- Blast recorded explosive month-on-month growth in terms of new addresses

- OP’s daily active addresses rose in May, while others saw their numbers fall

Layer 2s have made quite a buzz over the last few months because of their high network activity. As the first month of Q2 came to an end, Coin98 Analytics shared a monthly report highlighting the states of multiple top L2s, including Optimism [OP], Arbitrum [ARB], zkSync Era, and Base.

L2s’ state in April

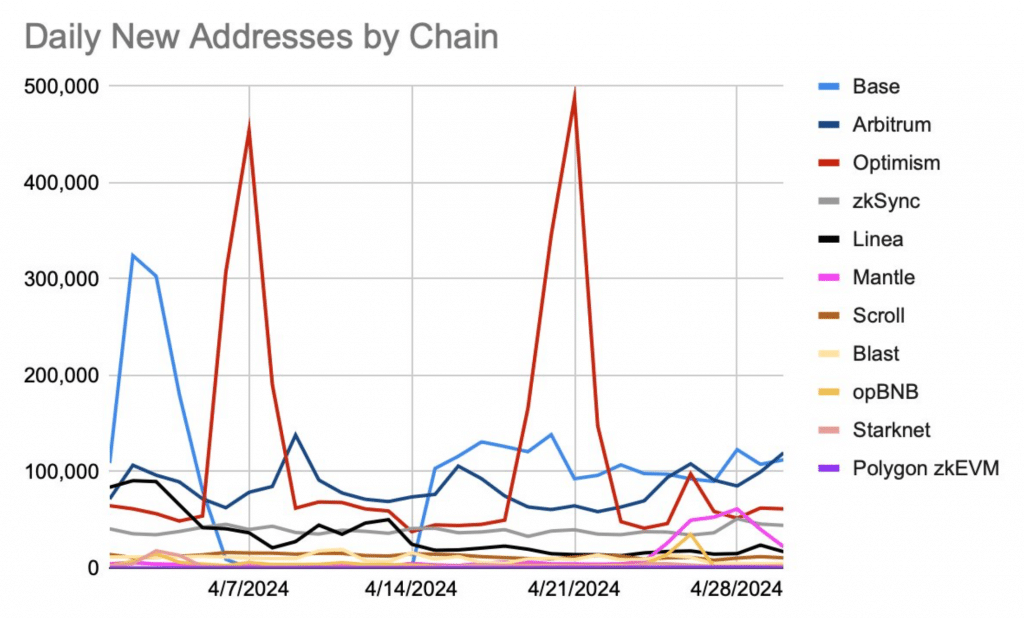

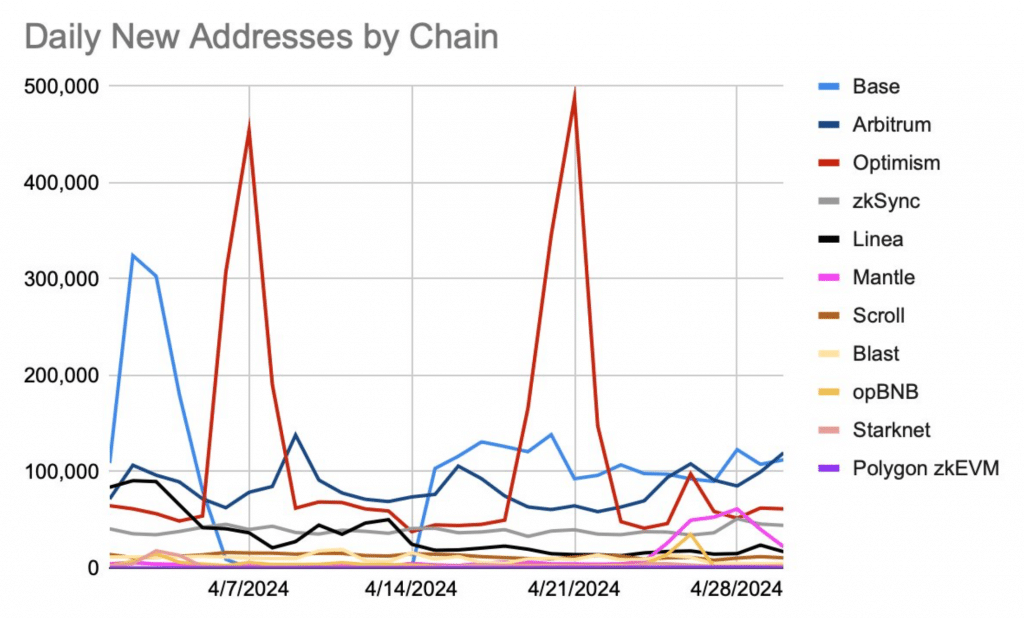

Coin98 Analytics’ report revealed that OP dominated others in terms of total addresses, as its value stood at 138 million. Base and ARB trailed behind, with values of 71.9 million and 22.3 million, respectively.

Moreover, OP also hit an all-time high on certain days this month, with over 450k new addresses per day. In April, Optimism recorded the highest number of new addresses created. Though OP’s numbers were the highest, Base and ARB also saw significant growth in April.

Source: X

While the aforementioned L2s’ performance was commendable, Blast took the limelight because of its explosive growth. Coin98 found that Blast’s number of addresses grew by a whopping 42% in April, while OP, Base, and ARB’s growth rates were 2%, 4%, and 12%, respectively.

The report additionally looked at L2s’ transactions in April. opBNB nabbed the first spot with over 872 million transactions. ARB, zkSync, and OP followed behind as their total transactions stood at 472 million, 346 million, and 257 million, respectively.

Interestingly, Blast noted the highest growth rate in terms of transactions as well, with a hike of 112% month-on-month.

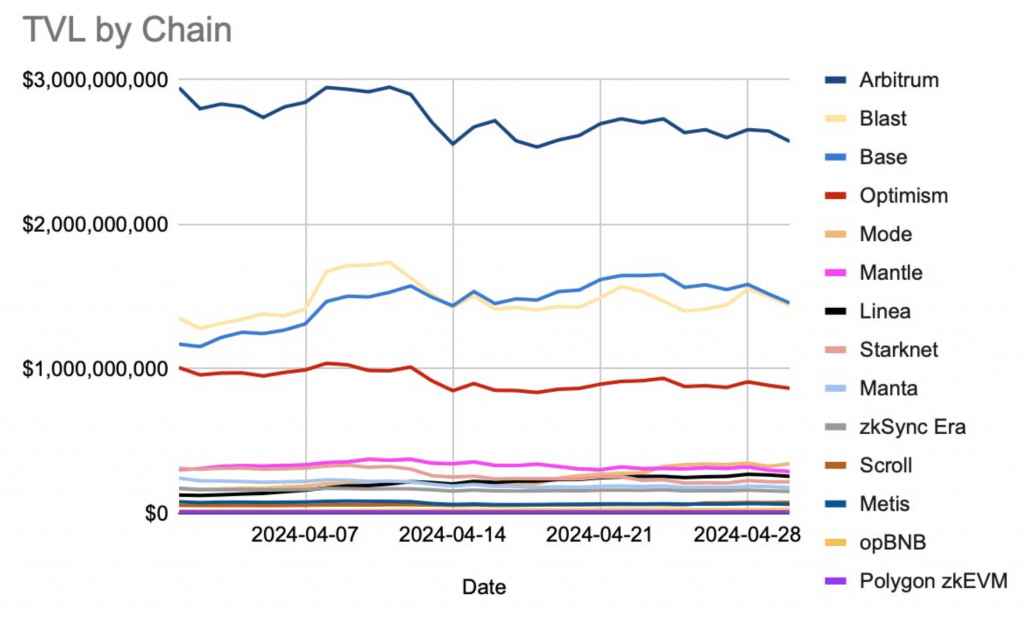

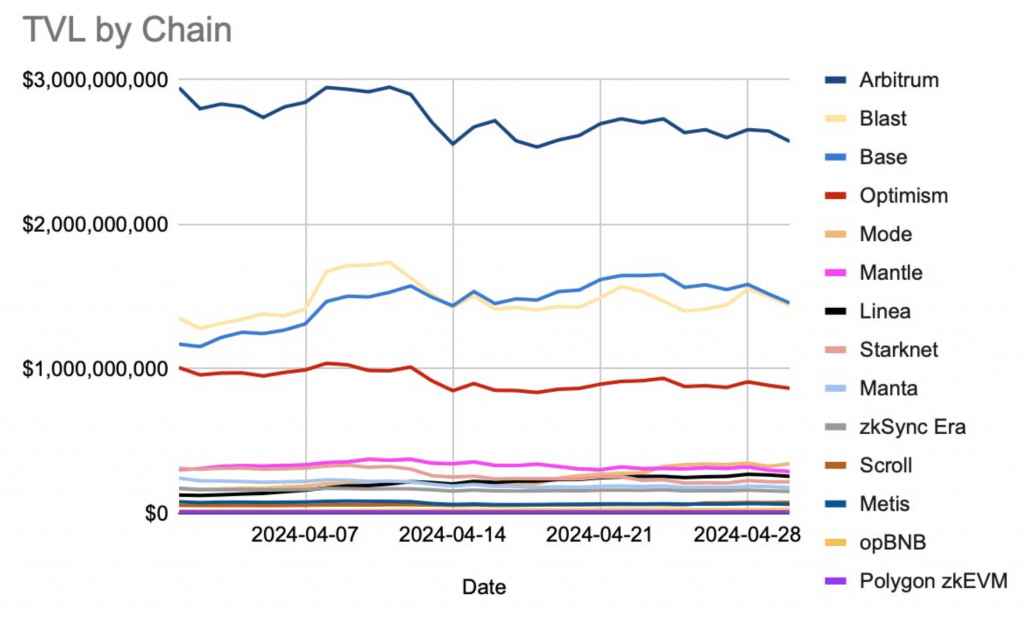

Also, the top 4 Layer 2 protocols with the largest TVLs have seen significant shifts in money flows, with ARB sitting on top. Base recorded a 24% MoM hike with figures of over $284 million. On the contrary, Arbitrum registered a decline of over $371 million in TVL.

Source: X

How is May looking?

Since the month of April was pretty active for L2s, AMBCrypto then checked the latest data to find out how these aforementioned L2s have done so far in May. However, our analysis of Artemis’ data revealed that ARB, Base, and zkSync’s daily active addresses have started to fall.

Optimism acted differently as its active addresses rose. While Base and zkSync’s daily transactions declined, Base and OP’s numbers moved up slightly.

Source: Artemis

Realistic or not, here’s ARB market cap in BTC’s terms

As far as captured value is concerned, Base had the highest revenue when May began, followed by OP. The declining trend was also true in this regard, as Base and zkSync’s graphs started to decline.

On the other hand, ARB and OP’s revenue gained upward momentum in May.

In light of these metrics, it seems likely that OP and ARB might see promising growth in May while Base and zkSync face some trouble.