- The US SEC is reportedly looking into the affairs of Ethereum Foundation.

- The price of ETH remained relatively unfazed despite the regulatory development.

Ethereum [ETH] has faced massive volatility over the last few days, which could partly be attributed to the correlation it had with Bitcoin[BTC]. Recent events could further amplify the volatility that ETH had been facing.

Facing some trouble

According to recent reports, the SEC has launched a legal initiative to potentially classify Ethereum as a security.

The regulatory body has issued subpoenas to multiple companies as part of an investigation into Ethereum, particularly focusing on their ties to the Ethereum Foundation, the organization overseeing the blockchain’s development.

The scrutiny follows Ethereum’s transition from a Proof-of-Work to a Proof-of-Stake consensus mechanism, prompting the SEC to delve into its implications.

Despite the news, the price of ETH remained unaffected. In a surprising turn of events, the price of ETH surged by 11.63% in the last 24 hours.

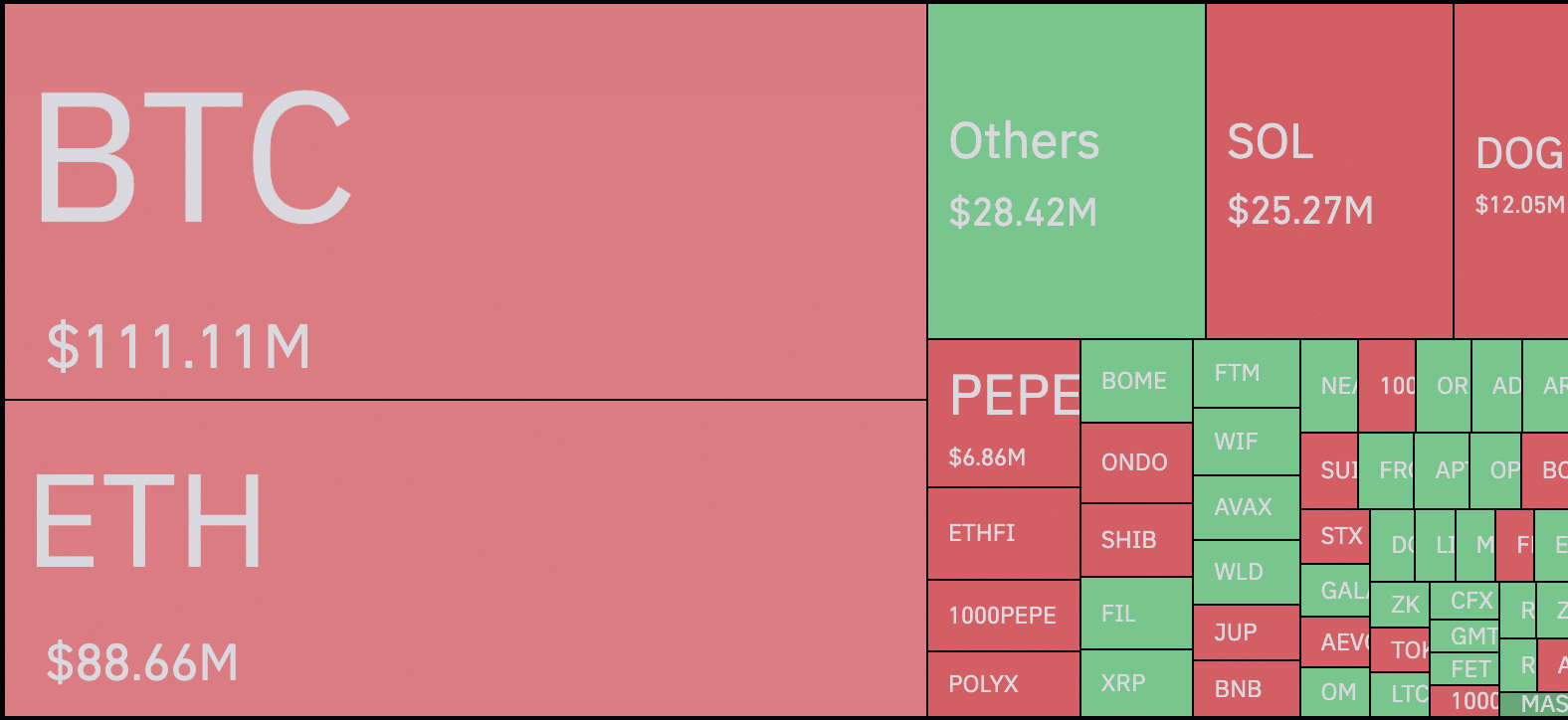

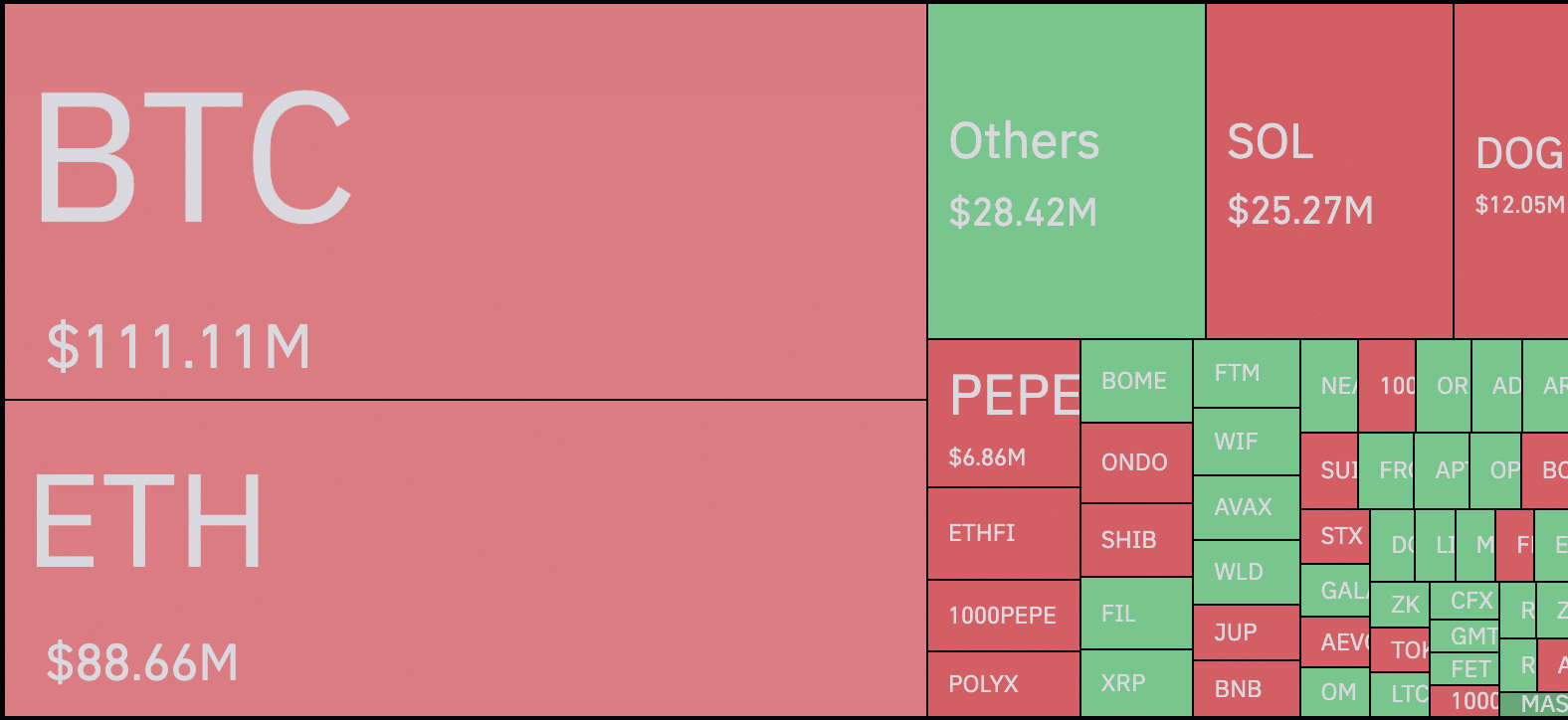

During this period, the price of ETH managed to surpass $3,500 resulting in the liquidation of multiple short positions. In the last 24 hours, around $48.9 million worth of short positions had been liquidated.

At press time, ETH was trading at $3,492.85.

Source: Coinglass

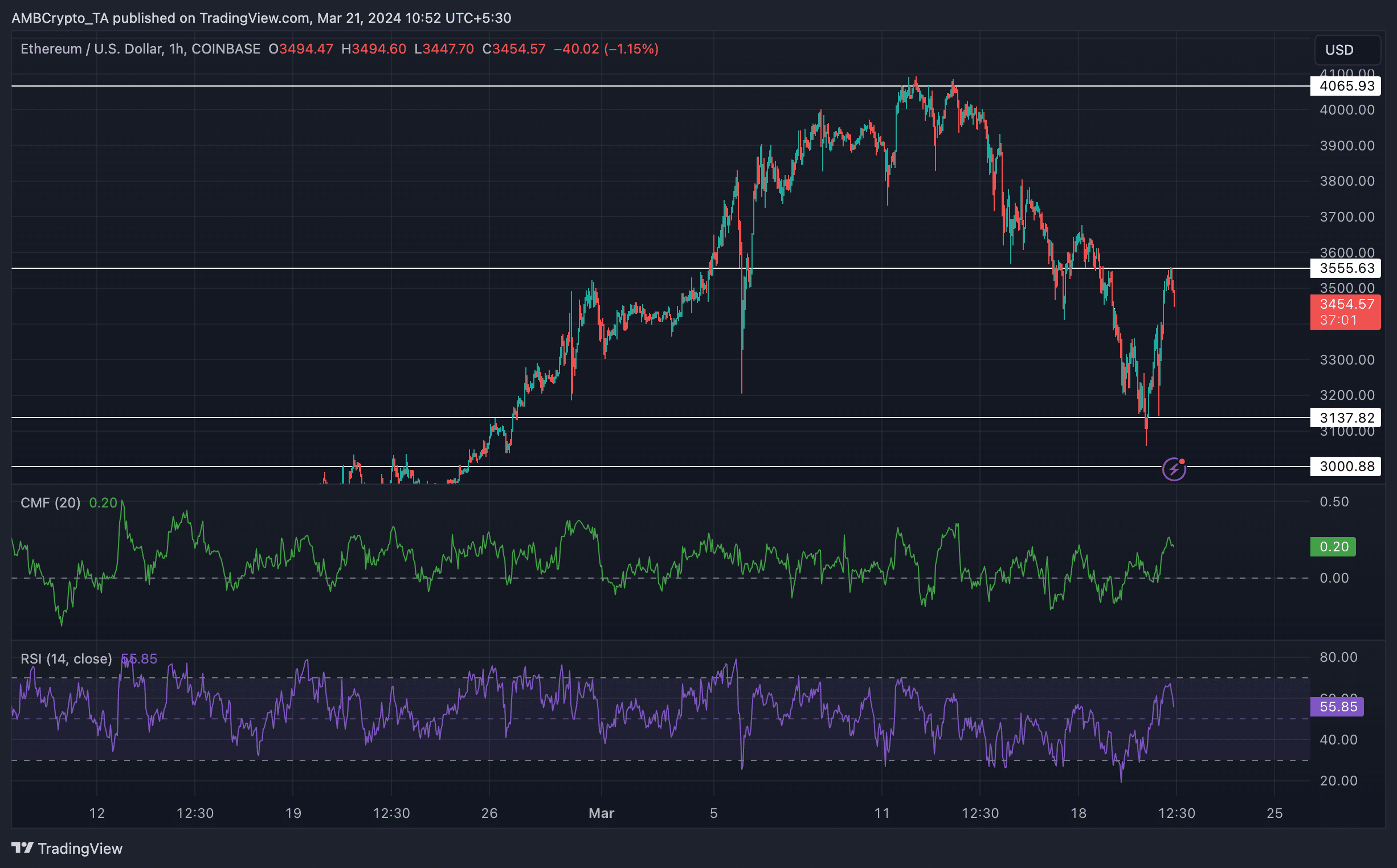

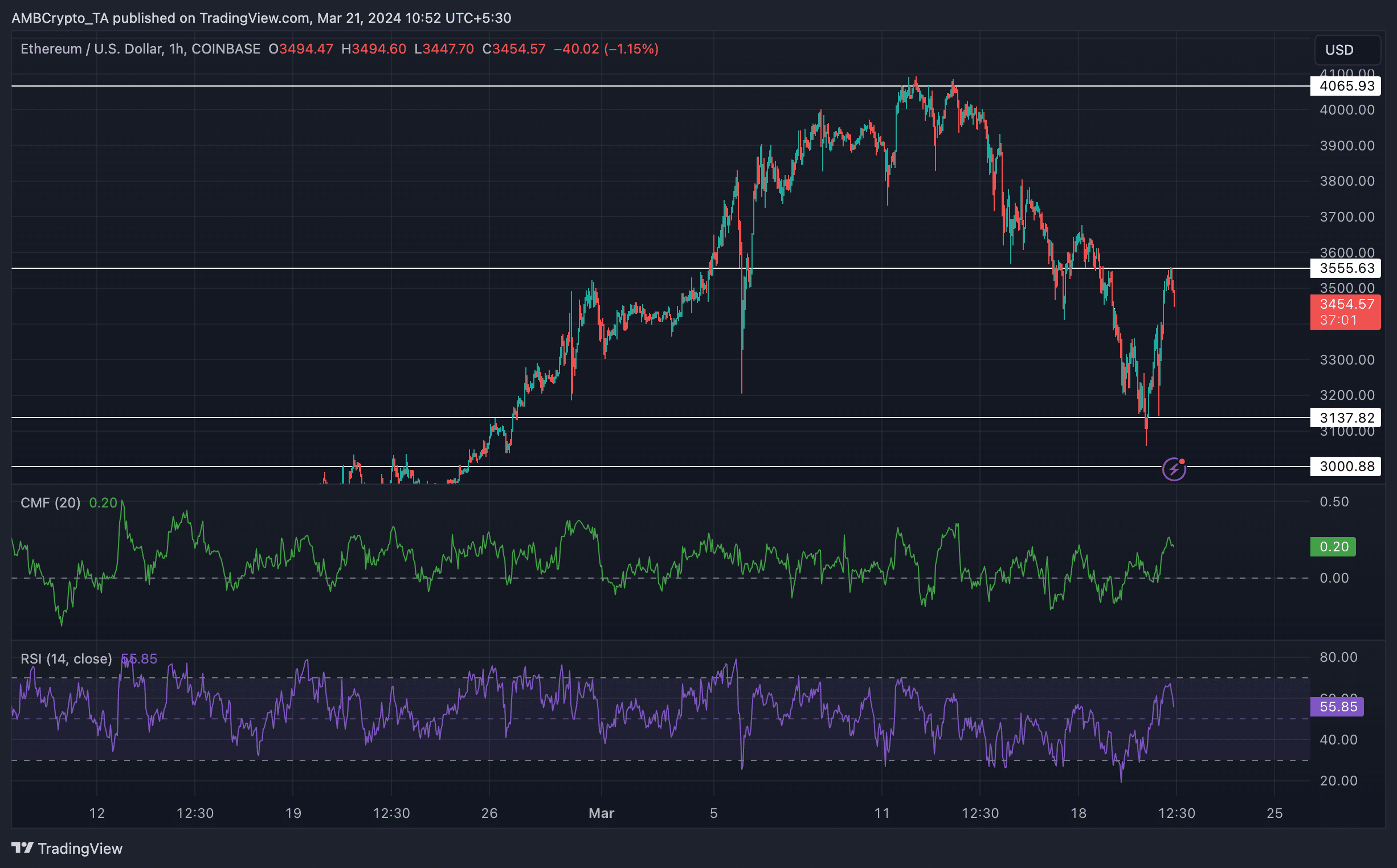

The price of ETH has tested the resistance of $3555 multiple times in the last few days. If the price of ETH regains momentum and tests the $3555 resistance yet again, it may be able to break past this level in the future and reach for the $4,000 level going forward.

However, looking at the larger trend seen over the last few weeks, the price of ETH exhibited multiple lower lows and lower highs and the recent surge in price has not been significant enough for a trend reversal.

If the price continues on its downward trajectory, it could see itself going all the way down to $3.137 support level. The price movement of ETH in the next few days will be pivotal for traders as it will dictate the larger trend that ETH will be following shortly.

Source: Trading View

How much are 1,10,100 ETHs worth today?

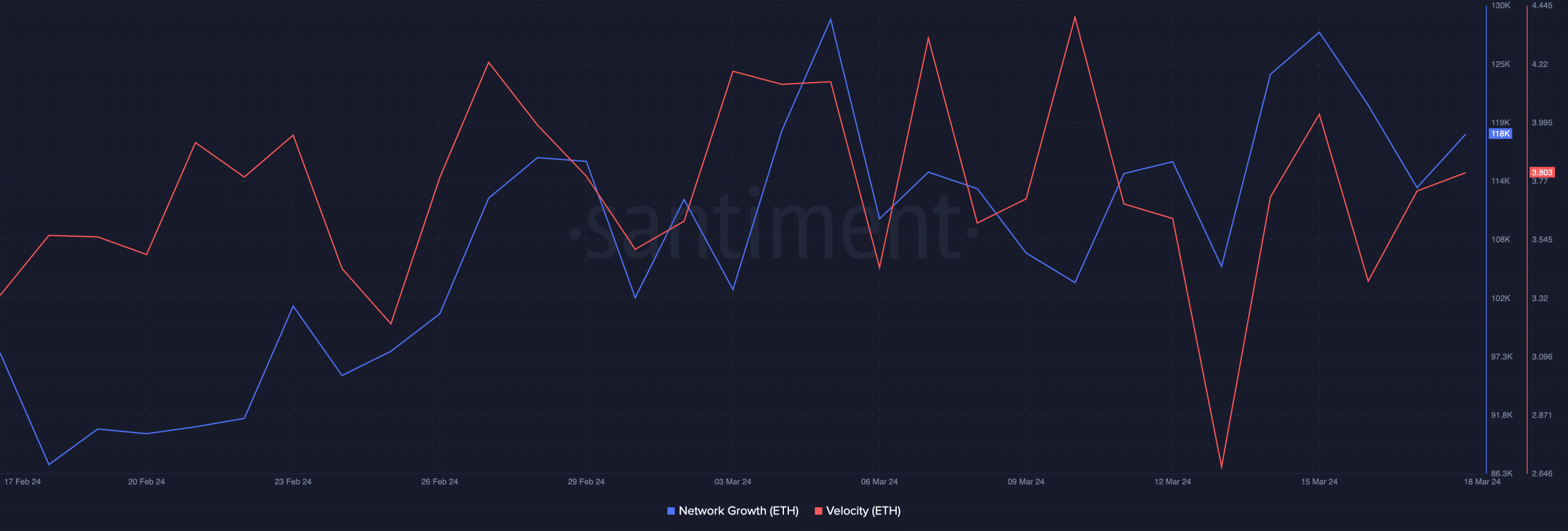

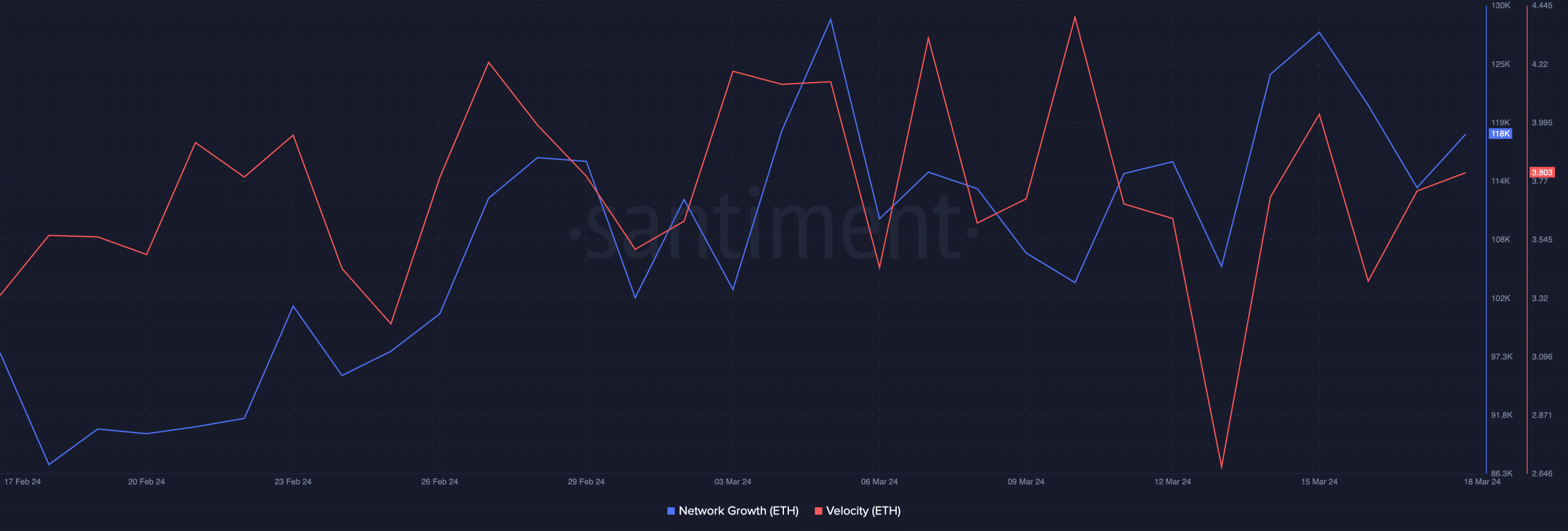

Moreover, ETH witnessed a massive uptick in its network growth. This suggested that new addresses were showing interest in ETH. The uptick in interest from new addresses could add more wind in the sails for ETH’s bullish momentum.

Additionally, the velocity of ETH also grew, indicating a higher frequency of ETH transfers.

Source: Santiment