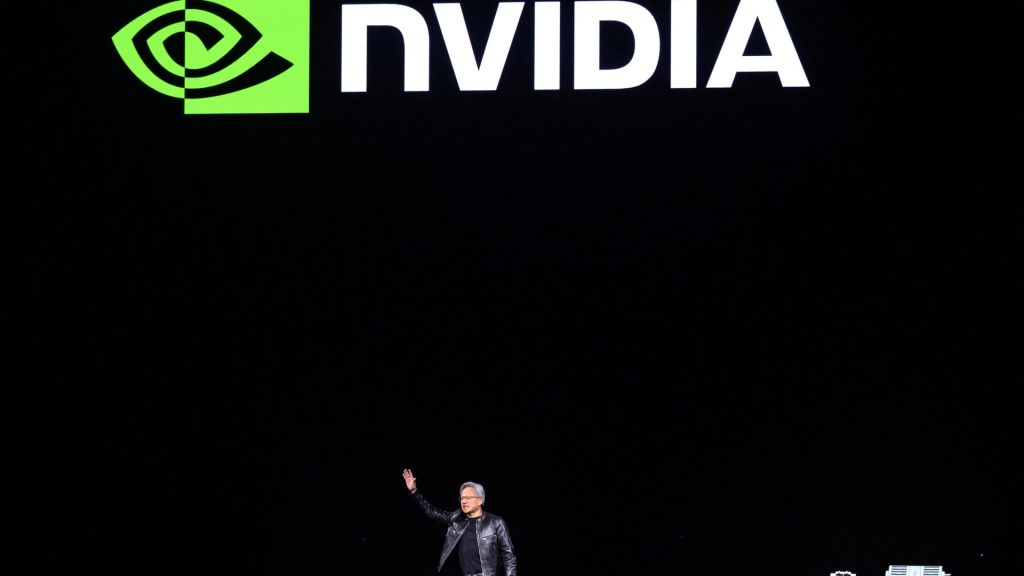

See the companies making headlines in midday trading. Nvidia — Shares of the chipmaker and artificial intelligence beneficiary rose 11% after Nvidia posted strong first-quarter financial results, posted better-than-expected guidance and announced a 10-for-1 stock split. Other AI and Related Companies nim semiconductor companies rose on these results. Super Micro Computer shares rose 1.2%. Boeing – Shares fell about 6% after Chief Financial Officer Brian West said he expected negative free cash flow and that the company’s aircraft deliveries would not rebound in the second quarter from the first. Boeing faces a number of production challenges to produce its best-selling planes. Live Nation Entertainment – Shares fell 7% after the U.S. Department of Justice filed a lawsuit to break up Ticketmaster’s parent company, accusing it of violating antitrust laws. Elf Beauty — Elf Beauty shares rose 21% after Elf Beauty’s revenue and earnings beat its fiscal fourth-quarter estimates. The cosmetics maker reported fourth-quarter adjusted earnings of 53 cents per share on revenue of $321.1 million. Analysts polled by LSEG expected earnings per share of 32 cents on revenue of $292.6 million. LiveRamp – Shares up 7% after stronger-than-expected fiscal fourth-quarter earnings, according to FactSet. In addition, LiveRamp issued strong revenue guidance for the current quarter and full year. GoodRx — Shares rose 3% after RBC upgraded GoodRx to outperform the sector, saying the telemedicine company has notable growth opportunities. Taiwan Semiconductor Manufacturing — Shares of Taiwan Semiconductor rose 2% after the chipmaker said it expects global semiconductor industry revenue to grow 10% annually. Snowflake — Shares of the cloud computing company fell 3%, reversing earlier gains, driven by the company’s better-than-expected first-quarter revenue and higher guidance for full-year product revenue. Snowflake posted revenue of $829 million, beating the consensus estimate of $786 million, according to LSEG. Adjusted earnings for the period were 14 cents per share, but 4 cents below analysts’ consensus estimates. Titan Machinery — Shares of the farm machinery and equipment maker fell 17% after Titan Machinery reported first-quarter earnings and revenue that missed expectations, according to FactSet consensus estimates. Triumph Group – Aerospace shares fell 11% after Triumph Group issued earnings forecast of 42 cents per share for the full year ending March 2025, below the FactSet consensus estimate of 70 cents per share. Cytokinetics – Shares of the biopharmaceutical company fell 15% following a $500 million common stock offering. JPMorgan, Goldman Sachs and Morgan Stanley are the joint joint book-running managers. VF Corp – Shares fell 3.5% after the apparel and footwear company reported a surprise loss per share. VF Corp suffered a loss of 32 cents per share in its fiscal fourth quarter, compared with a profit of 1 cent per share expected by analysts polled by LSEG. Revenue was also flat at $2.37 billion, compared with the consensus estimate of $2.41 billion. — CNBC’s Michelle Fox and Pia Singh contributed reporting.