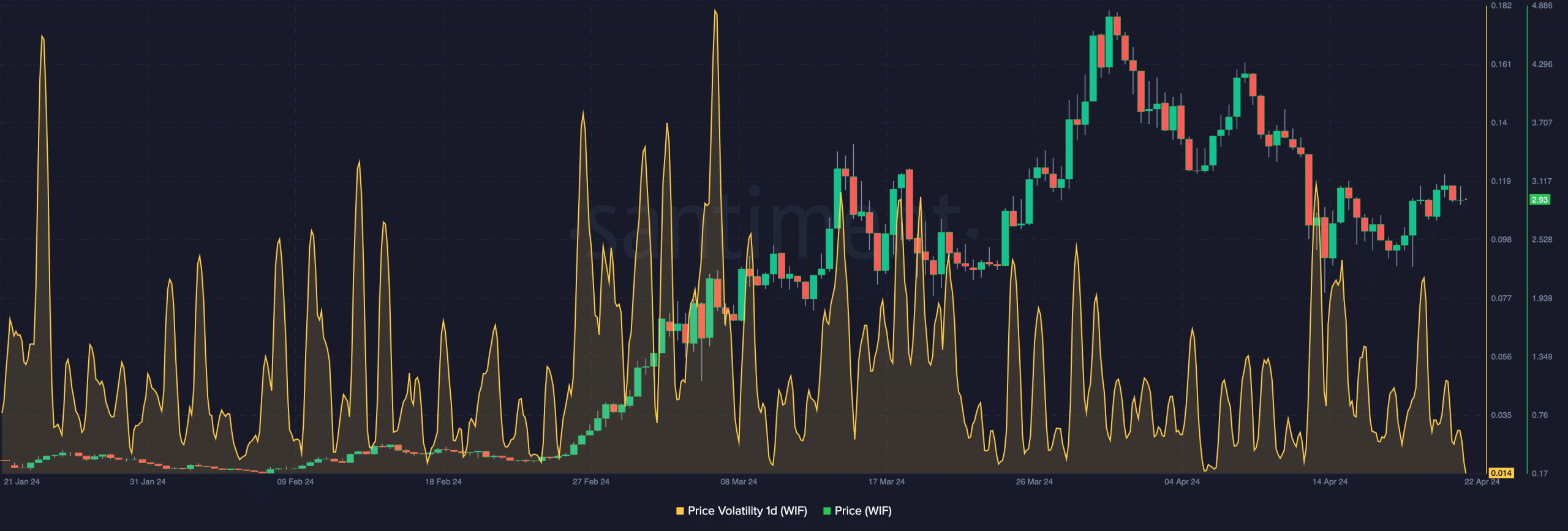

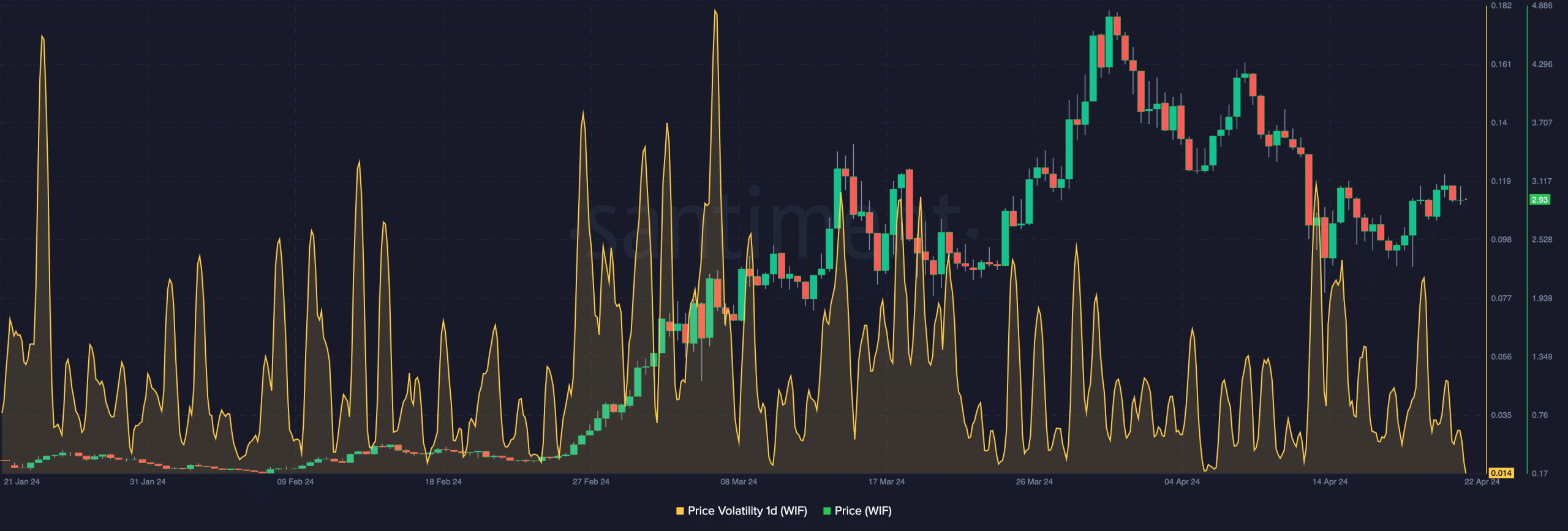

- Decreasing volatility suggests that WIF might keep trading between $2.31 and $4.

- Many traders have open short positions, predicting a price decrease.

Solana-based memecoin dogwifhat [WIF] might not hit $5 anytime soon, according to AMBCrypto’s market analysis. For the past three months, no other memecoin in the top 50 has outclassed the token.

But a look at the volatility showed that WIF might fail to experience the massive swings it had 90 days back, in the short term. According to Santiment, WIF’s one-day volatility was down to 0.014.

Recent history showed that any time the metric spikes, the token runs upward. And it was the same scenario when dogwifhat climbed to its all-time high of $4.84.

Source: Santiment

The path to $5 is not yet clear

At press time, the price of WIF was $2.95 with many predictions saying that the cryptocurrency might reach $5 in no time. AMBCrypto considers the price a reasonable prediction.

However, decreasing volatility could hinder the projected astronomical rise, and a run to the said value might be impossible before April ends.

But what are the likely targets for WIF within the said period? This is where the technical aspect of the market comes in.

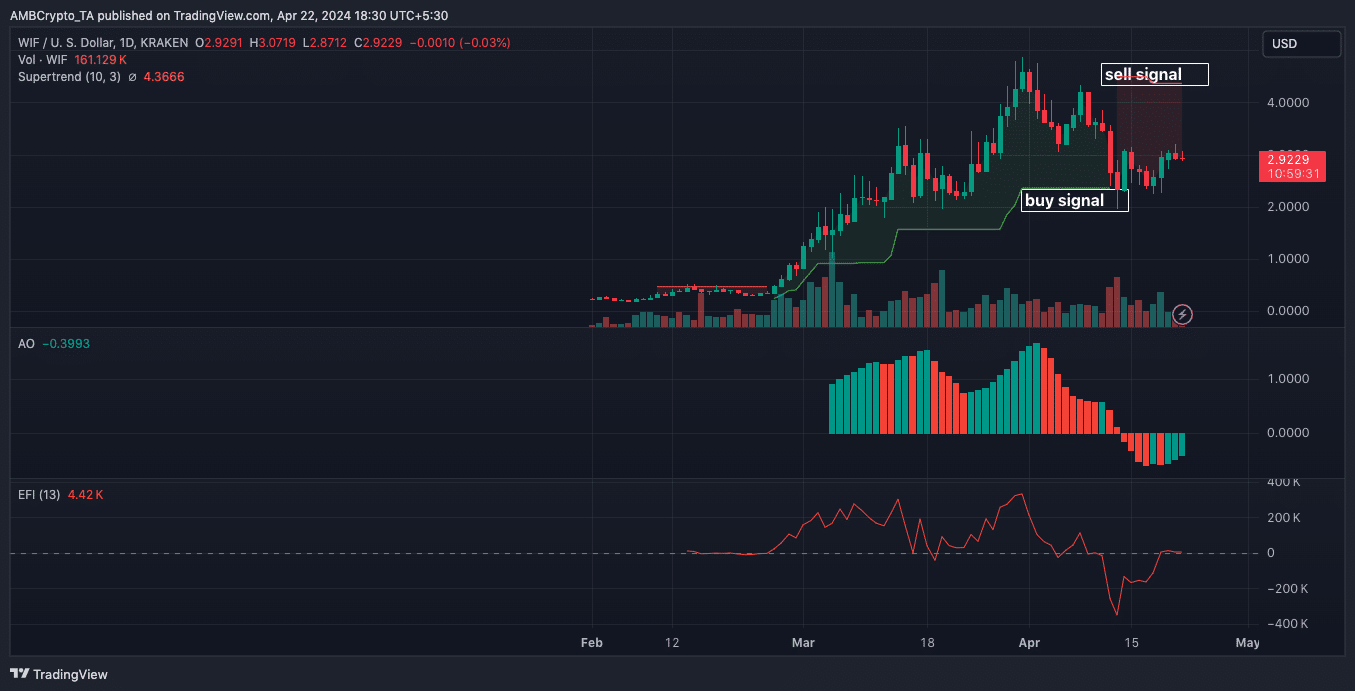

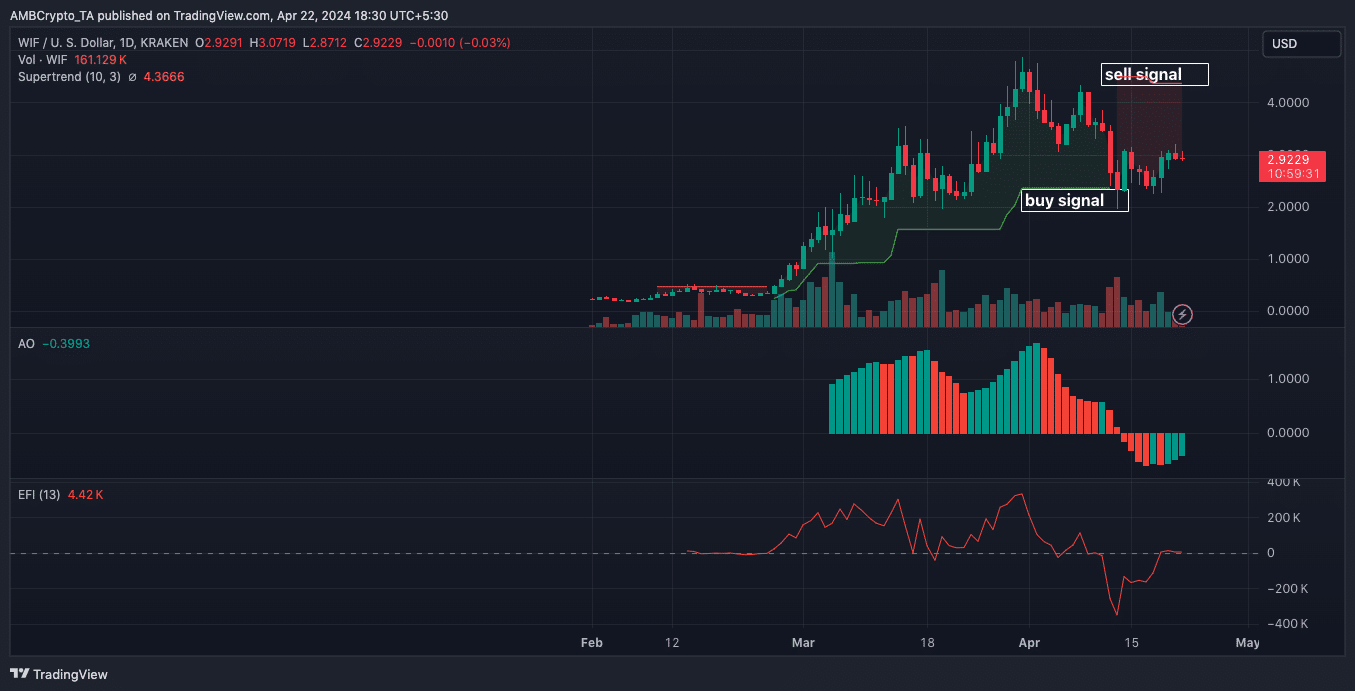

According to the WIF/USD daily chart, the Supertrend showed a buy signal at $2.31. This indicated that the price might drop to that level. But that would depend on the selling pressure intensity which was low at press time.

A decline to $2.31 could set the stage for a rebound. However, if WIF bounces and heads higher, it might not surpass $4.39 considering that the indicator flashed a sell signal at that point.

The Awesome Oscillator (AO) showed another evidence of this prediction. As of this writing, the AO was negative but with green bars, suggesting that the downward momentum might soon be over.

Despite the positive signal, WIF’s potential rise to $5 might happen within a few days. This could be the case as long the AO stays in the negative region. Likewise, the Elder Force Index (EFI) stalled, suggesting that buying pressure was non-existent.

Source: TradingView

Will the sentiment change?

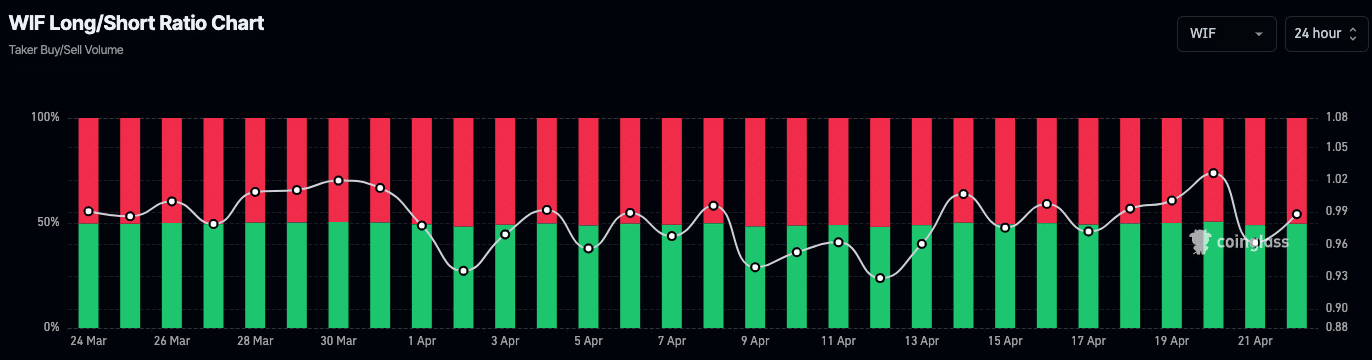

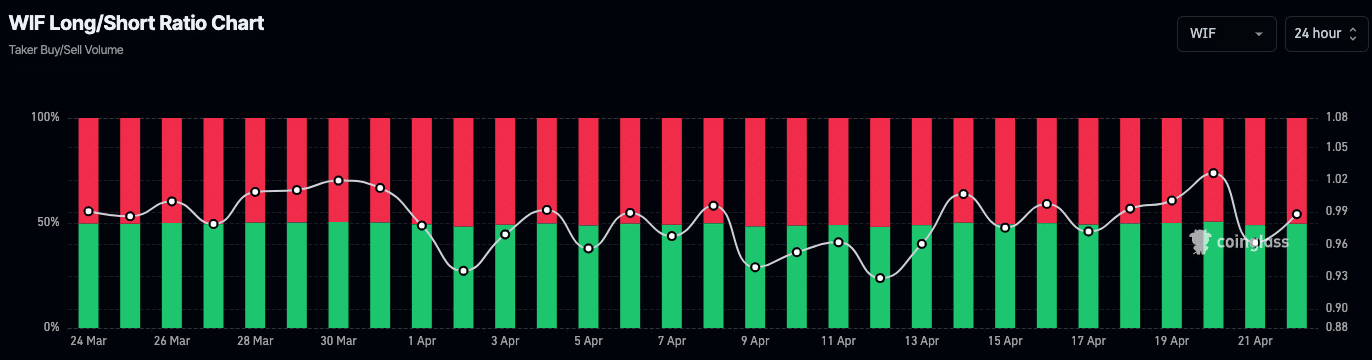

Meanwhile, it seemed traders were adjusting to this reality, based on the Long/Short ratio. This metric gives an overview of investors’ expectations.

Values greater than 1 imply that most traders are betting on a cryptocurrency’s price to increase. On the other hand, a value less than 1 suggests that short positions are dominant.

For WIF, Coinglass showed that the Long/Short ratio was 0.99, indicating that the sentiment was bearish on average. However, if WIF’s price hits $3, the sentiment might change and more traders might choose to go with a long position.

Source: Coinglass

Is your portfolio green? Check the WIF Profit Calculator

In the meantime, the price of the token could move between $2.31 and a little bit above $4.

In the long run, the value of the token might be worth more than $5. But that would only happen if memecoins’ dominance returned like it was in March.