What promising altcoin hasn’t been called an “Ethereum killer” at this point? Yet, out of the myriad crypto tokens and coins appearing (and promptly disappearing) every year, a few stand out. Solana is one of them.

Solana is known for being a highly efficient and functional smart contract platform. The project’s native cryptocurrency, SOL, has been near the top of market capitalization rankings for quite a while now and has become a favorite among many crypto investors. But what is Solana, what makes SOL unique, and why has this cryptocurrency garnered so much attention?

Key Takeaways: The Solana Blockchain & Cryptocurrency

- What Is Solana? Solana is one of the biggest cryptocurrencies in the world and a popular blockchain network with smart contract functionality.

- The SOL Token. SOL is Solana’s native cryptocurrency. It plays a central role in the network’s operations and economics.

- High-Performance Blockchain. The Solana blockchain is designed to support scalable decentralized applications (dApps) and cryptocurrencies with high transaction throughput.

- Unique Consensus Mechanism. Solana’s blockchain combines proof of stake (PoS) with proof of history (PoH), allowing for rapid processing and validation of transactions.

- Efficient and Scalable. Solana’s architecture enables it to handle thousands of transactions per second, addressing blockchain scalability issues.

- Low Transaction Costs. Solana offers significantly lower transaction fees compared to many competitors, making it an attractive platform for developers and users.

- Solana vs. Ethereum. Solana boasts faster transaction times and lower costs, though Ethereum has a larger ecosystem and developer community.

What Is Solana (SOL)?

Solana is a high-performance blockchain platform designed to support scalable decentralized applications (dApps) and cryptocurrencies. At the heart of its ecosystem is SOL, the project’s native cryptocurrency. Unlike many other blockchain networks that rely solely on the proof-of-work consensus mechanism, Solana employs a unique combination of the famous proof-of-stake and a more unique proof-of-history algorithm.

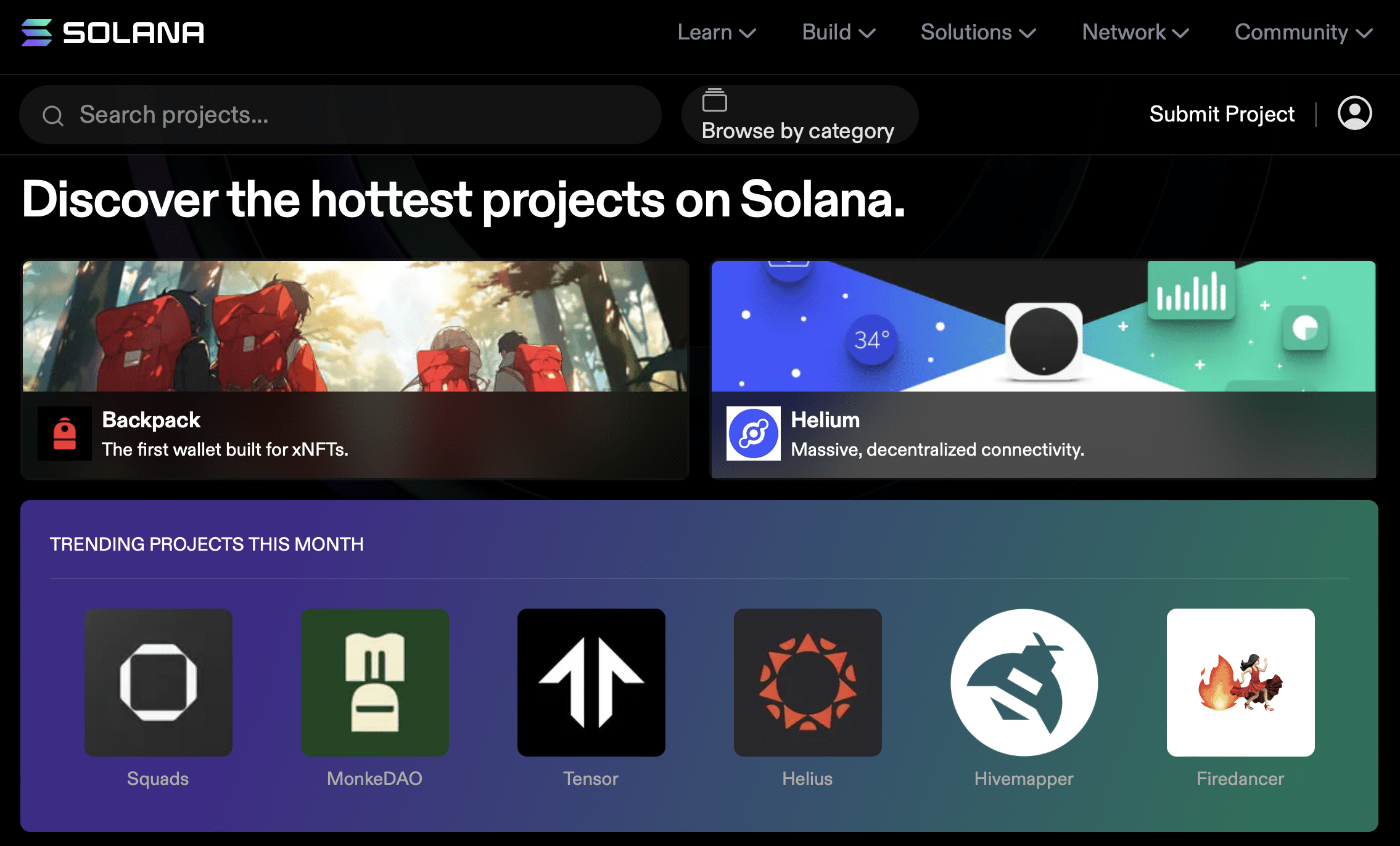

One of the biggest benefits of the Solana network is the wide variety of different projects built on its blockchain. In that sense, it is similar to Ethereum – although the world’s second-biggest cryptocurrency naturally has a much bigger ecosystem of apps and platforms built on it. Still, Solana has quite an impressive catalog, and each of those projects represents one more use case for its cryptocurrency, SOL.

Here are some of the projects built on Solana:

- HDOKI, an entertainment ecosystem that offers crypto rewards

- Star Atlas, a fully-fledged strategy game

- ALF Protocol, a Solana-based lending dApp

- Solanart, a zero-fee NFT marketplace

The History of Solana

Solana’s origin can be traced back to its white paper. It was published back in 2017 by Anatoly Yakovenko, who then teamed up with Greg Fitzgerald to found Solana Labs. Solana was not launched and made available to the public until 2020 following its initial token allocation.

While the rest of the crypto industry was battling with the “blockchain trilemma” of balancing transaction costs and speeds, security, and scalability, Solana emerged as a promising solution. Recognizing the demand for faster transaction speeds and lower transaction fees, the Solana Foundation laid the groundwork for what many claim to be one of the most scalable blockchains.

How Does Solana Work?

Solana is an incredibly efficient blockchain: it has the capacity to handle thousands of transactions in a fraction of a second, achieving unparalleled transaction throughput. This efficiency is achieved through using a combination of proof-of-history and proof-of-stake mechanisms.

The Solana protocol uses validator nodes to process transactions, ensuring the integrity and security of data. Validator nodes play a pivotal role in the proof-of-stake mechanism. They are network participants who run specialized software, helping secure the network by validating transactions.

- Role in Consensus. Validators leverage the historical records from PoH to achieve consensus quickly. They are responsible for producing blocks and validating transactions.

- Staking. To become a Solana validator, a node must stake a certain amount of SOL tokens that act as a security deposit. The more SOL tokens a validator stakes, the higher their chance of being chosen to validate a block of transactions.

- Incentives. Validators earn rewards for validating and producing blocks. However, they can lose their staked SOL if they attempt to validate fraudulent transactions or act maliciously against the network.

Just like Ethereum, Solana’s smart contract capability allows it to host a wide variety of different decentralized applications, from decentralized exchanges (DEXs) to games and non-fungible tokens (NFTs) marketplaces.

What Is Proof of History?

Proof of history is a consensus algorithm that can be seen as a cryptographic timestamp that ensures the proper sequencing of events on the blockchain. It functions as a decentralized clock for the Solana blockchain, allowing for a synchronized and efficient system. This innovative method reduces the need for validators to communicate excessively, resulting in faster transaction speeds.

Solana Mobile Stack

Solana’s Mobile Stack is an initiative aimed at integrating blockchain technology into mobile ecosystems. Designed to extend the capabilities of Solana’s high-performance blockchain network to mobile devices, it enables developers to build decentralized applications (dApps) that are not only scalable but also easily accessible on smartphones and tablets.

The Solana network makes this possible by leveraging its inherent strengths, such as low costs and fast transaction speeds, creating mobile applications that can handle high volumes of transactions without compromising on performance. This is particularly important for applications that require real-time updates and interactions, such as gaming, financial services, and social media on the blockchain.

What Makes Solana Unique?

Here are some of the features that make Solana stand out and have boosted its popularity as both a blockchain network and a cryptocurrency.

- High Throughput. Solana can process thousands of transactions per second, addressing the challenges many blockchains face with scalability.

- Reduced Transaction Costs. Leveraging its unique architecture, Solana offers significantly lower transaction fees compared to its competitors.

- Decentralized Network. Solana’s robust network of validators ensures a secure, decentralized blockchain, keeping it resistant to central points of failure.

- Adoption. Platforms like Solana Pay and the NFT trend have leveraged Solana’s infrastructure, further solidifying its position in the market.

Solana vs. Ethereum

Ethereum, another titan in the crypto space, uses the traditional proof-of-stake consensus algorithm. Solana’s unique approach, particularly its incorporation of proof-of-history, offers:

- Faster Transaction Times. Solana’s methodology drastically reduces transaction times compared to Ethereum.

- Lower Transaction Costs. Ethereum’s gas fees have been a significant concern, while Solana offers reduced transaction costs.

- Scalability. Solana’s architecture provides a solution to the scalability issues Ethereum has historically faced.

However, Ethereum’s longevity, larger developer community, and early market presence give it a significant position in the crypto industry. It is also important to note that the Ethereum blockchain network isn’t static – it keeps on evolving. For example, it is becoming increasingly scalable with the help of layer-2 solutions.

That said, Solana’s co-founder Anatoly Yakovenko is incredibly skeptical of the viability of L2 chains – he claims they break up the user base and create composability issues. If you want to learn more about his opinion on this topic as well as his vision for Solana, you can listen to his episode of the Lightspeed podcast on Spotify / Apple Podcasts.

Is Solana a Good Investment?

Like all cryptocurrencies, investing in Solana comes with risks. Its rapid growth, high market capitalization, and adoption by dApps and platforms like market makers signify its potential.

Solana has made a significant impact on the world of blockchain and cryptocurrency, and is currently one of the most popular cryptocurrencies worldwide. Its innovative approach to transaction validation and sequencing sets it apart from other players in the space. As with any new addition to their portfolio, potential investors should thoroughly conduct their research, consult financial experts if necessary, and make sure they understand market dynamics before making a decision.

You can see our Solana price prediction here.

How To Buy Solana

Purchasing SOL, the native crypto tokens of Solana, can be done on numerous centralized and decentralized exchanges – for example, Changelly. Some platforms do not offer direct Solana purchases – in that case, you can first purchase a stablecoin like USD coin, and then exchange it for SOL. Before buying, always ensure you’re using a reputable exchange and consider transaction fees, which, given Solana’s architecture, are often competitive.

FAQ

What is Solana used for?

Solana is primarily used as a high-performance blockchain platform designed to support decentralized applications (dApps) and cryptocurrencies. Within the Solana ecosystem, developers can build dApps, launch smart contracts, and validate transactions efficiently, solving many of the scalability issues that have been prevalent in blockchain technology, such as those on the Bitcoin network.

What is wrapped Solana?

Wrapped Solana refers to a representation of the SOL token on other blockchains. In the world of blockchain, “wrapping” a token means creating a new token on another blockchain that represents and is backed 1:1 by the original token.

Can you stake Solana?

Yes, you can stake Solana. By staking SOL tokens, users can earn rewards while also contributing to the security and stability of the Solana network. Staking involves locking up a certain amount of SOL to support the operations of the blockchain, particularly to validate transactions. The staked SOL acts as a form of collateral and, in return, stakers receive rewards for their contribution to the network’s operations.

What language is Solana written in?

Solana is primarily written in the Rust programming language. Rust is known for its performance and safety, making it an ideal choice for blockchain platforms that require both speed and security.

What is Solana’s maximum supply?

Solana has an uncapped maximum supply: it uses an inflation mechanism. At the time of writing, the Solana total supply was equal to 571M SOL tokens.

Can Solana Become the New Ethereum?

Solana has quite a few advantages over Ethereum as a smart contract platform. High transaction throughput (Solana’s 65K vs. Ethereum’s 10-30 TPS), lower costs, and more make it a great platform for building various dApps. The Solana network has also introduced numerous improvements and innovations to its platform to further enhance its scalability and efficiency, like the Turbine block propagation protocol and Tower Byzantine fault tolerance (BFT).

That said, Ethereum also has its own advantages. It has an established reputation, a thriving community, and years of experience — not to mention all of its upgrades, like Dencun, which can reduce Ethereum blockchain’s disadvantages.

In the end, it is hard to say whether Solana will become the ultimate “Ethereum killer” or not — but even if it doesn’t, it is still a highly effective and innovative network in its own right.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.