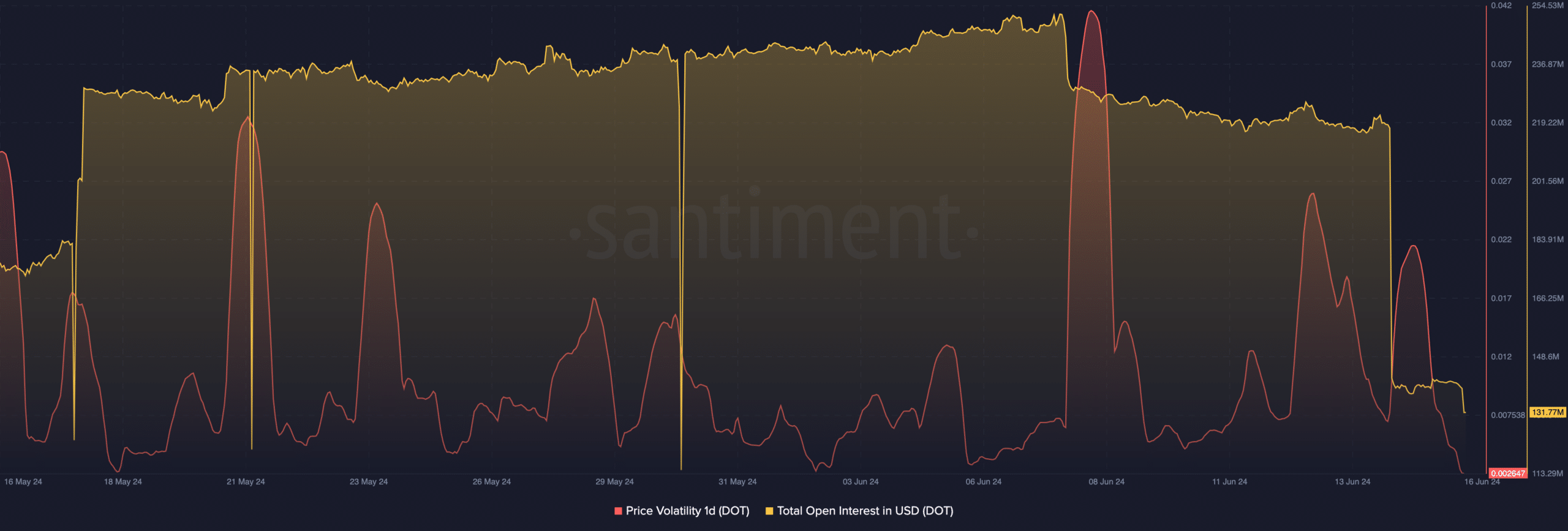

Additionally, AMBCrypto evaluated DOT’s liquidation heatmap. In simple terms, liquidation heatmap identifies price levels where large-scale liquidation events might occur.

Liquidations occurs when a trader can no longer fulfill the margin requirements to keep a position open. When this happens, an exchange forcefully closes this position to prevent further losses.

Estimated liquidation levels can also act as support or resistance, as price might move toward the high liquidity points. In Polkadot’s case, a cluster of liquidity appeared between $6.02 down to $5.77.

Therefore, the price of the token might move toward that area in the short term. However, in the case of invalidation, DOT’s next target could be between $6.60 and $6.95.

Source: Hyblock

Despite the bearish outlook of DOT, some analysts believe that the token’s potential remains bullish in the long term. One of those with such opinion is Michaël van de Poppe.

Read Polkadot’s [DOT] Price Prediction 2024-2025

According to van de Poppe, DOT was trading at an accumulation point. He added that the fundamentals behind the project makes it one that will do well in the coming years.

In his post on X (formerly Twitter), he noted that,

“DOT reaching the crucial area of support and the area for accumulation. Given the upcoming RWA narrative and the large number of projects within the Polkadot ecosystem, this one is going to be a great mover in the coming years.”