- Worldcoin bulls have reason to hope for an uptrend after the move past $6.188.

- The buying pressure remained weak and might need time to gather strength.

Worldcoin [WLD] was a trending token on Monday, the 6th of May. It was likely not for popular reasons, with WLD’s trend attributed to allegations of financial misconduct, particularly concerning AI.

Nevertheless, there was a structural bullish shift. The momentum favored the bulls, but the volume indicator was uninspiring.

With Bitcoin [BTC] also struggling to trend upward, WLD bulls could face a tough few weeks ahead.

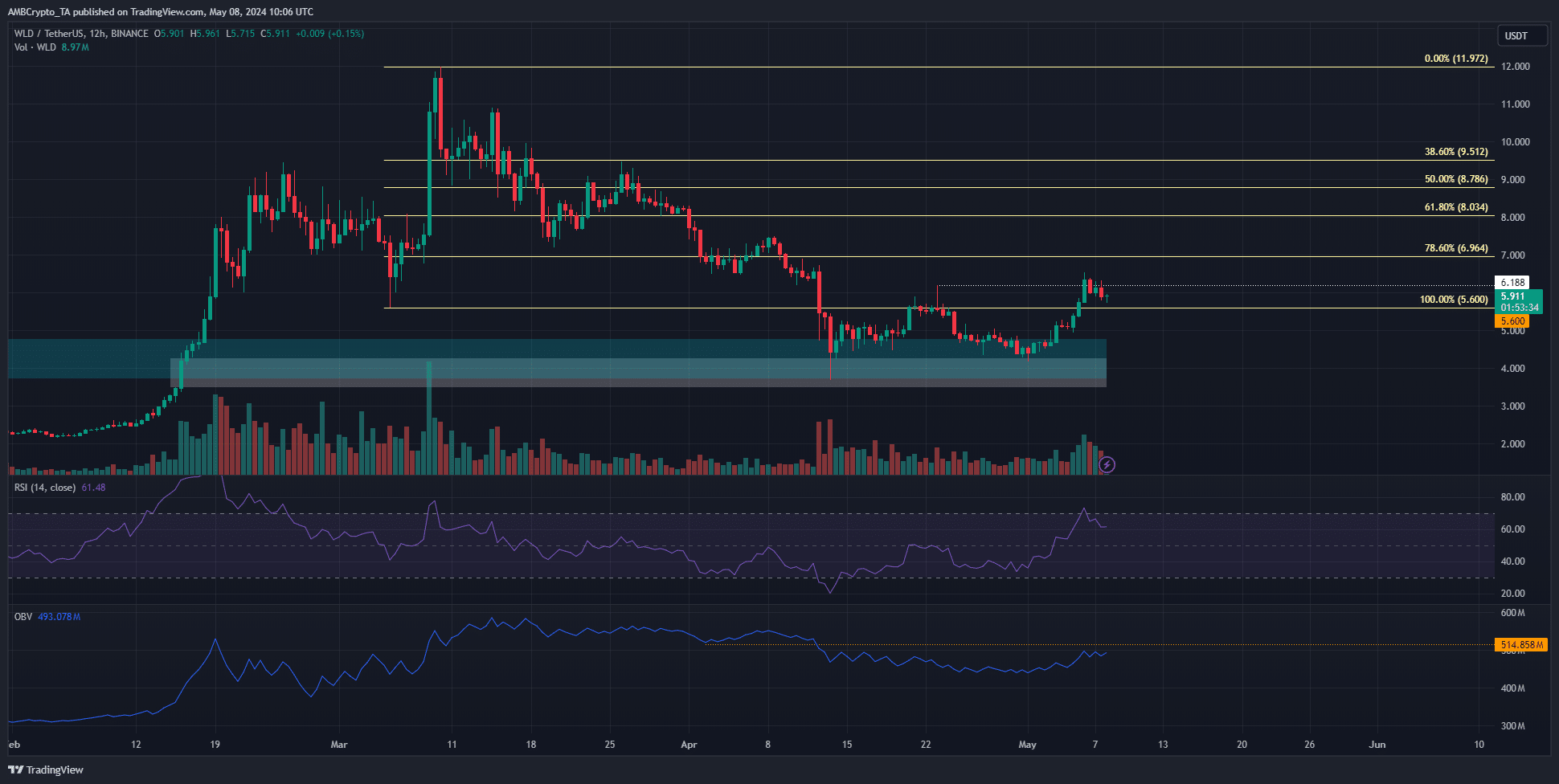

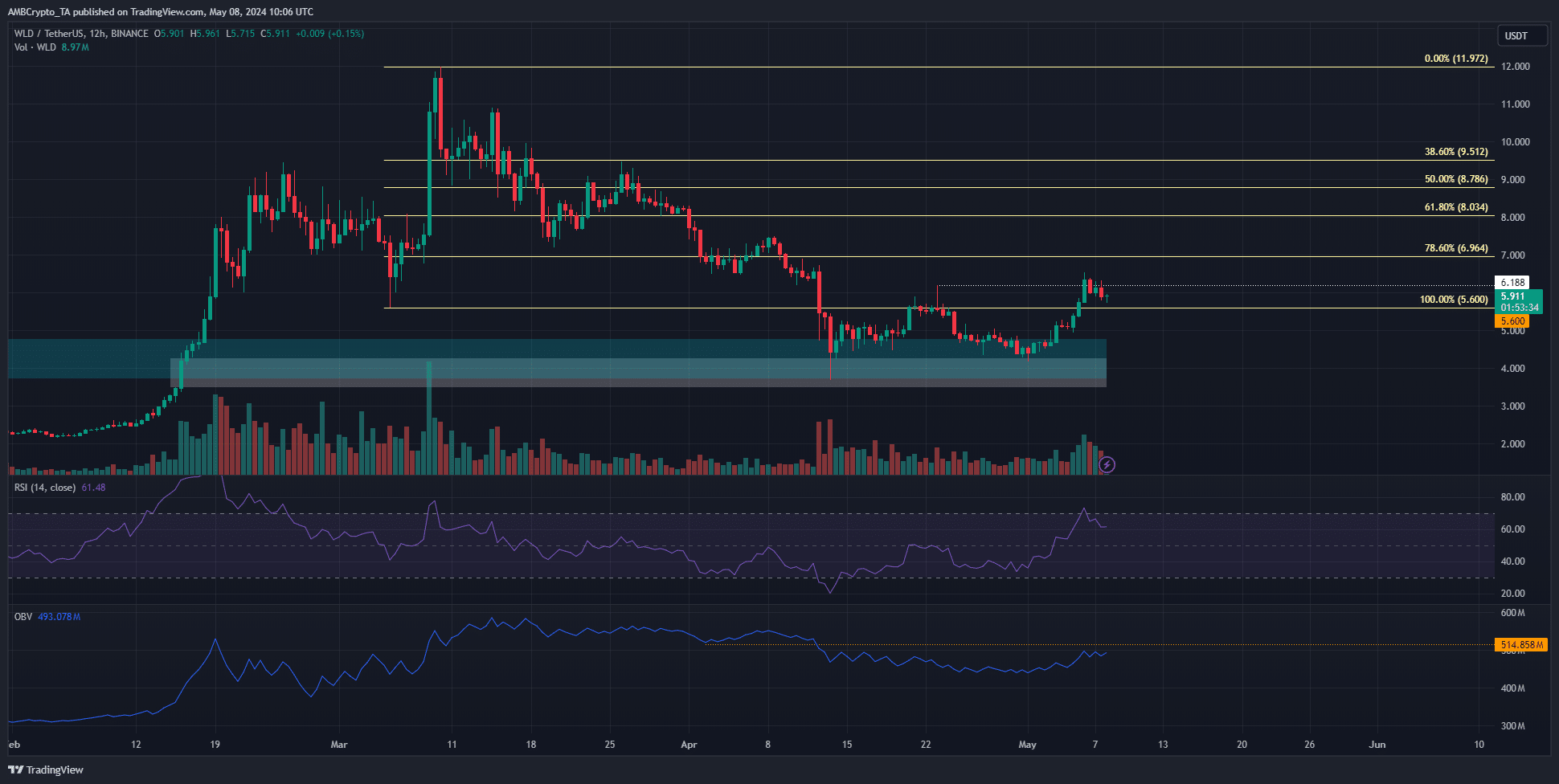

The HTF demand zone saw a positive reaction

Source: WLD/USDT on TradingView

In mid-December 2023, the $3.72-$4.79 region formed a bearish order block on the 1-day timeframe.

The February rally shifted this to a demand zone that was retested in mid-April after the extensive losses of recent months.

Worldcoin retraced into this former resistance zone, now demand, and bounced twice in the past month. However, the OBV was unable to climb past former local support.

This indicated that, despite the price bounce, the buying pressure was minimal.

On the other hand, the RSI on the 12-hour timeframe was strongly bullish with a reading of 61.48. The price also closed a session above the $6.188 lower high, shifting the structure bullishly.

Will the bulls keep the uptrend going?

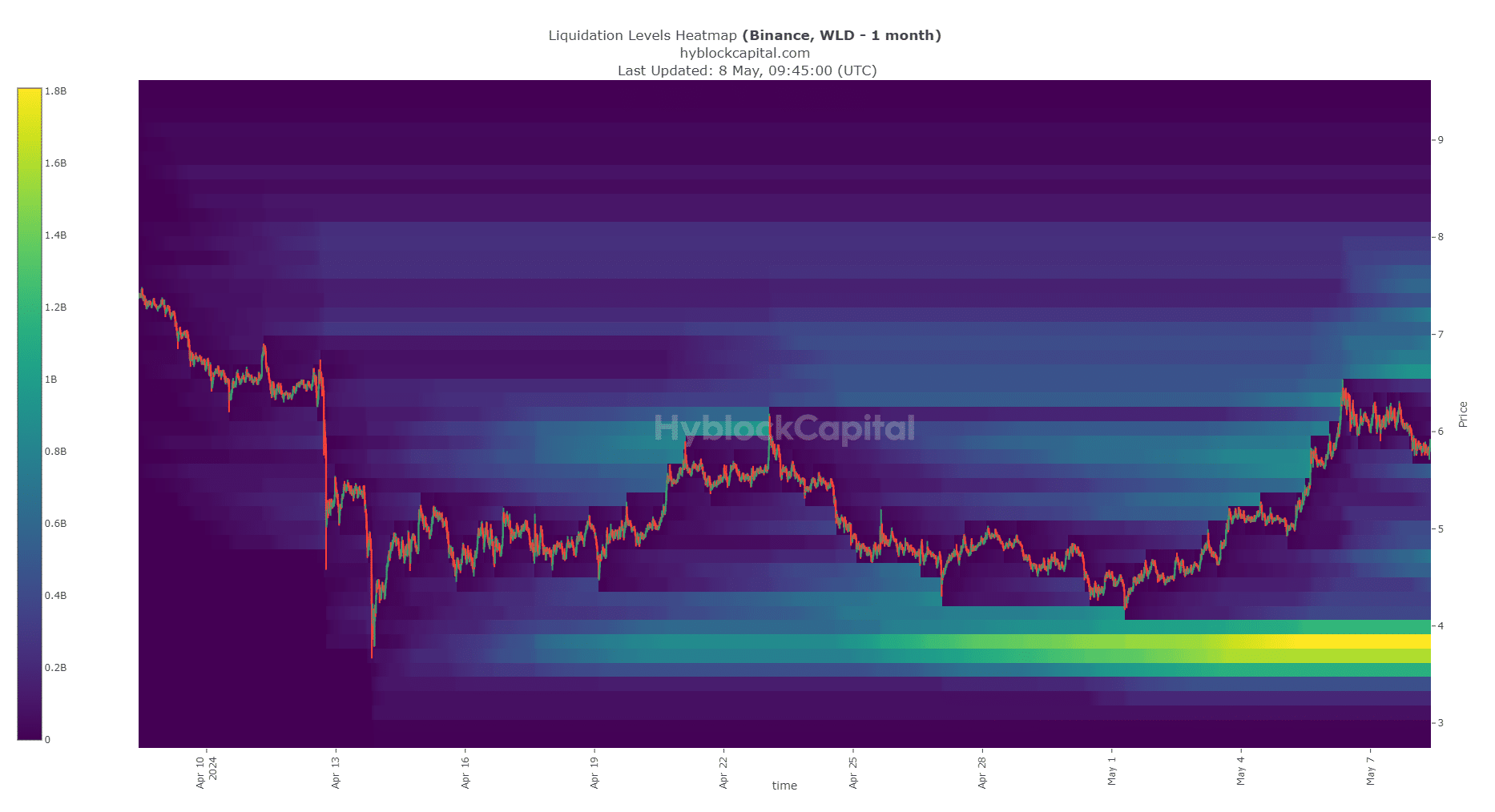

Large clusters of liquidation levels act as magnets to the price. AMBCrypto analyzed the liquidation levels heatmap and found that the $3.84-$4 region was the area with the greatest amount of liquidity.

Is your portfolio green? Check out the WLD Profit Calculator

However, it was also pretty far away, sitting 35% lower than the current Worldcoin price of $5.91.

To the north, the $6.6-$7.2 was also a liquidity pool that was closer to current market prices but not as deep. Therefore, we may see another deep retracement to collect the liquidity around the $3.8 zone.