- Decreasing volume and the price increase could cause consolidation for DOT.

- Search for DOT has reduced, indicating a slide in demand.

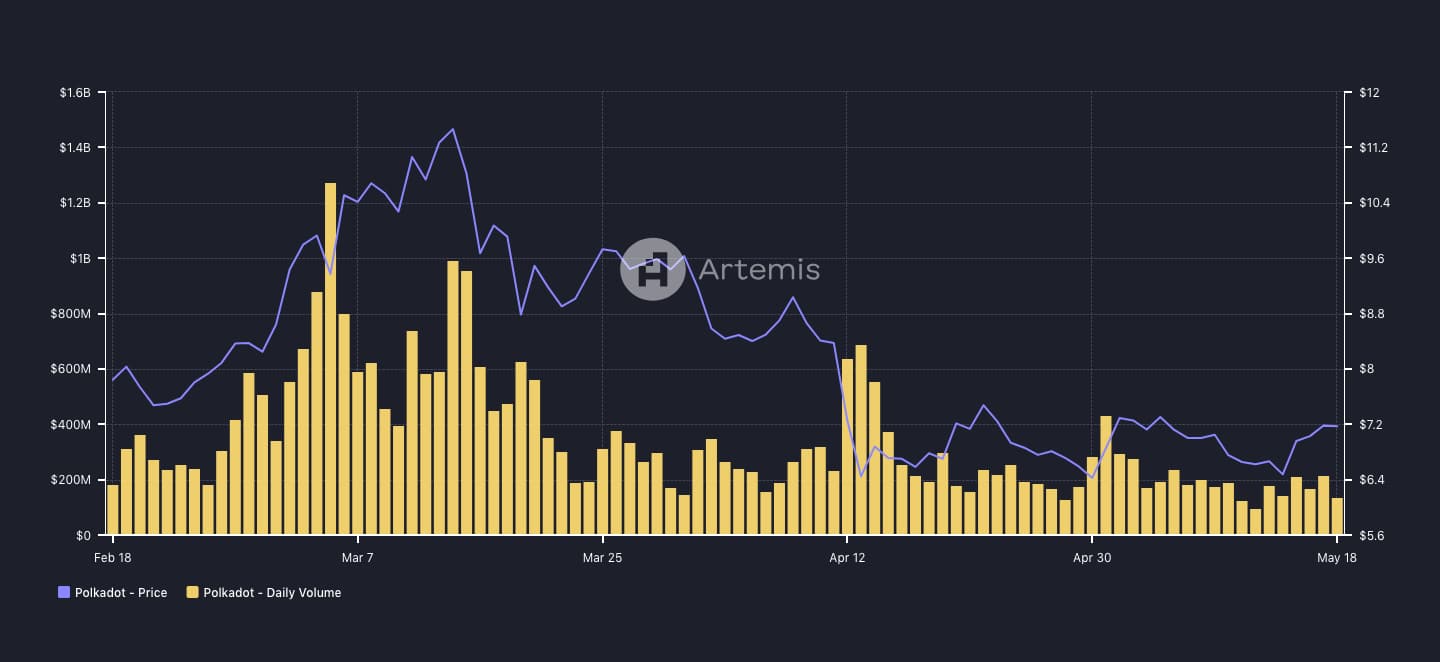

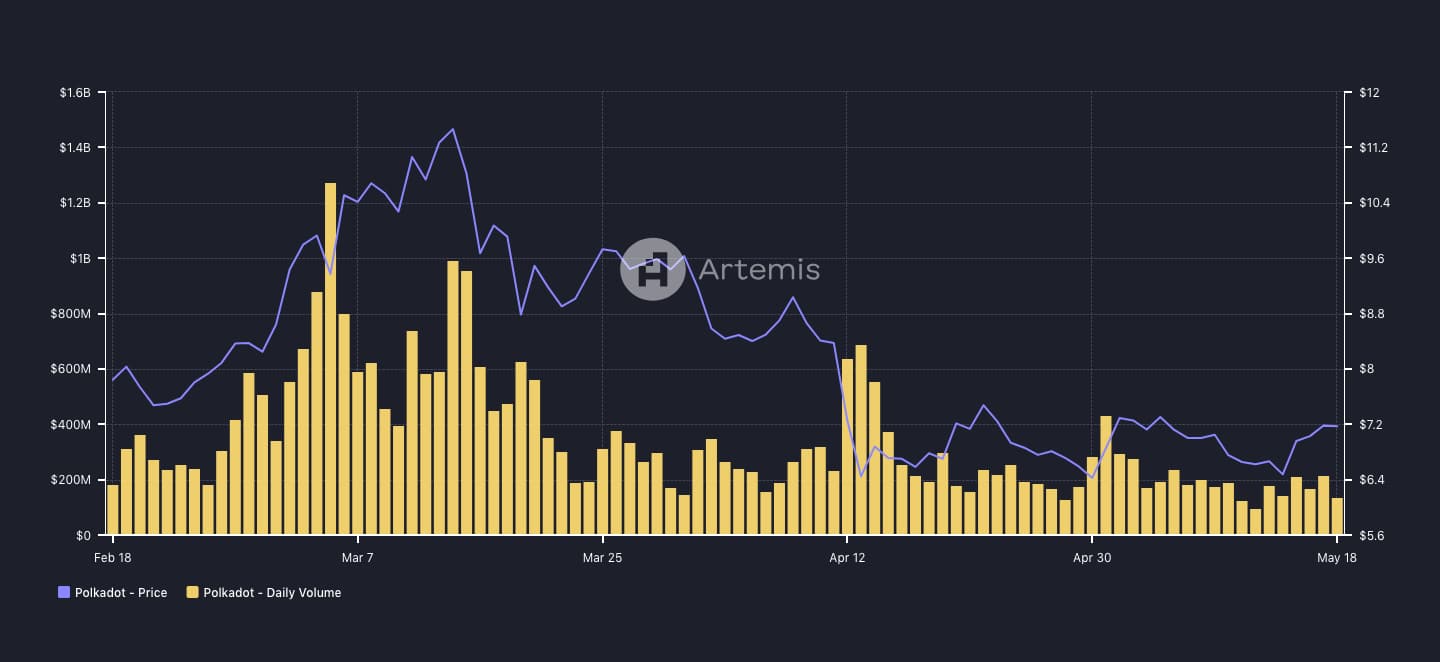

A significant decrease in its daily trading volume has put Polkadot [DOT] at risk of another decline. Volume is not necessarily an indicator of a price increase.

If the trading volume increases, it means that there is a lot of exchange going on with a token. Conversely, a decline in the metric suggests that interest in a cryptocurrency has decreased.

Excitement in the token drops

For Polkadot, data from Artemis.xyz showed that the volume was $137.80 million. This was one of the lowest the project has seen since the second quarter of the year began.

However, the price of DOT has increased by 6.61% in the last seven days. But a massive decline in the volume could be a stumbling block to that hike.

Source: Artemis

Previously, there have been predictions that DOT could ride back to $10. If the volume pumps as the price increases, then this forecast might become a reality.

But that was not the case, as rising prices and decreasing volume indicate weakness in the trend. As such, DOT could swing between $7.15 and $7.60 in the short term.

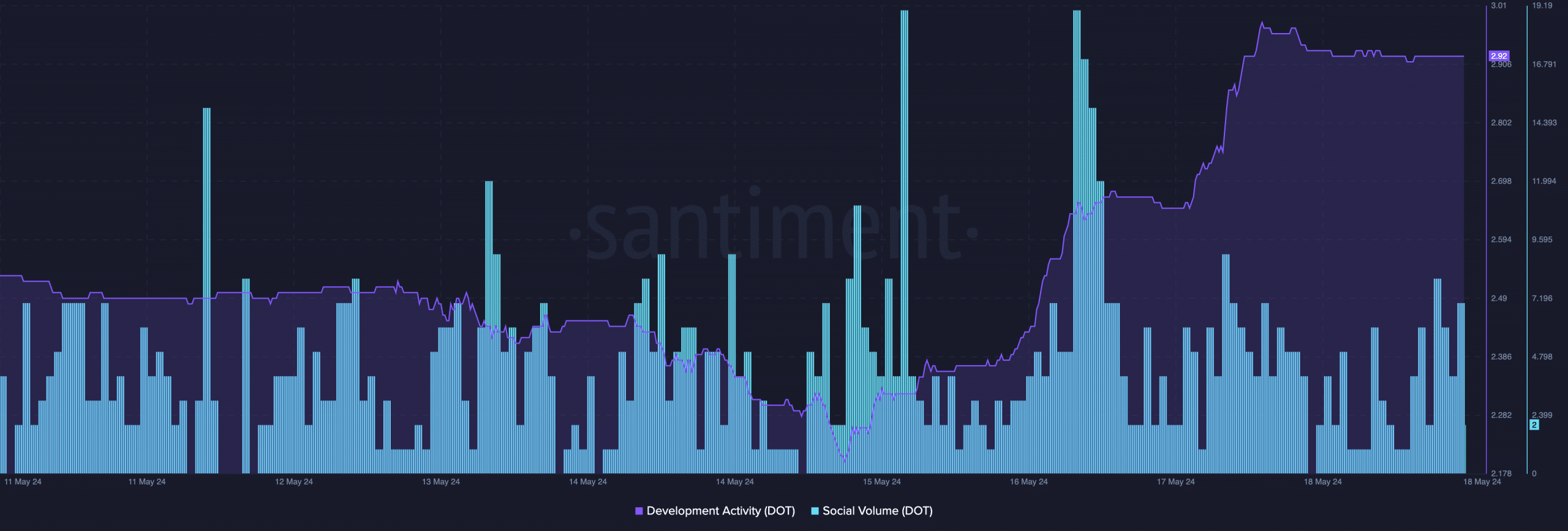

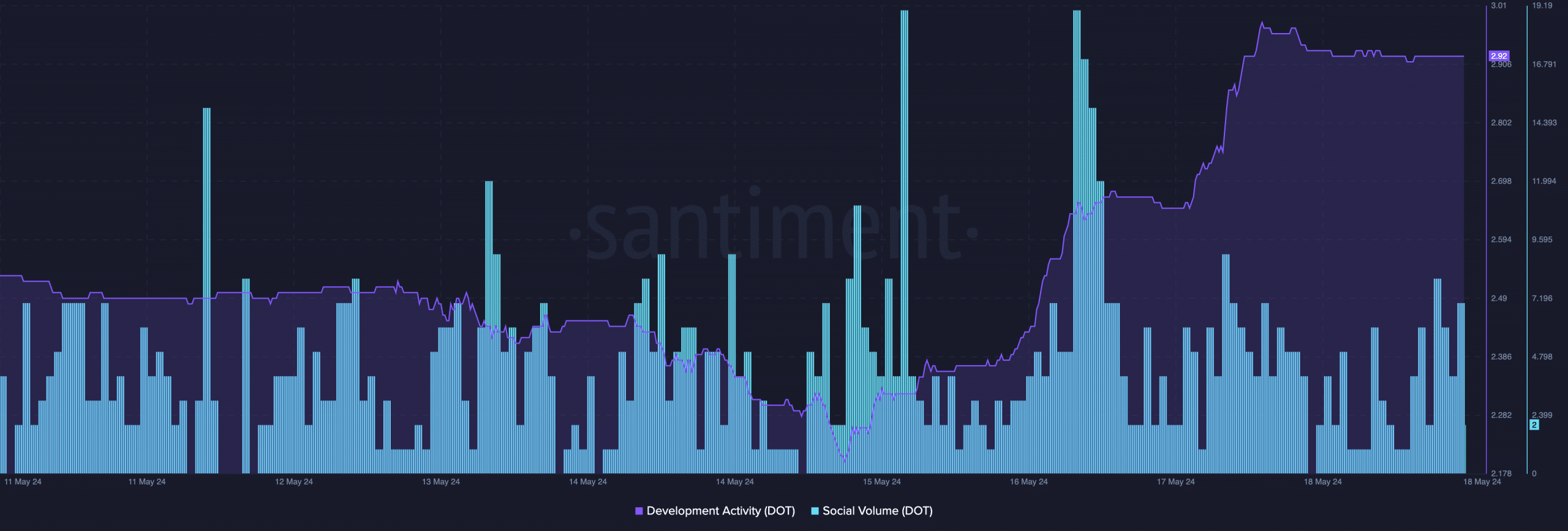

Furthermore, AMBCrypto looked at Polkadot’s development activity as this was one aspect the project has dominated. According to Santiment, development activity on the network was 2.92.

Two days ago, the reading of the metric was 2.20, indicating that more codes have been committed to ensure that Polkadot functions properly

Bulls are not the kings this time

For some projects, a rise in development activity is a bullish sign for the price. But for DOT, it is not always the case. Sometimes, DOT’s price rises with the metric. Other times, the price does not follow.

Therefore, this network improvement cannot be said to be a propeller to drive the token’s value higher. Apart from this, AMBCrypto checked the social volume.

When social volume increases, it implies that the search for a project is increasing. On the other hand, if the social volume dwindles, it suggests that arbitrary text linked to DOT is on the decline.

Source: Santiment

At press time, Polkadot’s social volume jumped on the 17th of May. On the 18th, the metric fell. For the price, this means that demand for DOT was low.

Hence, a 25%+ price increase might be unattainable in the short term. Meanwhile, the metrics discussed here are not the only one that has the potential to influence DOT’s price.

Is your portfolio green? Check the Polkadot Profit Calculator

To get a full understanding, other on-chain indicators like network growth can also impact the value.

If the network growth rises, demand for DOT could lead the price to increase. However, that has not been the case, indicating that DOT’s potential to hit double-digits might not be an option this month.

![Why Polkadot’s [DOT] price bounce will not come anytime soon](https://chartdogs.app/wp-content/uploads/2024/05/polkadot-news-and-volume-1000x600.webp)