- XRP tumbled as Ripple moved 50 million tokens, causing a market stir.

- The overall market sentiment for XRP is mixed, with neither the bulls nor the bears in control.

Ripple’s [XRP] recent price surge hit a wall, leaving investors questioning what’s stalling its momentum. The cryptocurrency saw a promising 6% rise yesterday but has decreased by 2% today.

What exactly is dragging XRP down?

Why is XRP down today?

Recent data from the blockchain tracker Whale Alert revealed a massive transfer of 50 million XRP tokens from Ripple Labs Inc. to an unknown wallet valued at approximately $25.7 million.

This large-scale movement follows another huge transaction last week, in which over 100 million XRP were sent to an external wallet.

Typically, these Ripple dumps tend to shake XRP’s price negatively. This is because they increase the supply of XRP in the market, which can lead to downward pressure on the price if demand remains constant.

And it has — XRP crossed the $0.55 threshold less than 24 hours ago, but the token is worth $0.53 at press time.

What does the market tell us?

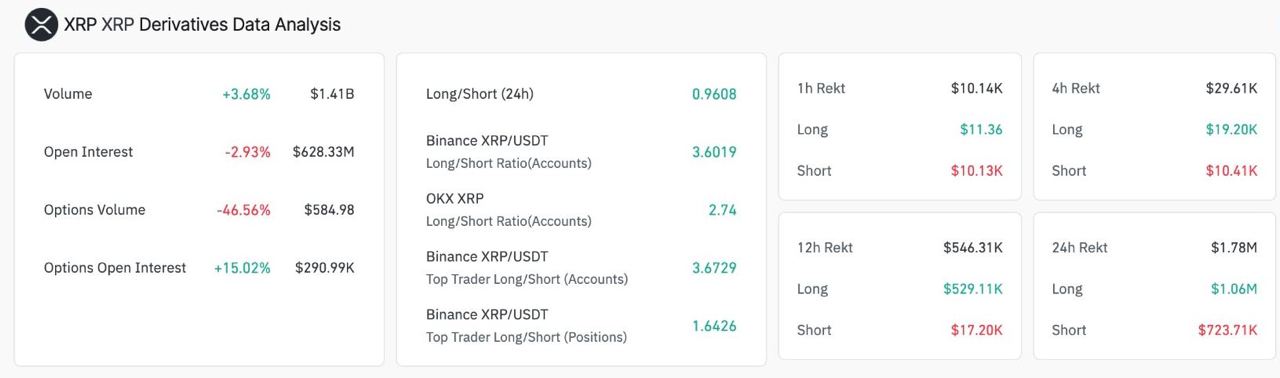

AMBCrypto’s look at Coinglass’ data revealed that XRP’s trading volume has increased slightly by 3.68%, totaling $1.41 billion, indicating a moderate rise in trading activity.

However, Open Interest has decreased by 2.93%. This decrease suggested a slight cooling off in market enthusiasm or a consolidation phase.

Source: Coinglass

The Long/Short Ratio across platforms showed a mix of bullish and bearish sentiments. These mixed signals suggested a cautious sentiment among traders and investors.

The contrast in Long/Short Ratios imply that while some top traders are bullish, the broader market remains divided. If the top traders’ bullish bets prove correct, we might see an upward price movement for XRP.

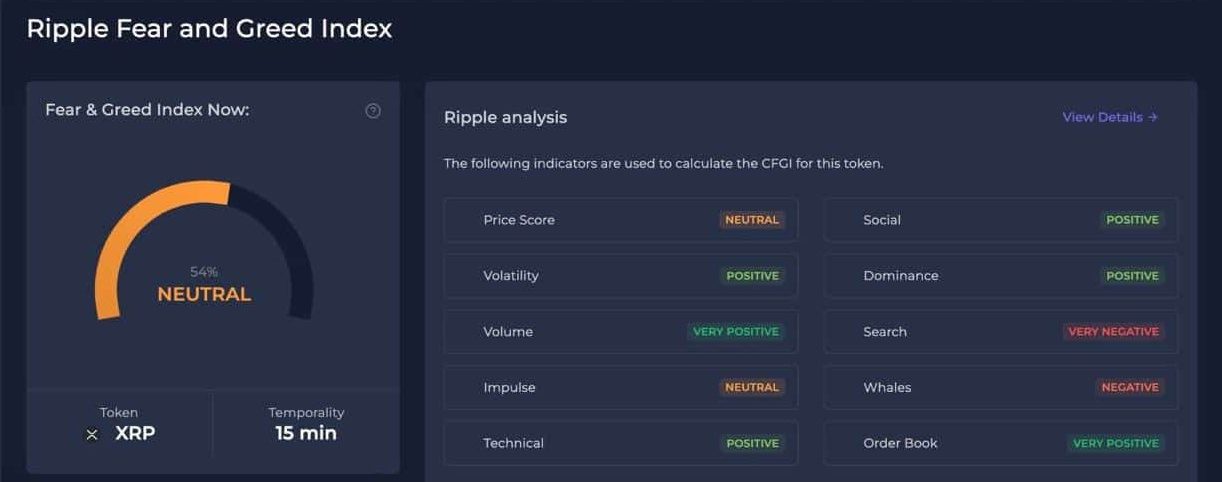

Meanwhile, AMBCrypto’s look at the social sentiment data revealed that the Ripple Fear and Greed Index stood at 54% at press time, which indicated a neutral market sentiment for XRP.

Source: CFGI

Is your portfolio green? Check out the XRP Profit Calculator

Investors might consider maintaining their positions as suggested by the index’s “Hold On” investment suggestion while keeping an eye on the volume dynamics, order book conditions, and whale activities.

These factors could shift the market sentiment quickly either way.