Cathie Wood’s Ark Invest sold 270,365 Coinbase shares across three of its exchange-traded funds on Monday, worth $68.7 million, according to the company’s latest trade filing.

Of the total Coinbase stock sold, Ark Invest offloaded 171,154 shares ($43.5 million) from its Innovation ETF, 23,330 shares ($5.9 million) from its Next Generation Internet ETF, and 75,881 shares from its Fintech Innovation ETF ($19.3 million).

The amount sold is one of the largest in U.S. dollar terms offloaded in a single day and follows the $150 million worth of Coinbase shares Ark Invest sold last week as it continues to rebalance its fund weightings amid a surge in COIN’s price. Ark aims to let no individual holding take up more than 10% of an ETF’s portfolio.

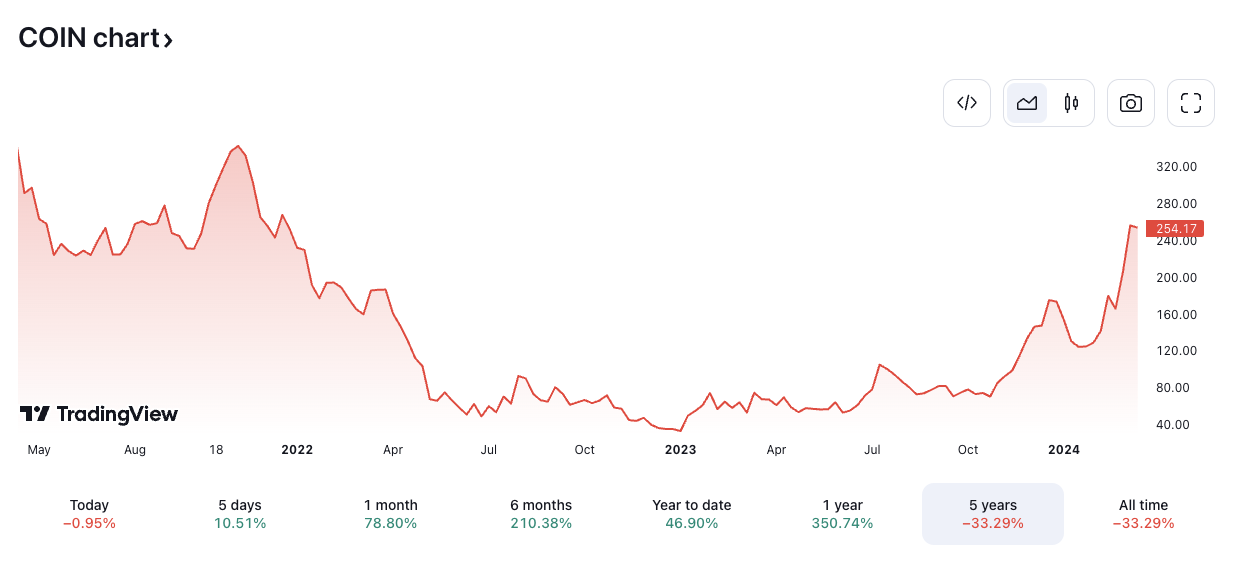

Coinbase stock traded for $254.17 at market close on Monday, up more than 10% over the past week, according to TradingView. COIN has gained 79% over the last month — and 350% over the past year — to reach the highest level since December 2021. However, the stock remains 26% down from an all-time high of $342.98, set in November 2021.

COIN/USD price chart. Image: TradingView.

Coinbase is currently valued at $47.3 billion, according to The Block’s data dashboard.

Despite the surge in its stock price as bitcoin reaches all-time highs, Coinbase Institutional claimed yesterday that the crypto market may encounter “macro headwinds” and “negative technical factors” in the coming weeks.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2023 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.