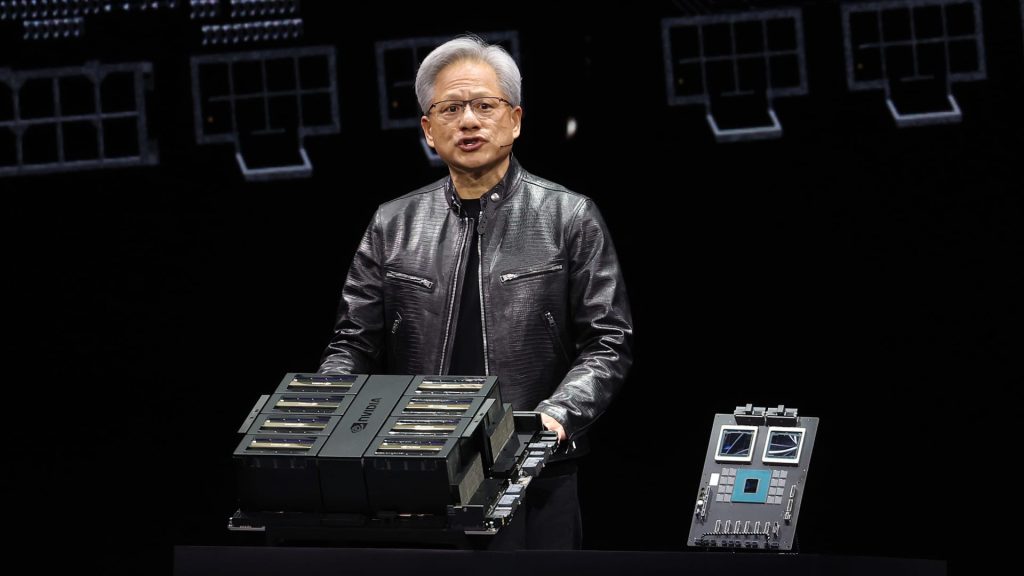

Nvidia CEO Jensen Huang delivers the keynote address at the Nvidia GTC artificial intelligence conference at the SAP Center on March 18, 2024 in San Jose, California.

Justin Sullivan | Getty Images

Nvidia Shares jumped more than 9% on Thursday after the company reported earnings Wednesday that beat Wall Street estimates and showed demand for its artificial intelligence chips remains strong. The company’s data center revenue rose a whopping 427% in the quarter.

The stock closed above $1,000 for the first time, hitting a high of $1,037.99. The previous high of $953.86 was set on May 21.

First-quarter revenue came in better than expected at $26.04 billion, compared with LSEG’s estimate of $24.65 billion. And demand hasn’t wavered.

The company issued strong guidance, saying it expects current-quarter revenue of $28 billion, beating LSEG’s estimate of $26.61 billion.

While some analysts are wary of an air pocket, others have become even more bullish on the company following its results. Bernstein’s Stacy Rasgon increased the company’s price target to $1,300, writing in a note to investors that the story surrounding the company is “clearly far from over or likely far from its peak.” He wrote that the stock seemed inexpensive.

Jefferies raised its share price target to $1,350 due to strong sales growth of its new AI GPUs called Blackwell and expectations of an acceleration in “impact magnitude” later this year when the platform launches.

Nvidia reported net income of $14.88 billion, or $5.98 per share, up significantly from the $2.04 billion, or 82 cents per share, it reported in the year-ago quarter.

Nvidia on Wednesday announced a 10-for-1 stock split, with shares set to begin trading on a split-adjusted basis at the market open on June 10.