- Ethereum noted a decline in bullish conviction in the Futures market

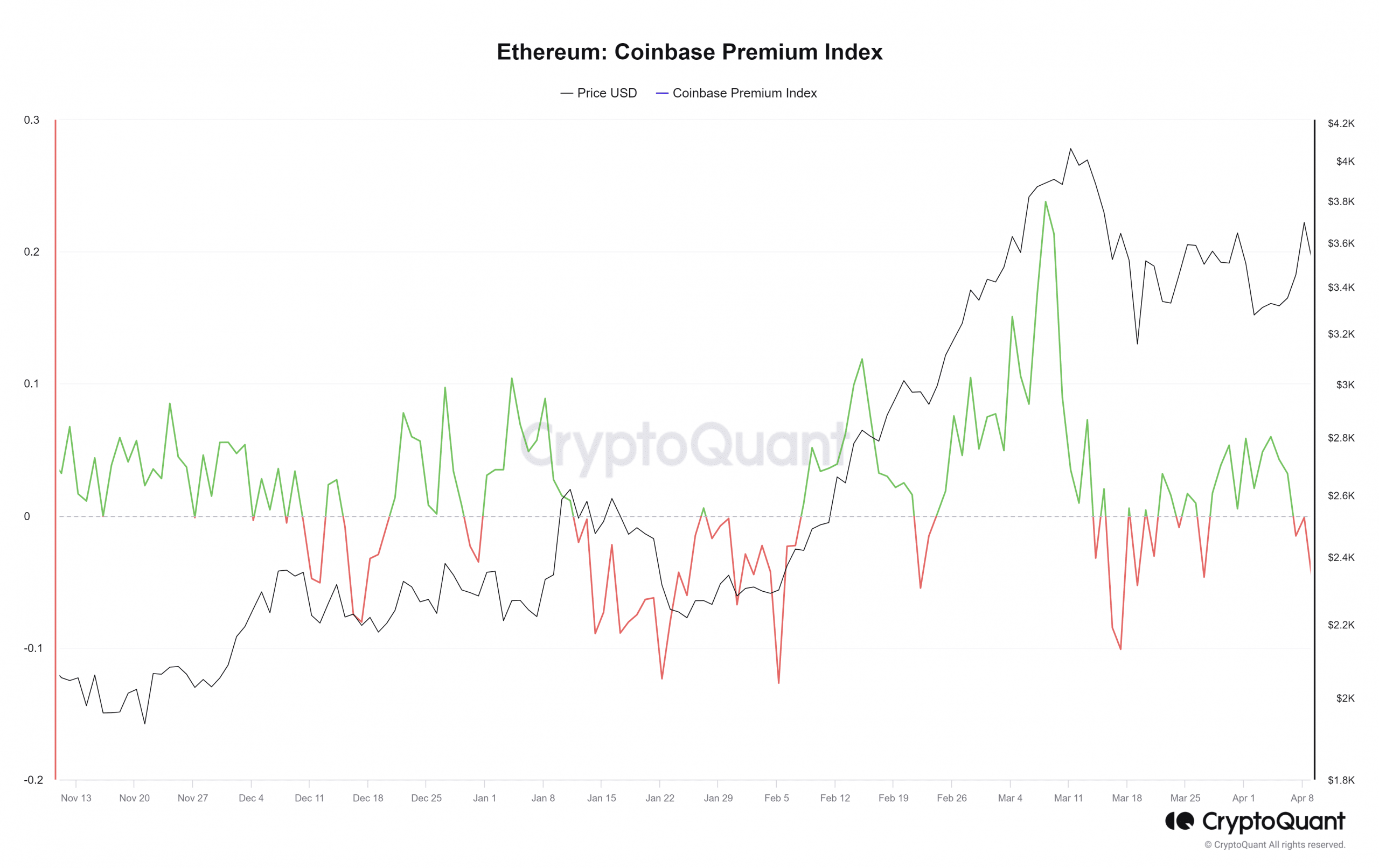

- Coinbase Premium Index showed traders from the U.S are adamant about the altcoin

Ethereum [ETH] rallied swiftly from $3.2k to $3.7k, making a 16.2% move in three days. However, the bulls were rebuffed at the same near-term resistance from a month ago – $3.7k.

The local top coincided with a massive influx of ETH to exchanges on 8 April, according to AMBCrypto’s latest analysis. While the sentiment had been bullish, it has begun to shift over the last 24 hours.

U.S investors refuse to believe in ETH’s rally

The Coinbase Premium Index represents the percent difference in prices (USDT pair) between Binance and Coinbase. This index has fallen since 5 April to show that Binance ETH prices were greater.

In other words, it reflected a lack of bullish enthusiasm from U.S investors, since they can’t trade on Binance and have to rely on Coinbase. Hence, despite the sharp bounce to $3.7k, sentiment west of the Atlantic has been muted.

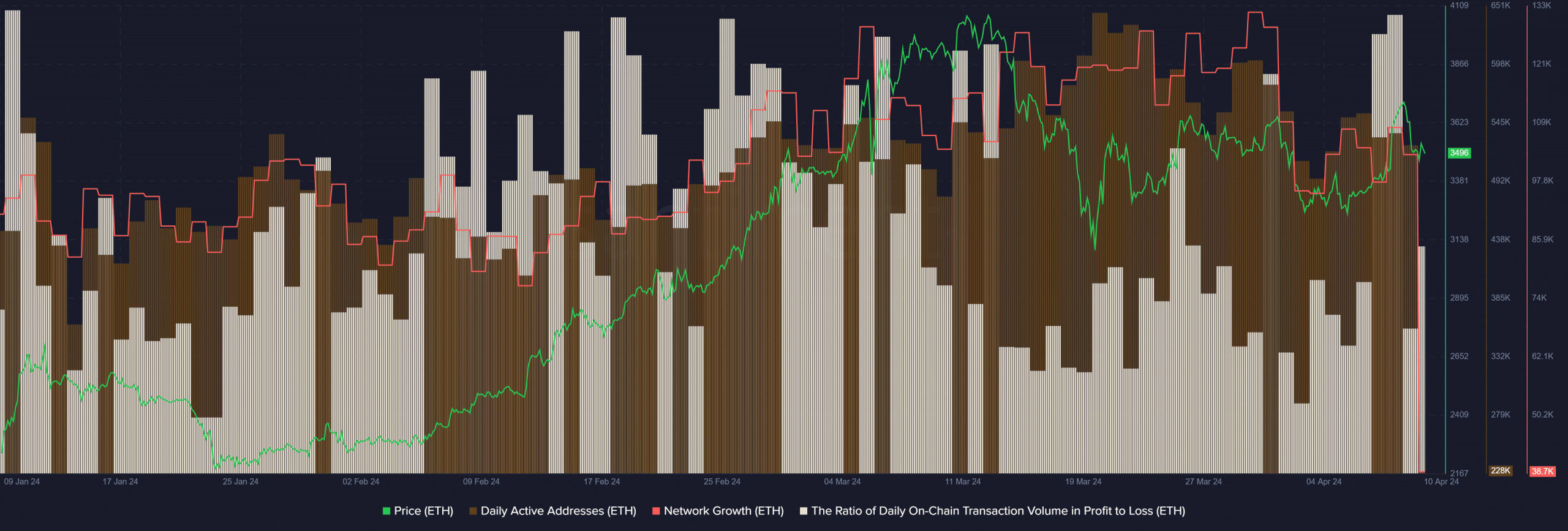

The ratio of daily on-chain transaction volume in profit to loss metric from Santiment leapt to 3.01 on 8 April. Since February, this metric has faced a glass ceiling at 3. Therefore, traders could keep an eye on this metric’s daily readings to understand if a short-term price depression might be inbound.

Daily active addresses and network growth metrics saw a slump on 30 March. They continued to trend lower over the past ten days. This was a sign of a lack of user adoption and organic demand for Ethereum. It raised the question – What is the short-term sentiment like in the spot and Futures ETH markets?

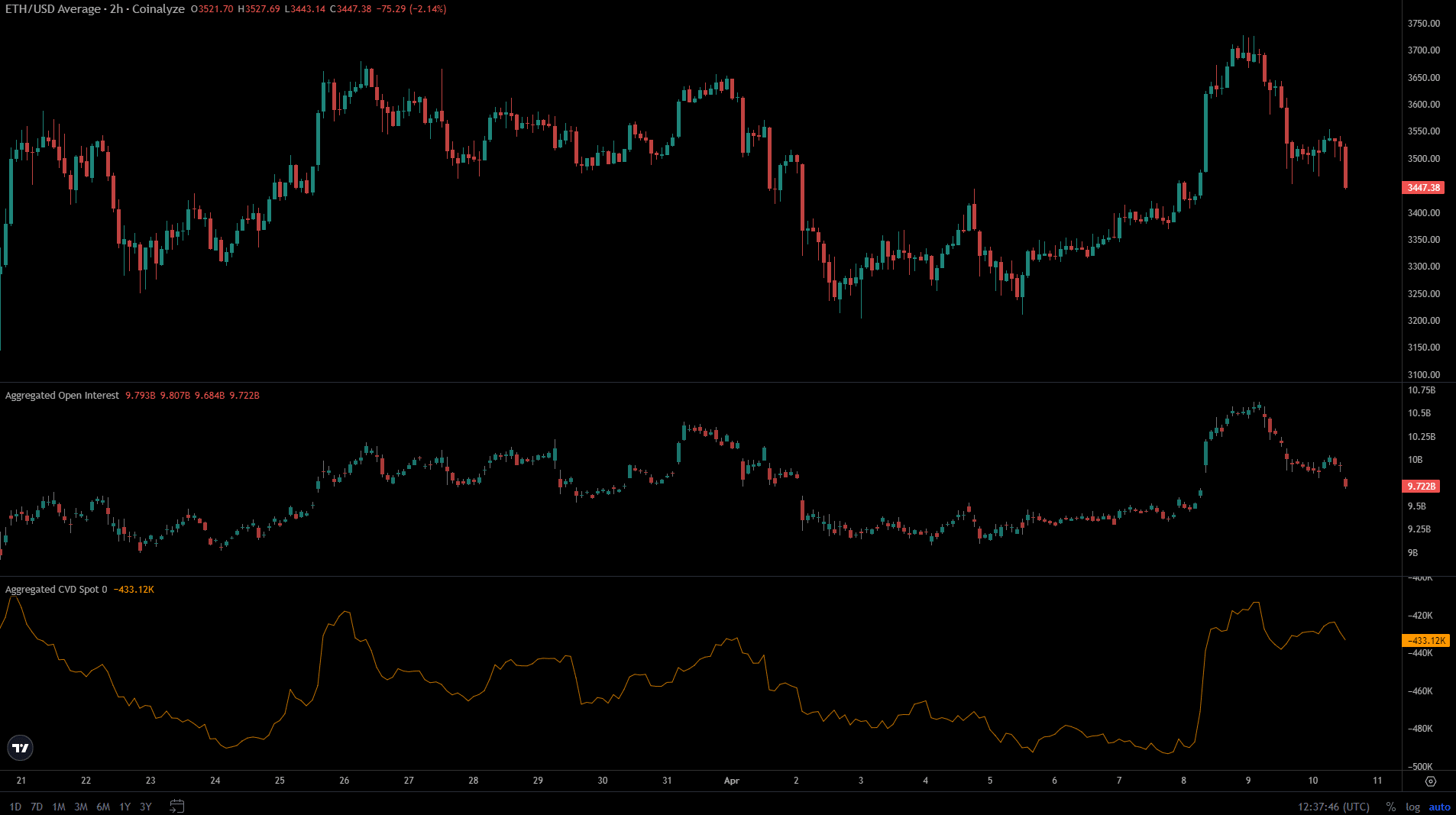

Open Interest data supported idea of bearish market sentiment

When ETH faced rejection at $3.7k, the Open Interest also took a turn south. Over the last 36 hours, the OI has fallen from $10.6 billion to $9.72 billion. A drop in prices, alongside the Open Interest, seemed to be a sign of bearish sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

The spot CVD also began to fall lower, but it has not retraced all the gains it made since the 8th. That being said, the period from 26 March to 8 April saw Ethereum’s spot CVD trend south. It highlighted that spot market participants were not bullishly convinced yet, but there was a chance of a turnaround should ETH break past the $3.7k-mark.