- WIF has witnessed a price decline amid the rally in the general market.

- Key indicators suggest that its price might witness a further drop.

The dog-themed meme coin dogwifhat [WIF] has not seen a significant price rally in the last week despite the general market rally during that period.

According to CoinMarketCap, WIF exchanged hands at $2.84 at press time, witnessing a 2% decline in the last seven days. This has made it the only leading meme asset that has failed to register a price growth in the last week.

More losses ahead

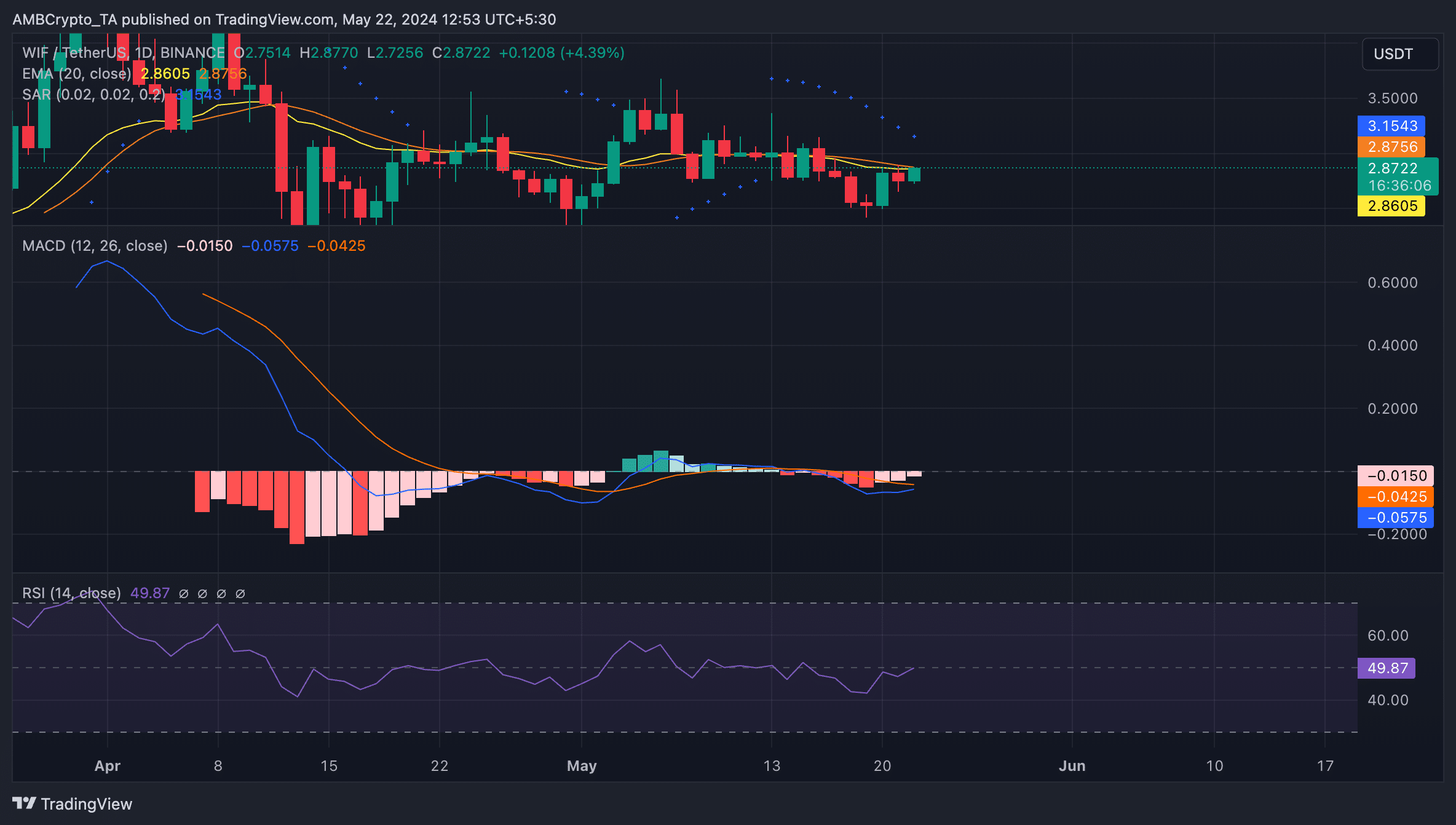

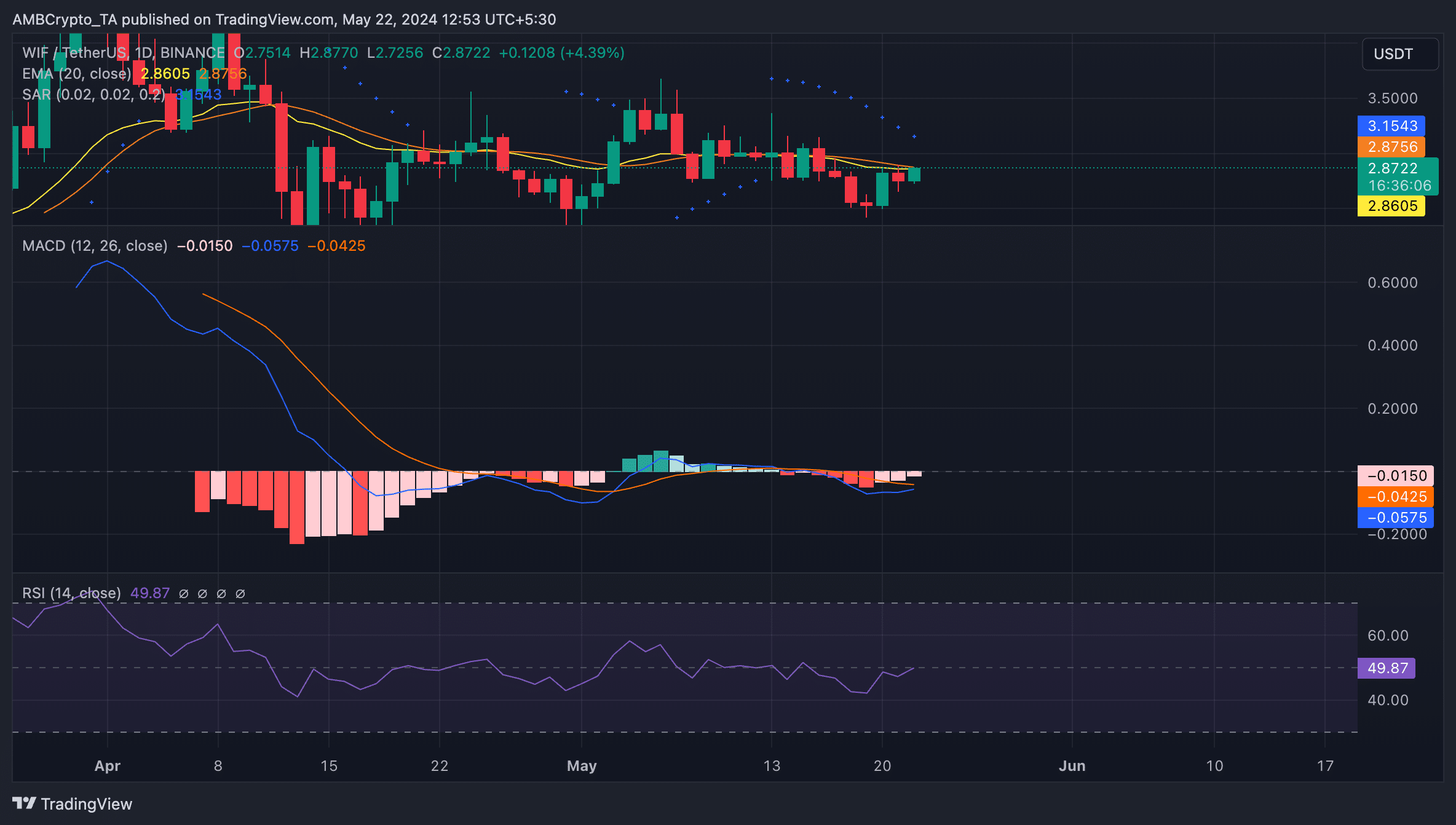

As assessed on a daily chart, WIF’s key technical indicators hinted at the possibility of a continued price decline. Firstly, the meme asset trades below its 20-day Exponential Moving Average (EMA) at press time.

When an asset trades below its 20-day EMA, it is regarded as a bearish signal because it means its current price has fallen under its average price of the past 20 days. Market participants interpret it as a shift toward coin sell-offs.

The decline in WIF demand among market participants is illustrated by its Relative Strength Index (RSI), which was below its neutral spot at 49.47 as of this writing. This value shows that WIF traders favored token sell-offs over accumulation.

Further, WIF’s MACD line (blue) rested below its signal (orange) and zero lines.

When these lines are set up in this manner, the asset’s short-term moving average is below its long-term moving average. It is a bearish signal which confirms an ongoing downtrend.

Confirming the bearish trend, the dots of WIF’s Parabolic SAR were atop its price. They have been since the 13th of May.

This indicator is used to identify potential trend direction and reversals. When its dotted lines are placed above an asset’s price, the market is said to be in a decline.

It indicates that the asset’s price has been falling, and the drop may continue.

Source: WIF/USDT on TradingView

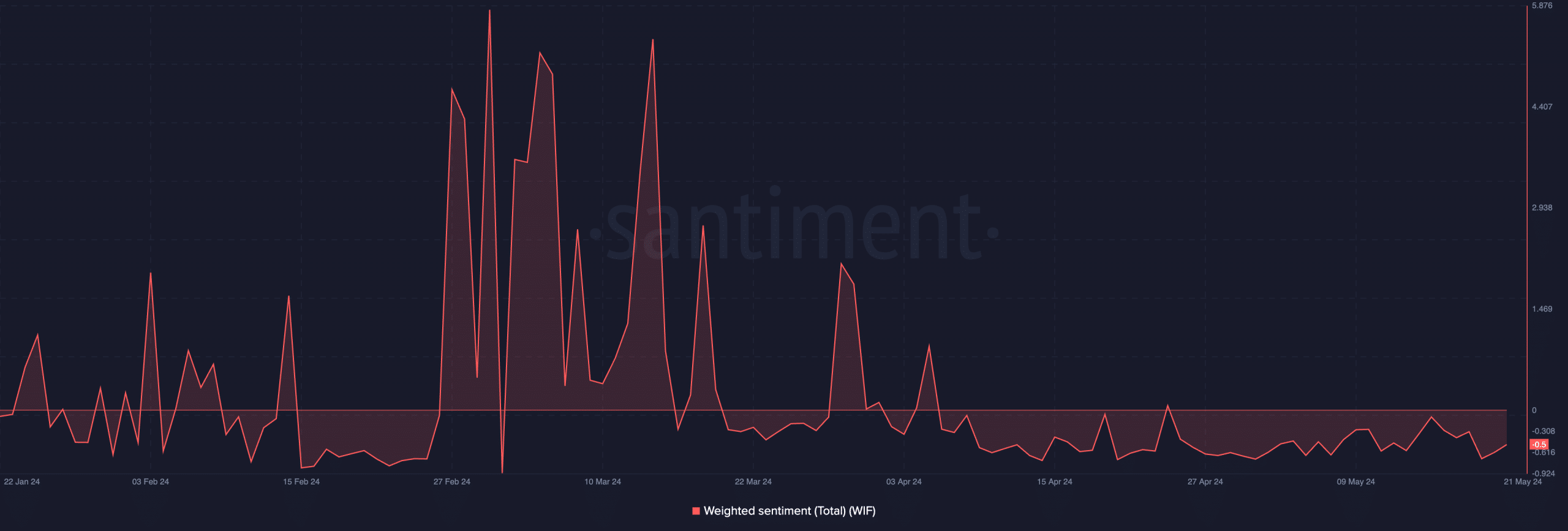

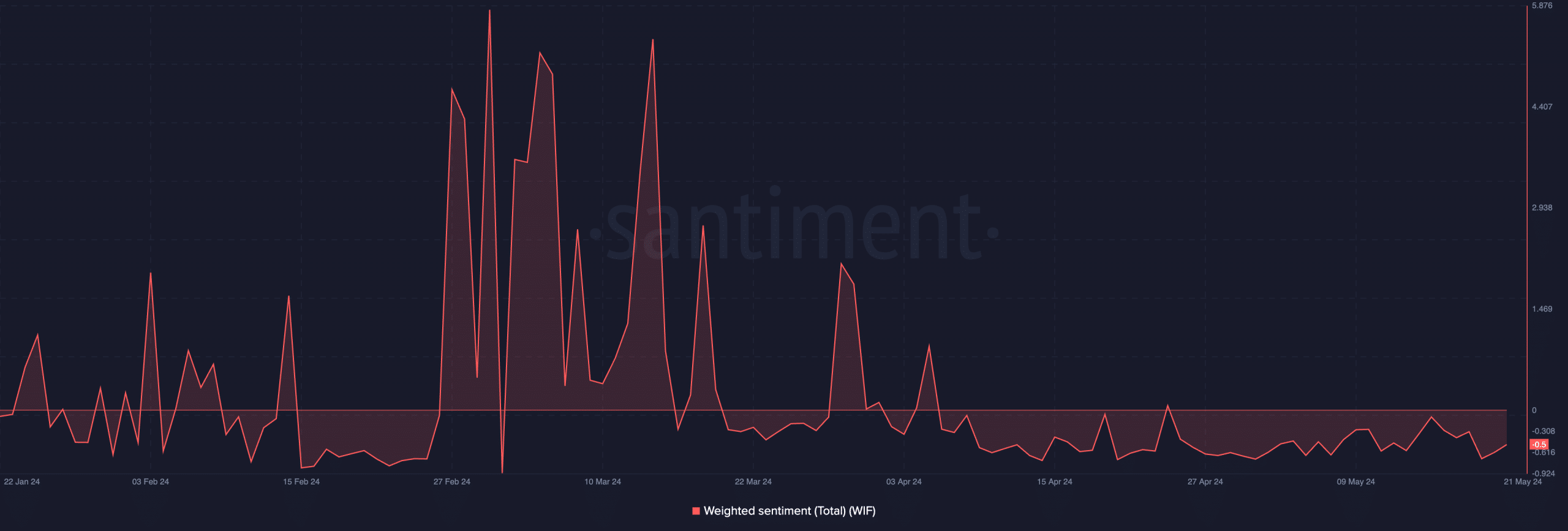

A look at the token’s weighted sentiment lent credence to the above position. It was at -0.5 at press time, per Santiment’s data.

Source: Santiment

Read dogwifhat’s [WIF] Price Prediction 2024-25

When an asset records a negative weighted sentiment, it generally connotes a downtrend in investor confidence.

Poor sentiment often leads to distribution, as some investors might be inclined to sell their holdings due to a lack of confidence in the asset’s short-term price growth.