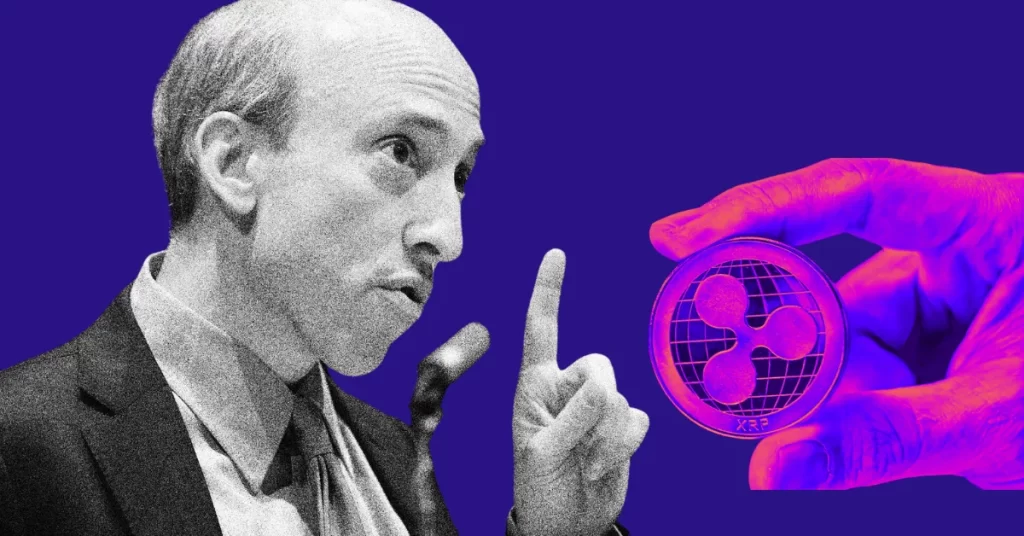

Bill Morgan, a respected figure in the crypto world, has sounded the alarm about Ripple’s legal troubles. The company is currently locked in a battle with the U.S. Securities and Exchange Commission (SEC), facing potentially significant challenges ahead.

Could this legal fight trigger a wave of investor lawsuits? And what impact might it have on the XRP price? Read on to find out the latest developments in this high-profile case.

SEC’s Move: A $7 Billion Demand?

Just two days ago, the SEC revealed a chart proposing remedies, hinting at the severity of the situation. Today, they’re expected to formally disclose their demands, rumored to include a hefty $7 billion in damages and fines.

Bill Morgan took to Twitter to share his concerns about the SEC’s accusations against Ripple’s sales practices. The SEC alleges that Ripple’s favoritism toward certain institutional investors led to massive losses totaling $480 million. Morgan warns that investors left out of these deals could band together to sue Ripple, but proving the harm caused by the lack of disclosure will be key.

Read More: Ripple vs. SEC: Legal Expert Sheds Light on Potential Outcomes

Understanding the SEC’s Strategy

Morgan also points out that the SEC classifying Ripple’s sales as investment contracts carries significant implications. It suggests that Ripple should have disclosed information as if the sales were registered, adding complexity to the legal battle and emphasizing the importance of transparency in cryptocurrency transactions.

As Ripple faces these legal challenges, the crypto world watches closely. The outcome of this legal showdown could have far-reaching effects on Ripple and the broader crypto market.

Also Read: XRP Price Set for Breakout as Ripple vs. SEC Settlement Nears