- Ethereum locked on L2s hits a milestone.

- ETH bounced back above $3,200 at press time.

Recent data indicates that Ethereum [ETH] Layer 2 platforms have achieved a significant milestone in terms of the volume of Ether locked.

How do the contributions of these Layer 2 solutions compare, and what is the overall trend of Ethereum’s Total Value Locked (TVL) as Layer 2 TVL rises?

Ethereum on Layer 2s hit milestone

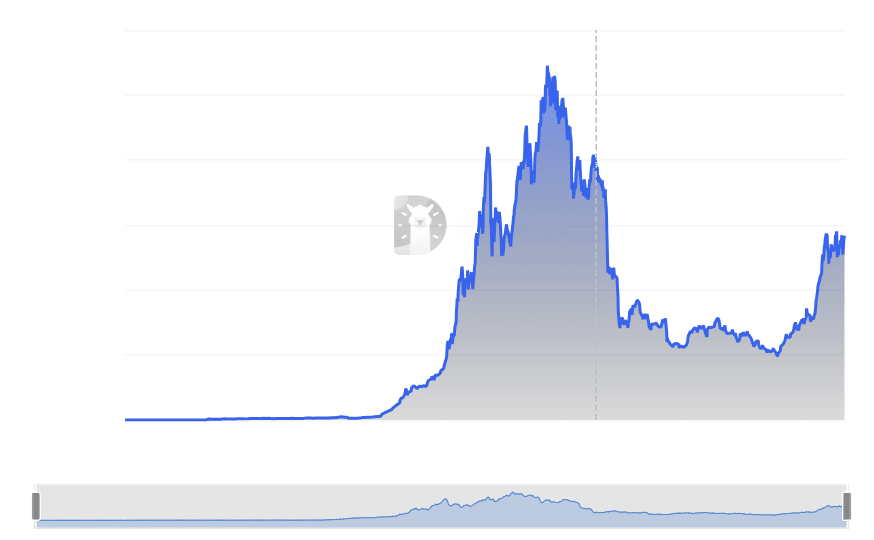

AMBCrypto’s analysis of the Ethereum Layer 2 Total Value Locked (TVL) on L2 Beats revealed a recent milestone in the volume of ETH locked on these platforms.

The data indicated that the amount of ETH locked on these Layer 2 solutions recently surpassed 12.7 million.

Although the dollar TVL on these platforms had previously reached an all-time high, the volume of locked Ether had just now done so.

Also, as of this writing, the volume of ETH locked on these Layer 2 solutions was over 12.734 million.

It’s worth noting that the dollar value of locked assets is calculated based on the volume of ETH locked, but it fluctuates according to the market price of ETH.

Therefore, while the volume of locked ETH continues to increase steadily, we may observe fluctuations in the dollar equivalent based on the price movements of ETH.

Layer 2s with the highest TVL

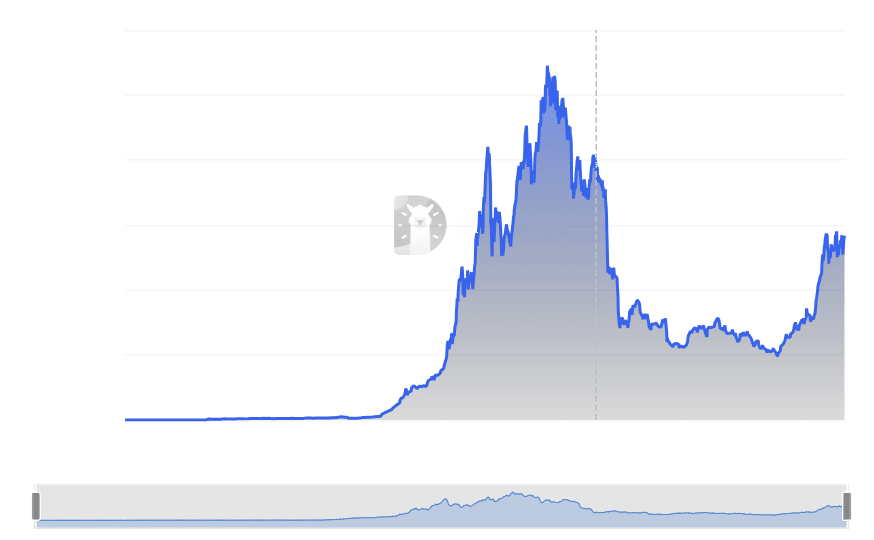

An examination of the Ethereum Layer 2 Total Value Locked (TVL) revealed that three prominent L2 platforms collectively accounted for over 73% of the TVL.

As of the current data, the total TVL for Layer 2 solutions stands at approximately $40 billion.

Furthermore, among these platforms, Arbitrum commands the largest share, with around $16.6 billion locked, constituting approximately 41.4% of the total L2 TVL.

Additionally, Optimism and Base Protocol hold significant portions, with approximately $7.33 billion and $5.55 billion locked. These figures represent over 18% and nearly 14% of the total L2 TVL, respectively.

Ethereum maintains a $50 billion TVL range

AMBCrypto’s look at Ethereum’s Total Value Locked (TVL) indicated a dynamic trend over the past few months.

According to analysis of data from DefiLlama, Ethereum’s TVL surged into the $50 billion range and has since maintained this level. As of the latest writing, the TVL was around $56.7 billion.

While the growth in Layer 2 TVL has contributed to this trend, a significant factor driving this uptrend is the appreciation in the value of Ethereum itself.

Source: DefiLlama

Ethereum shows weak bull trend

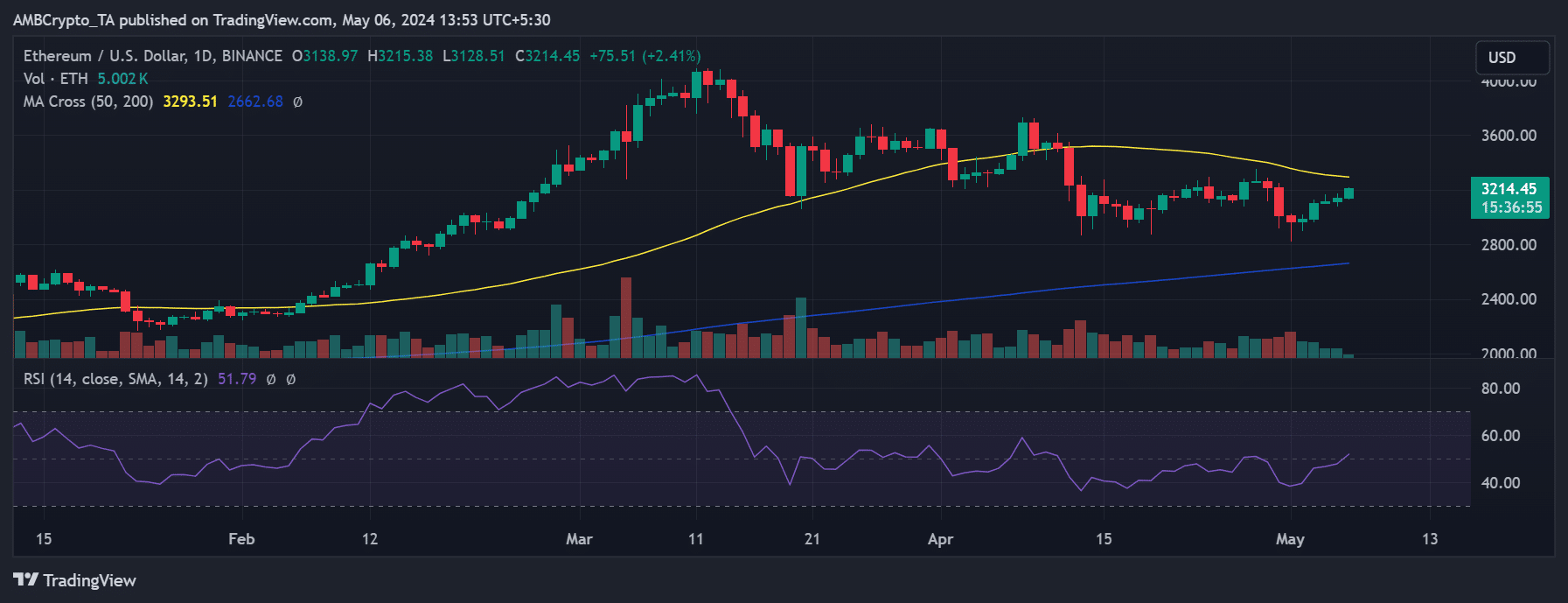

Ethereum’s daily timeframe chart revealed a promising upward trajectory following a period of disappointing downtrends.

Read Ethereum’s [ETH] Price Prediction 2024-25

As of press time, Ethereum was experiencing a positive bounce, with its price showing an increase of over 2% and trading at around $3,200.

This gradual ascent suggested a potential return to a bullish trend, a sentiment supported by its Relative Strength Index (RSI).

Source: TradingView