- Ethereum has seen significant consecutive increases in the past 48 hours.

- Whales have bought over $70 million worth of ETH within 24 hours.

On 7th April, Ethereum experienced its highest returns for the month. This positive uptrend coincided with a recent increase in the volume bought by certain whales.

Additionally, it occurred while the network’s overall volume remained relatively stable, with Layer 2 (L2) solutions handling most of the transactions.

Ethereum increased by 7%

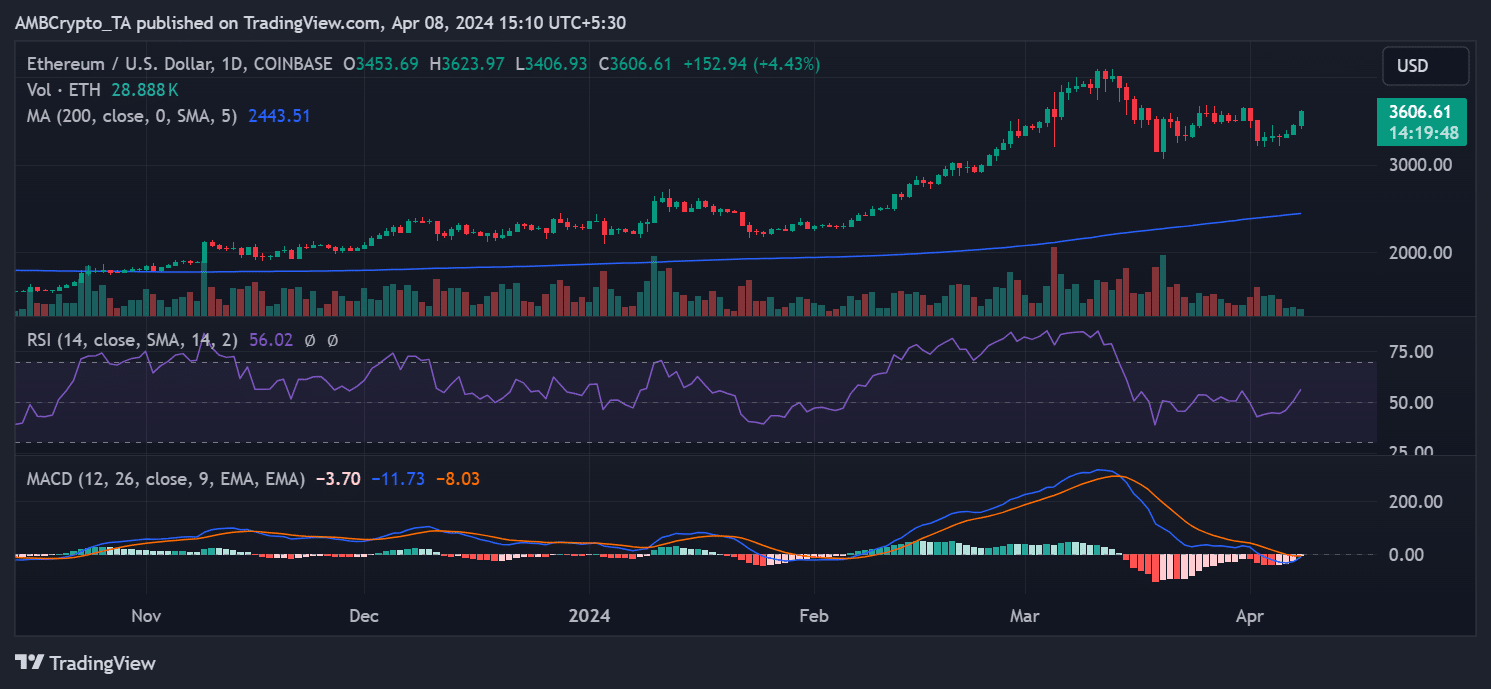

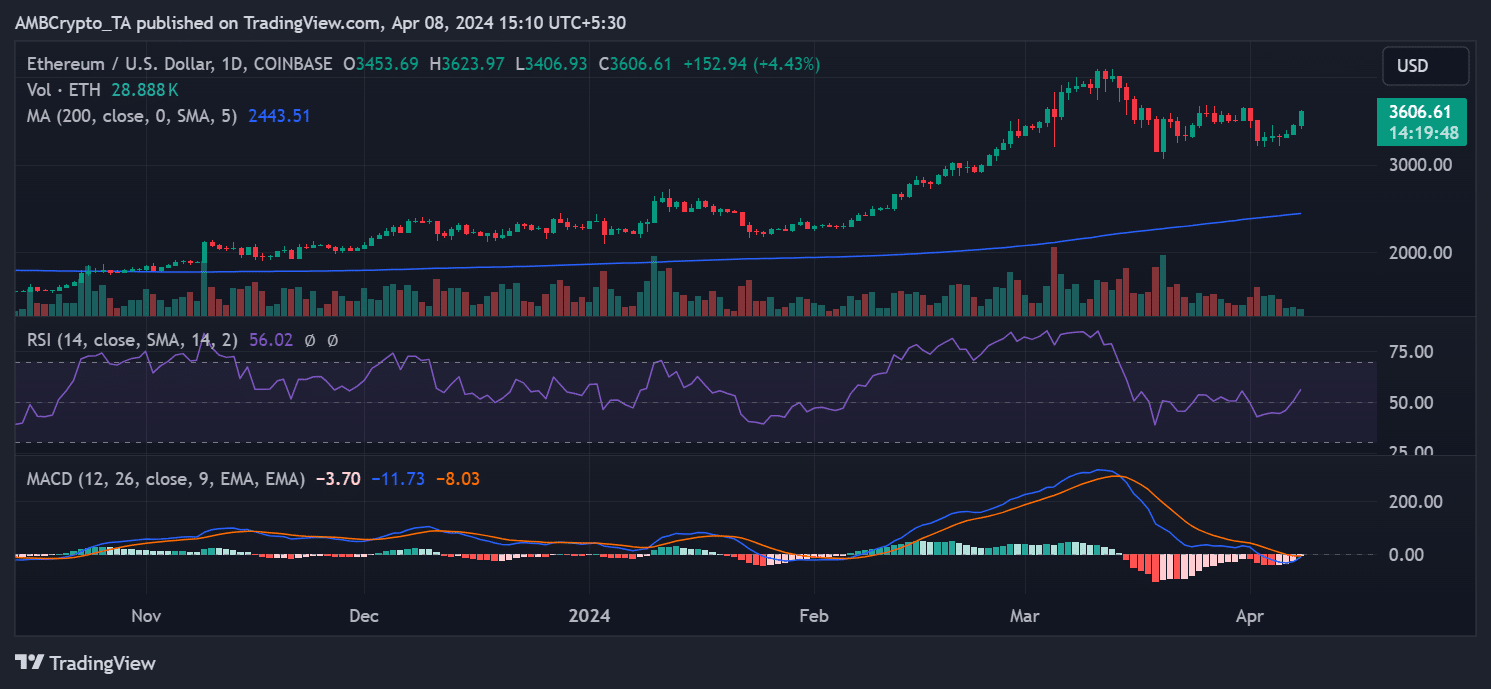

Analysis of the Ethereum daily timeframe chart revealed that on 7th April, it closed trading with an increase of over 3%, reaching above $3,400. This price trend was notable because Ethereum had experienced significant declines before, making this the first major uptrend observed.

Source: Trading View

However, at the time of writing, Ethereum was experiencing an even larger uptrend with over a 4% price increase. The chart indicates that ETH was trading above $3,600 with this recent surge.

Observing the chart, it was noted that the highest point reached this year was around $4,000. Given the current trend, surpassing this record in the coming weeks is possible.

Furthermore, a study of the chart revealed that the price rise effectively reinstated Ethereum into a bull trend. Data from its Relative Strength Index (RSI) indicated that ETH was now above the neutral zone, signaling a bullish trend.

Whales mop up more Ethereum

As the Ethereum price continues upward, recent data showed increased buying activity from certain whales. According to Spot on Chain, within the last 24 hours, two whales collectively spent over $35 million to purchase ETH.

Specifically, these whales acquired 10,322 ETH at an average price of around $3,400.

Additionally, as the price climbed to approximately $3,455, two more whales withdrew 11,657 ETH, valued at over $40 million, from an exchange. This movement by the whales suggests heightened accumulation, likely in anticipation of further price appreciation.

More cash flows into ETH

Analysis of the Ethereum Open Interest trend on Coinglass indicates a recent decline over the past few days. However, there was a slight uptick at the time of writing, with over $13.3 billion in open interest observed.

Is your portfolio green? Check out the Ethereum Profit Calculator

This suggests that more capital was flowing into Ethereum, potentially acting as a catalyst for further price increases.

When considering the current behavior of whales and the uptick in Open Interest, key metrics display positive signs, indicating that a new price level may be imminent.