- Solana ecosystem witnessed an uptick in activity and development activity.

- Interest in Solana’s DeFi and NFTs declined.

Solana [SOL] attracted large amounts of activity on its network due to the recent popularity of its meme coins.

However, it’s not just the meme coins that have been attracting users to the Solana network – dApps on the Solana network have also played a crucial part.

Taking a look at Solana’s ecosystem

Popular dApps such as Wormhole, Jupiter and Pyth network have managed to gain a large number of active addresses over the past few weeks.

Development Activity on these dApps also grew, which suggested that the new updates and upgrades might be on the way. These new developments could help attract even more users to the network.

Source: Santiment

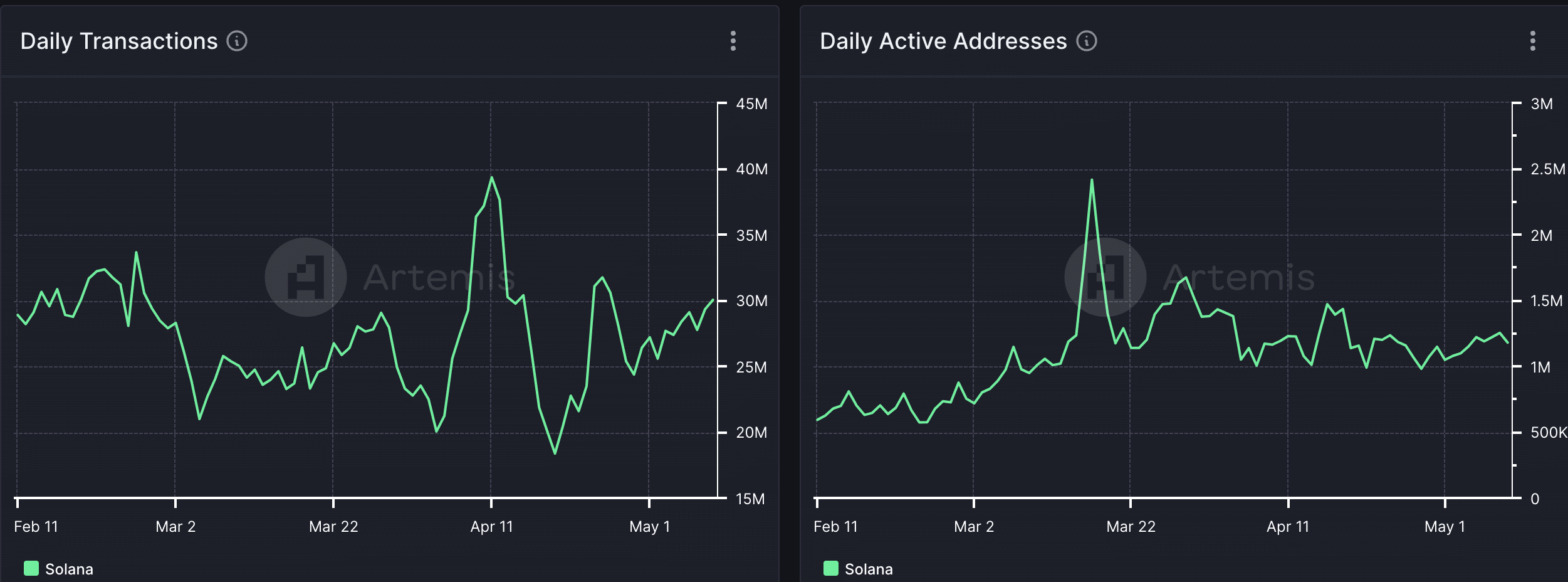

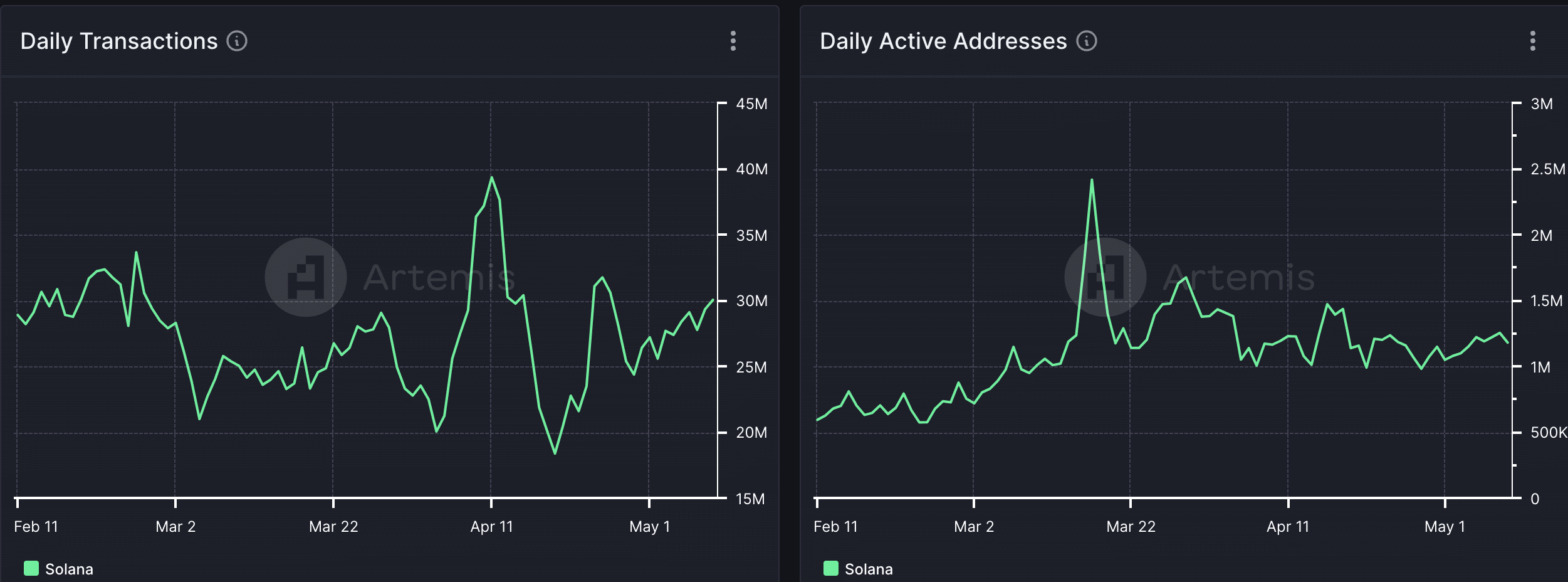

Over the past few weeks, the number of daily transactions occurring on the Solana network had grown from 20 million to 30 million.

However, the number of daily active addresses on the network had remained the same.

This indicated that the high number of transactions on the network were not being driven by new addresses but the same old ones.

Source: Artemis

Some challenges ahead

In the DeFi sector, the Solana network faced some problems. The DEX (Decentralized Exchange) volumes on the network fell significantly over the last few days. Coupled with that, the TVL (Total Value Locked) began to stagnate.

Source: Artemis

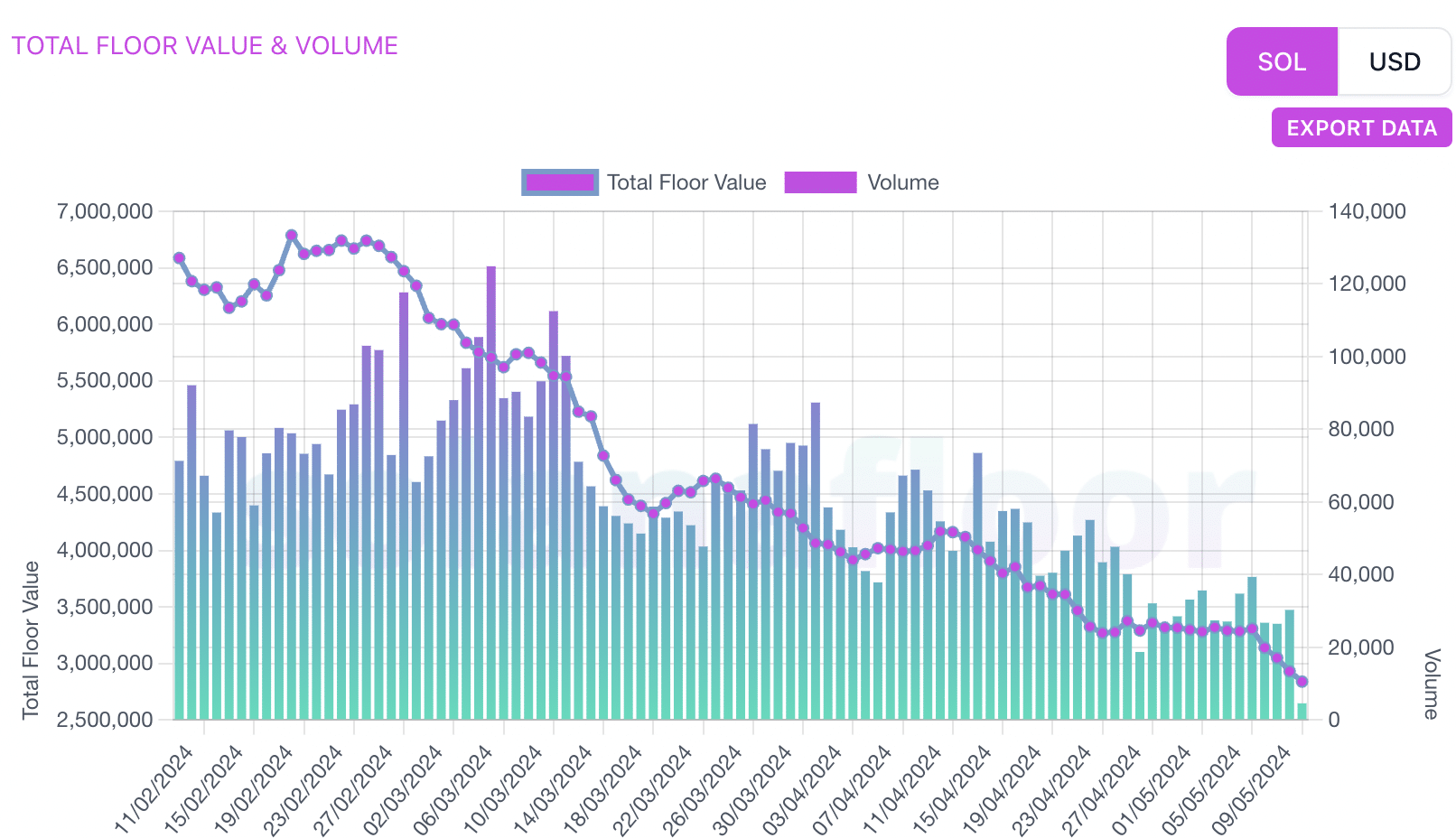

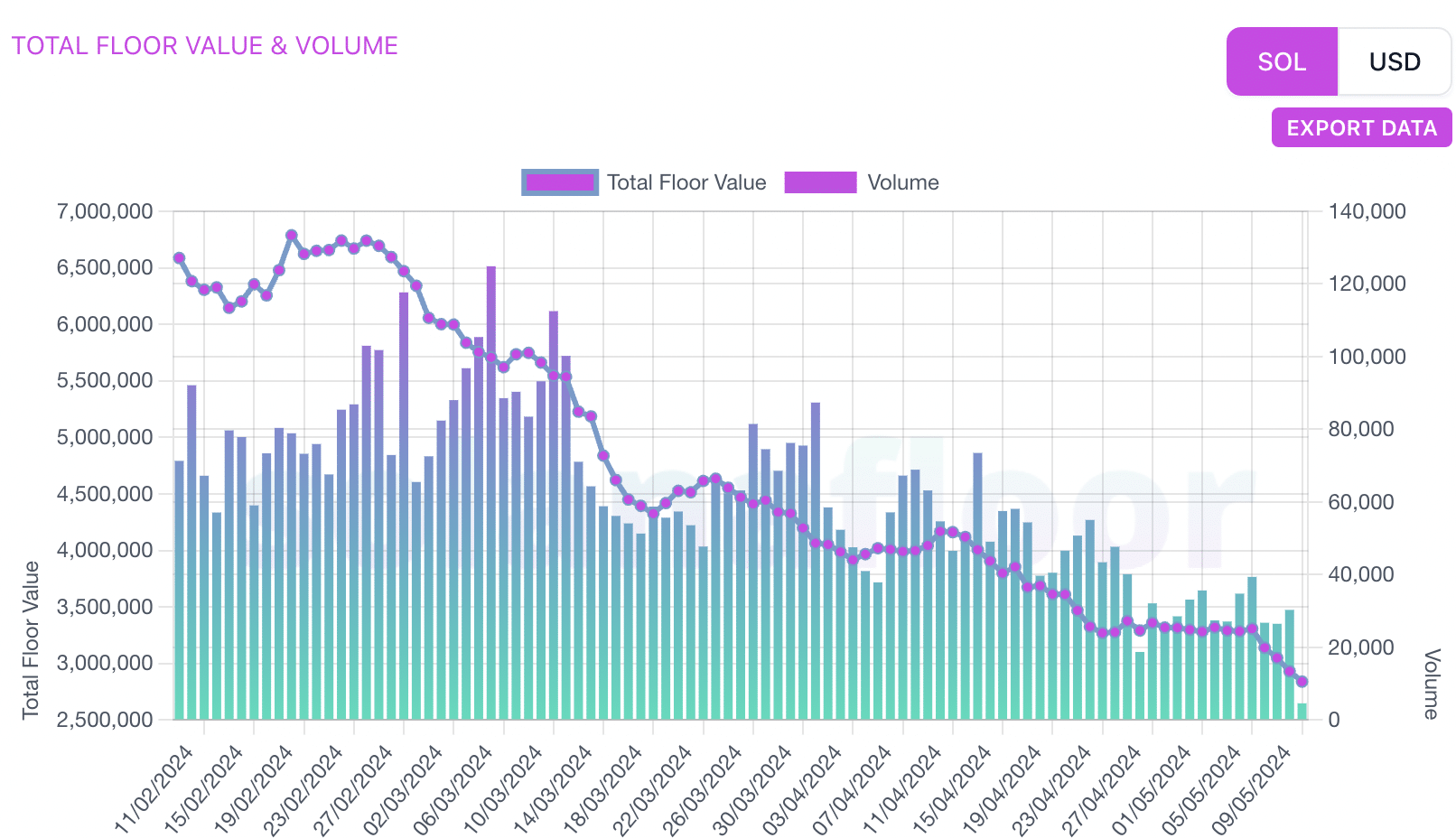

Solana was also observed to be seeing a decline in interest in its NFT sector. AMBCrypto’s analysis of Solana Floor’s data indicated that the total floor value of Solana NFTs had fallen significantly over the last few days.

The volume of NFTs being sold on the Solana network had also declined during this period.

Source: SolanaFloor

These factors could impact the Solana ecosystem negatively and prove to be a hindrance in the growth of the ecosystem, going forward.

Read Solana’s [SOL] Price Prediction 2024-25

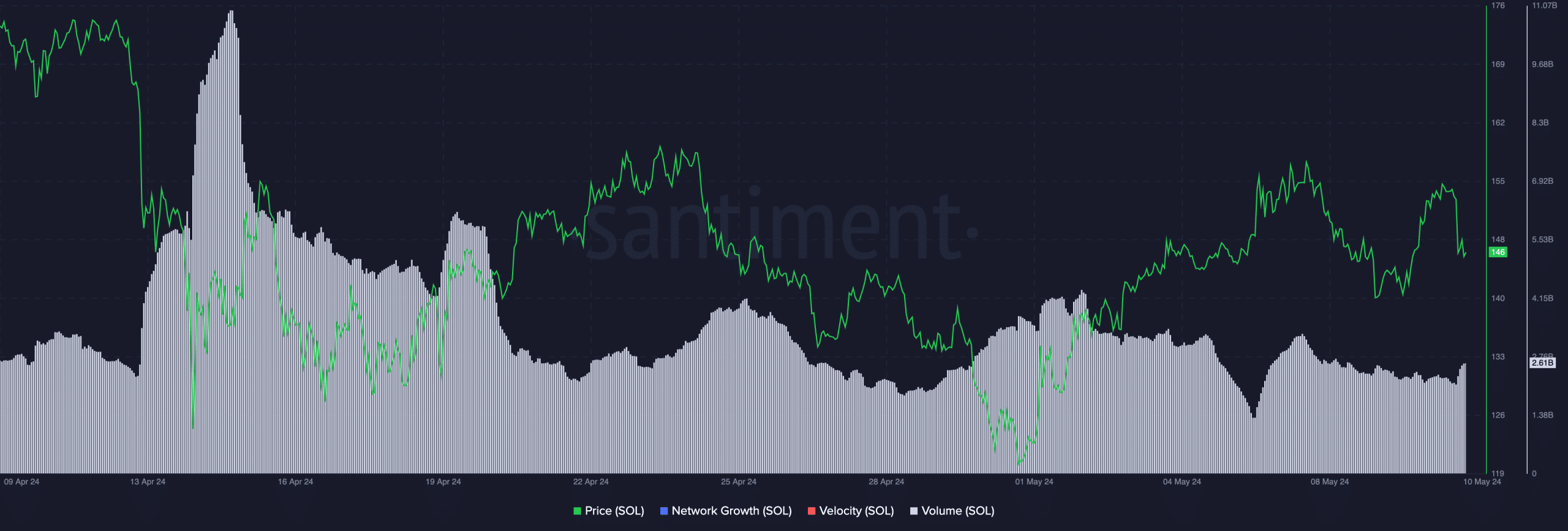

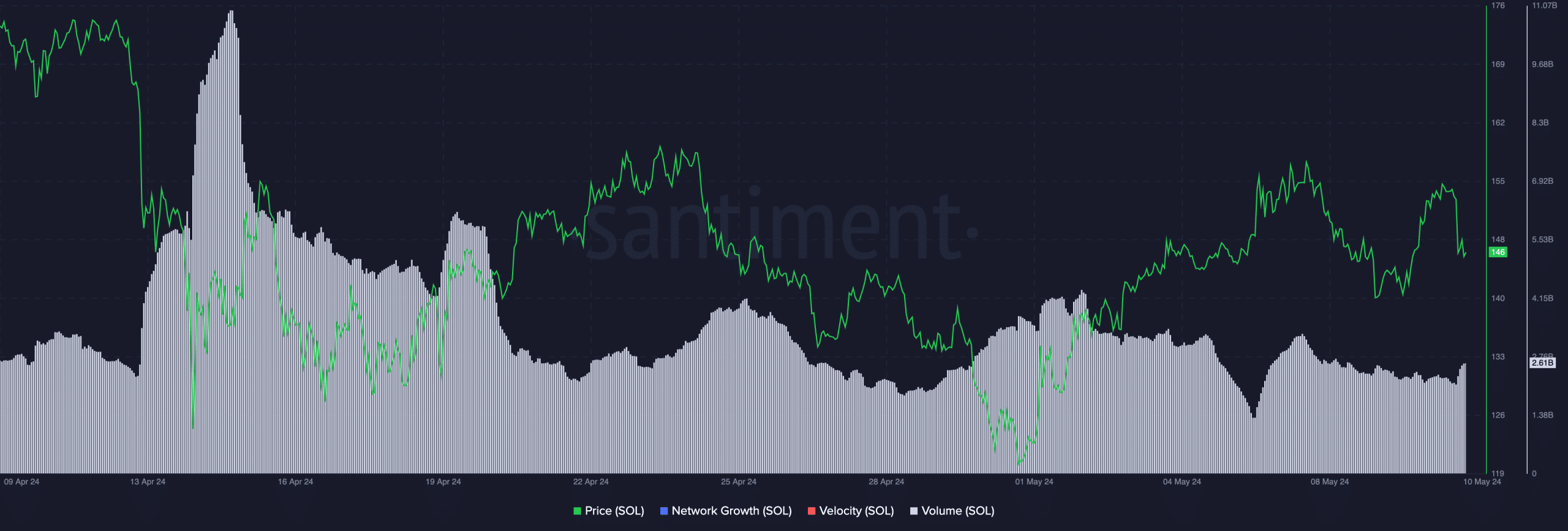

A waning interest in Solana’s ecosystem may have adverse impacts on the price of the SOL token as well. At press time, SOL was trading at $146.24 and its price had declined by 4.84% in the last 24 hours.

The volume at which SOL was trading at had also fallen by 9.53% during this period.

Source: Santiment