- MSTR extended its weekly losses to about 20%.

- Bitcoin’s halving and ‘over-valuation’ concerns could offer sellers more edge

MicroStrategy’s (MSTR) stock extended its weekly losses to over 19%, just hours before Bitcoin’s [BTC] fourth halving. After hitting a recorded high of $1999.99 on 27 March, the stock retraced, reversing part of its monthly gains. MSTR’s weekly losses marked a three-week-long extended pullback on the charts.

On a quarterly basis, the stock was down 30% in Q2. On the contrary, its Year-to-Date performance had a reading of +73.4%, at the time of writing.

On 17 April, MSTR closed at $1188.05, a massive discount for anyone who missed jumping on the stock previously. Even so, macro conditions and price charts revealed that more juicy discounts may still be feasible for anyone choosing to dive in.

Will MSTR extend losses amidst Bitcoin halving?

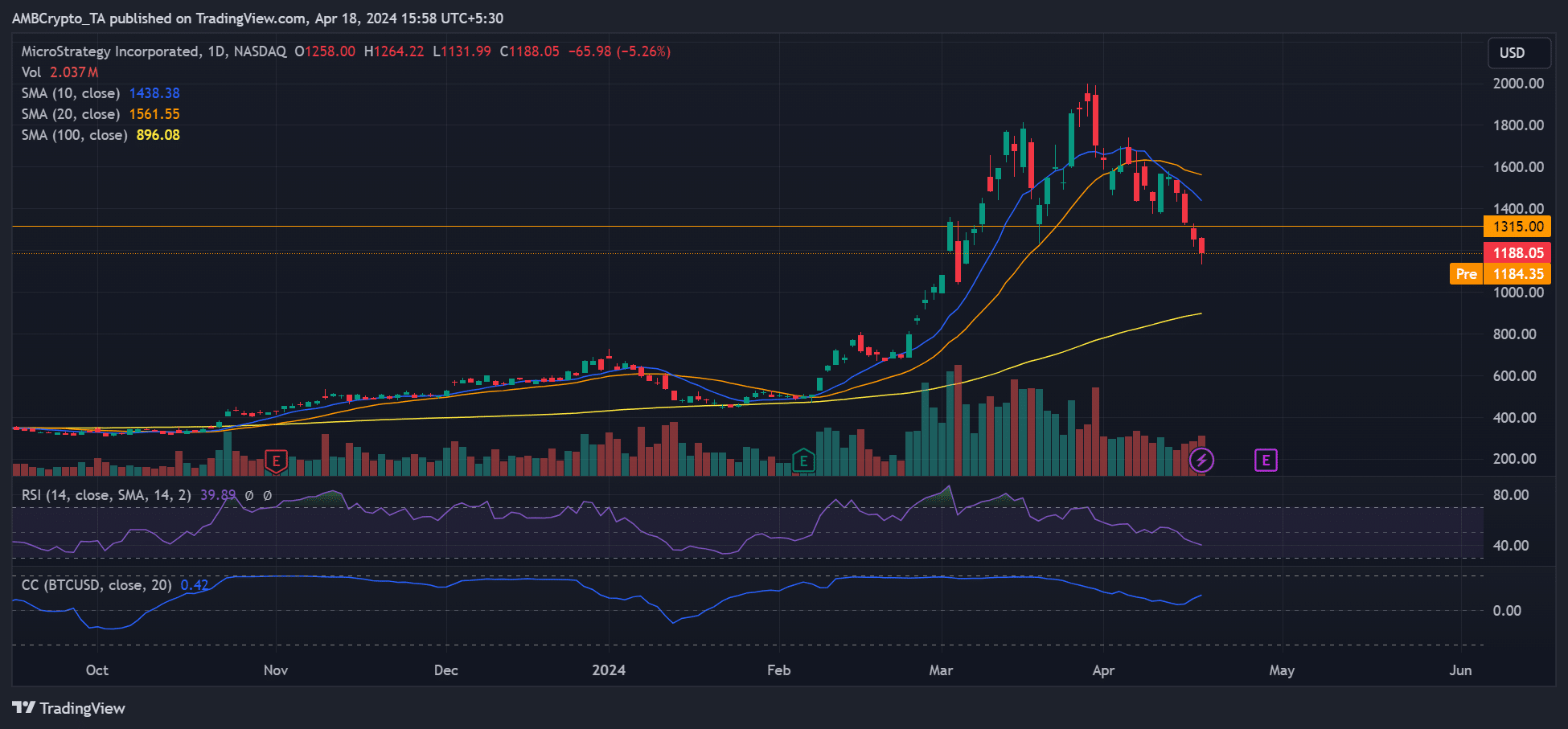

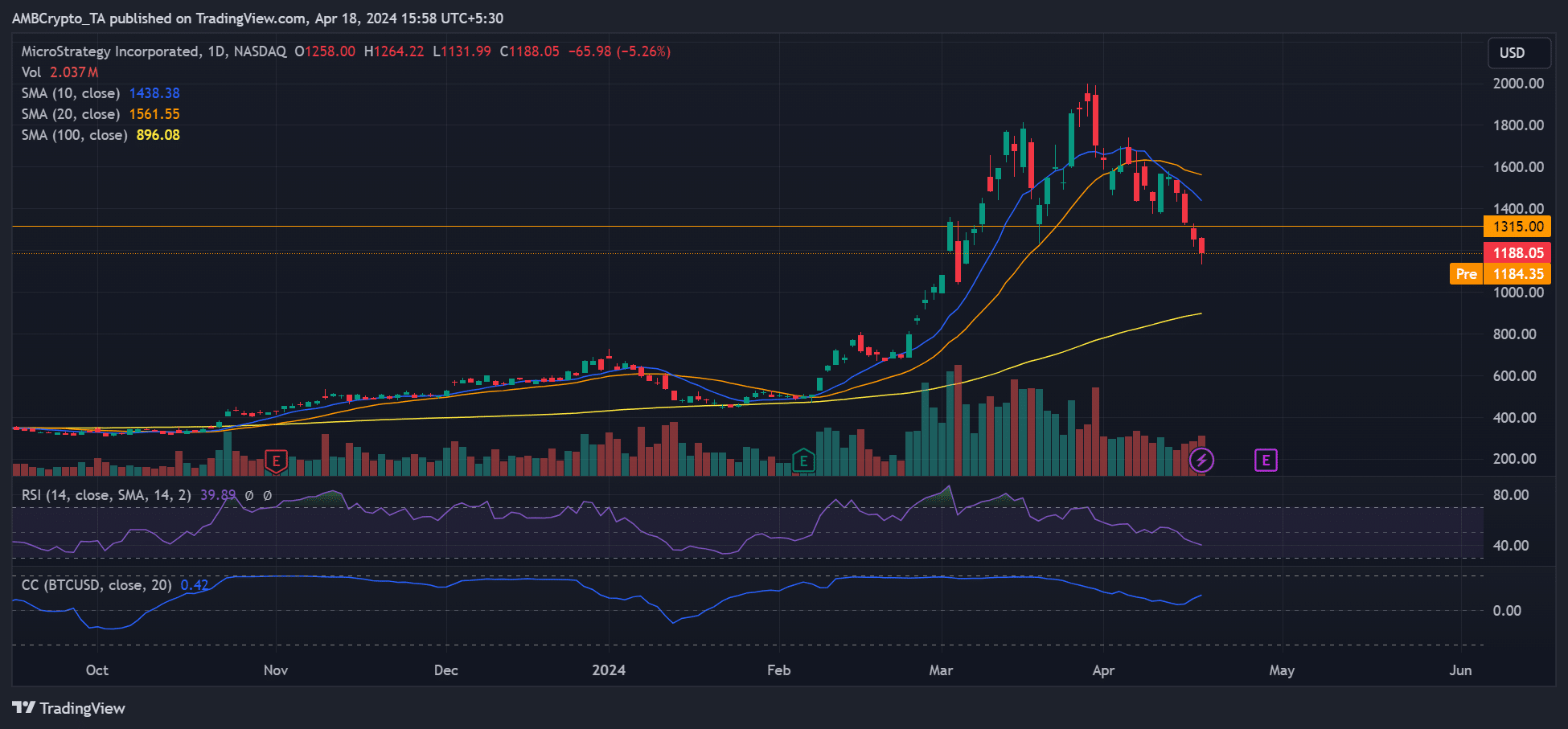

Source: MSTR stock, daily chart

As one of the corporations with a Bitcoin strategy, MSTR’s stock strongly correlates with BTC. This was evidenced by its positive correlation coefficient since mid-February.

What this means is that BTC’s extended price dump has been dragging MSTR stock too.

Between 27 March and 18 April, BTC dropped by 13%, from $71.7K to $62.4K on Bitstamp. Over the same period, MSTR slumped by 40%—More than 3x BTC’s drop.

Right now, bears have more leverage after dropping MSTR below the 10- and 20-day SMA (Simple Moving Average), marked blue and orange, respectively.

Should bears push further, the next target is the 100-day SMA ($896), which will mark an effort to pull MSTR’s value below $1000. If this happens, it could be a better discount for bulls who missed the previous action.

The below-average reading on the RSI (Relative Strength Index) is a sign of heightened sell pressure – Supporting the extended drop projection.

Bitcoin halving and MSTR being “overvalued”

Additionally, Bitcoin’s halving could embolden MSTR bears if BTC selling pressure spikes around the event.

MicroStrategy’s current BTC holdings stand at 214,246 coins, worth over $13B based on current market prices. Most of them have been acquired through company-issued convertible notes.

However, the ongoing dump also resonates with some market watchers who feel MSTR stock is overvalued. Last month, private investment manager Kerrisdale Capital stated the same,

“We are long Bitcoin and short shares of MicroStrategy, a proxy for Bitcoin which trades at an unjustifiable premium to the digital asset that drives its value.”

Kerrisdale Capital argued that new spot BTC ETFs offer alternatives to gain exposure to BTC, which denies MicroStrategy any unique advantage for the premiums it charges.

For perspective, some investors had previously preferred buying MSTR to gain an indirect exposure to BTC.

Simply put, the private investment manager sees MSTR’s fair value as $700 – $800. The upper estimate is closer to the bearish target marked by the 100-day SMA (yellow).

However, the projection could be invalidated, especially in the unlikely event of a massive Bitcoin rally around the halving.