- ADA’s price may breach support and chase new lows.

- ARB may witness further decline as the demand for the altcoin continues to drop.

Cardano [ADA] and Arbitrum [ARB] are the two leading Layer 1 (L1) and Layer 2 (L2) assets with the highest count of holders in losses, IntoTheBlock noted in a recent post on X (formerly Twitter).

According to the on-chain data provider, 60% of ADA holders are at a loss. For ARB, 83.43% of its holders do so at a loss.

The values of both assets have declined significantly in the last month. According to CoinMarketCap’s data, ADA’s price has cratered by 30% in the last 30 days, while ARB has shed 35% of its value during that period.

More downsides in the interim for ADA

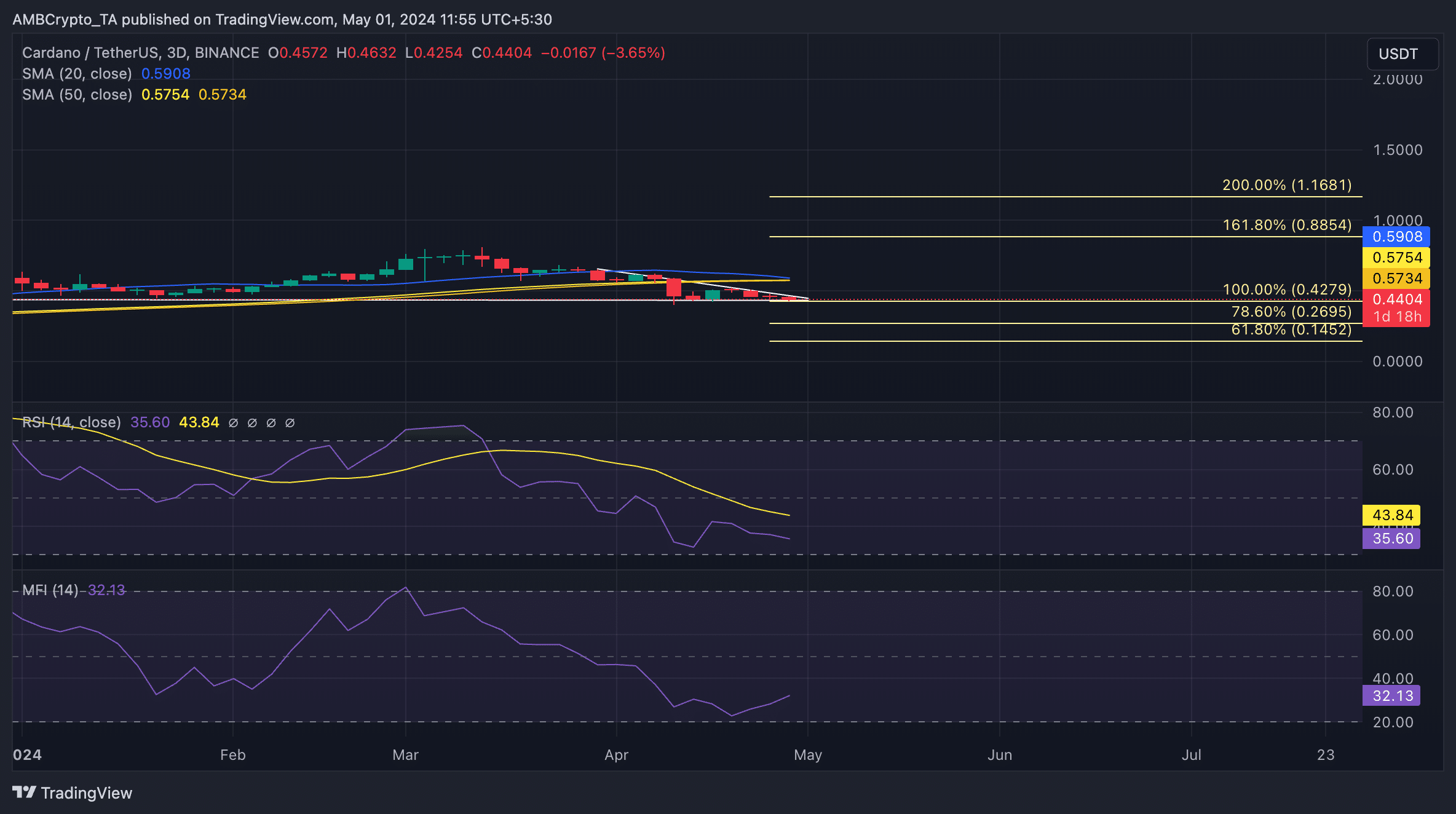

An assessment of ADA’s price movements on a 3-day chart revealed the likelihood of a further decline in its value.

Readings from the chart showed that the coin’s price fell below its 20-day and 50-day moving averages (MAs) at the beginning of April.

When an asset’s price falls below these MAs, it often indicates a shift from bullish momentum to bearish.

If accompanied by low demand for that asset, it offers a confirmation that the market is in a downtrend, and the asset’s price may continue to fall.

A look at ADA’s Relative Strength Indicator (RSI) and Money Flow Index (MFI) indicators confirmed the decline in ADA’s demand by market participants.

As of this writing, ADA’s RSI was 35.60, while its MFI was 32.13.

The values of these indicators showed selling activity slightly outpaced coin accumulation among ADA traders.

Also, ADA’s double-digit price drop in the last month has forced it to trade at its support level of $0.44 at press time.

Although a descending triangle has been formed, and bullish breakouts are typically expected, there is a high chance that the bearish outlook will push its price downward to $0.26.

However, if the bulls can regain control, the coin might break out in an uptrend to exchange hands at $0.88.

Source: ADA/USDT on TradingView

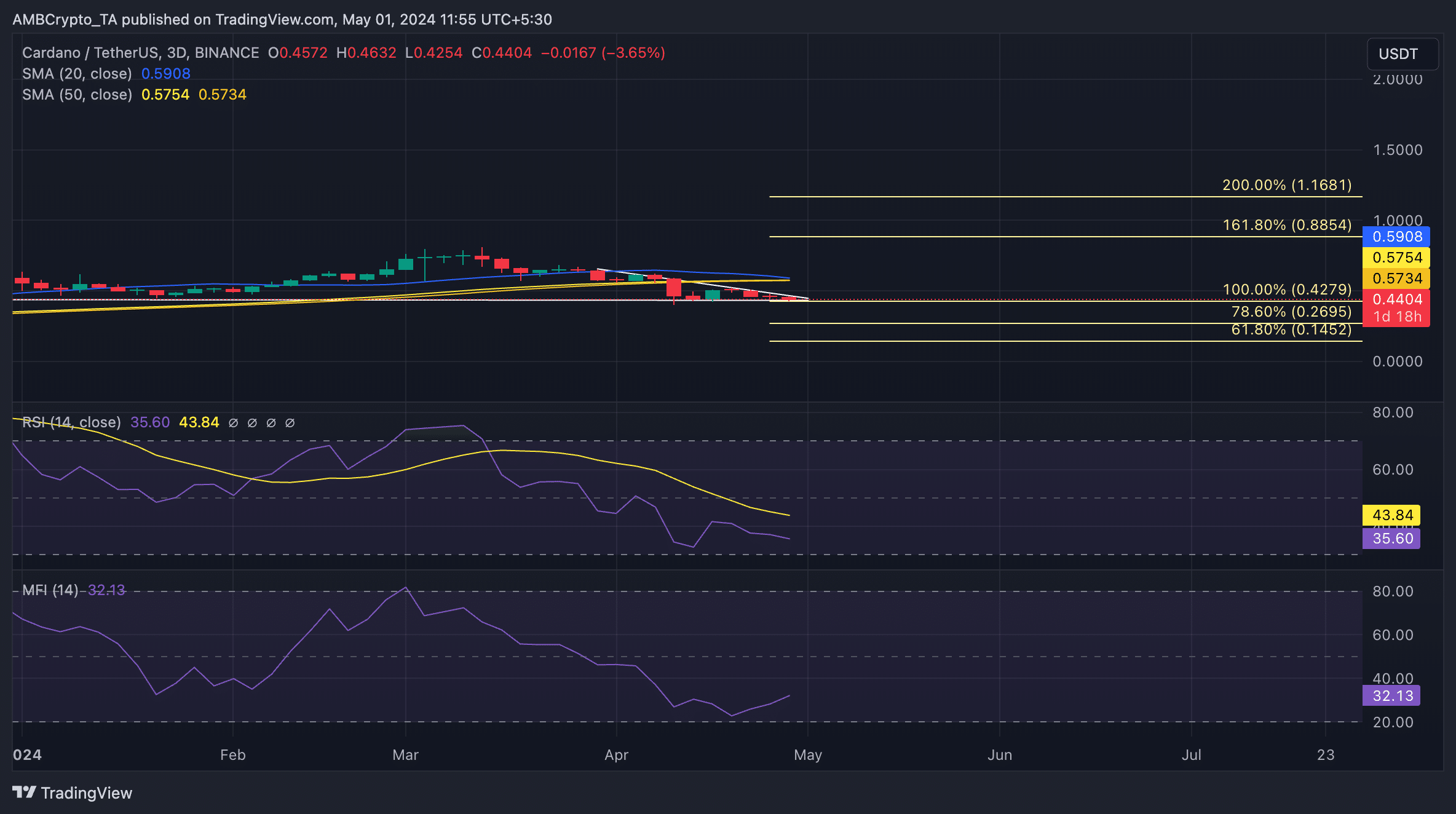

ARB has little to offer

At press time, ARB traded at $1.03. Its movements on a 1-day chart showed that it has also witnessed a significant decrease in demand. Its RSI and MFI rested below their respective center lines at press time.

Read Cardano’s [ADA] Price Prediction 2024-25

Signaling that the market was under bearish influence, its Elder-Ray Index, which measures the relationship between the strength of the altcoin’s buyers and sellers in the market, returned a negative value.

Source: ARB/USDT on TradingView

When this indicator is negative, bear power is dominant in the market.

![60% Cardano [ADA], 83% ARB holders lose money – Breaking down why](https://chartdogs.app/wp-content/uploads/2024/05/ADAARB-1000x600.png)