- Uniswap’s strong defence indicates potential victory against SEC’s Wells Notice.

- SEC’s sanctions raises concerns, highlighting scrutiny over its crypto platform regulation approach.

As the cryptocurrency market experiences a positive surge post-halving, all eyes are once again on the Wells notice issued by the SEC to Uniswap [UNI], suggesting a looming enforcement action. In a recent Unchained YouTube stream, several exces shared their unique perspectives on this development.

What’s interesting here is that this isn’t the first time the SEC has scrutinized crypto firms. In response, Uniswap has chosen to follow in the footsteps of Coinbase and Ripple [XRP], taking a proactive stance in addressing regulatory challenges.

A win-win for Uniswap

Applauding Uniswap’s articulate defence, Robert Leshner, founder and CEO of Compound said,

“I feel like they are ready and willing to champion and fight to the death on a case that they have an extremely good shot at winning.”

Adding to the fray, Haseeb Qureshi, managing partner at Dragonfly Capital said,

“It really feels like a huge huge miscalculation in choosing Uniswap as a defendant here.”

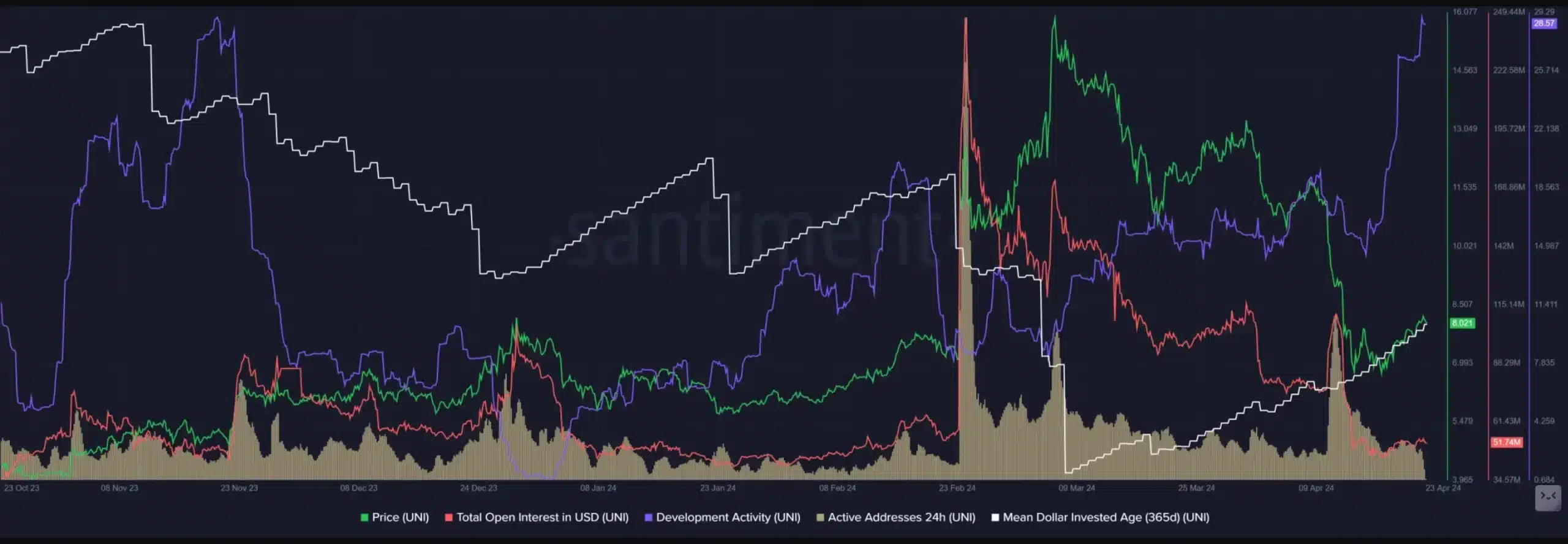

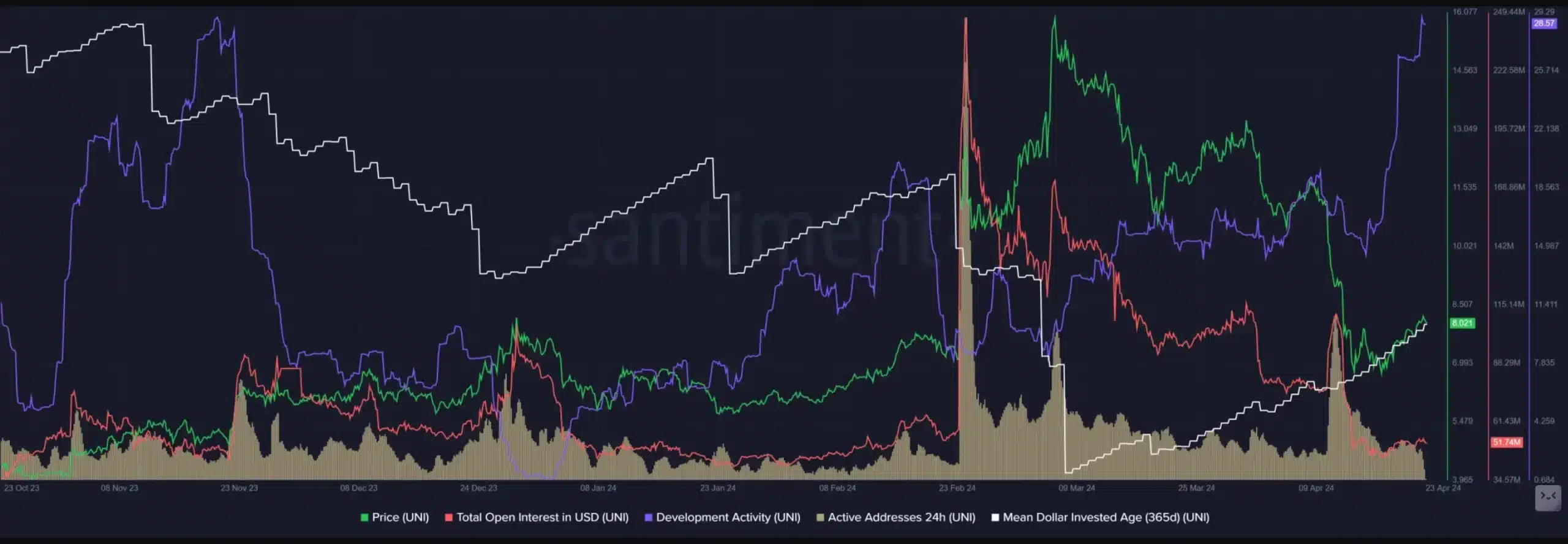

Despite the legal challenges, investors maintain optimism for Uniswap, reflected in Santiment data showing a surge in development activity over six months, suggesting positive growth.

While active addresses stabilized, long-term UNI holders stayed hopeful.

Source: Santiment

Additionally, despite price drops, the mean dollar invested age increased, hinting at accumulation.

Echoing similar sentiments, Hayden Adams, Uniswap’s CEO, in a separate interview with the “Bankless” podcast, noted,

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

SEC’s abuse of power

Additionally, challenging the SEC’s approach to regulating crypto platforms, U.S. District Judge Robert Shelby made a notable move by sanctioning the SEC in a lawsuit related to the DEBT Box.

The judge pointed out various instances of what he termed as “bad faith” behavior, ultimately accusing the agency of a “serious abuse of power.”

Reitrating the same, Leshner commented,

“I feel like at this point most of what the SEC is doing when it comes to crypto is about defining their political perimeter. Right?”

Uniswap’s price action

Despite challenges, UNI saw a modest 0.37% increase in the last 24 hours, hinting at a potential bullish recovery. Additionally, weekly data from CoinMarketCap showed a 1.12% rise, indicating growing investor optimism.

However, as the exact details of the case remain unclear, there is still room for speculation. Nonetheless, the outcome of this case will have significant implications for the DeFi space.